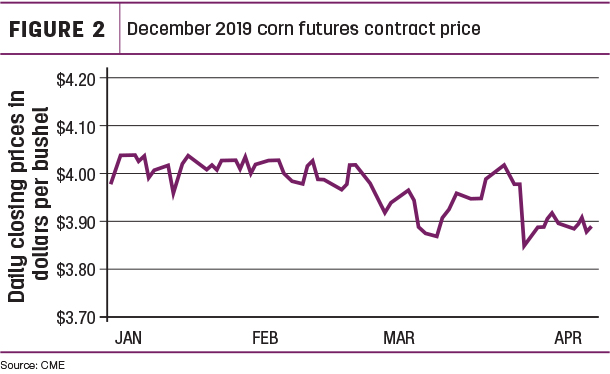

The 92.8 million number was on the high end of analyst expectations going into the report and contributed to a decline in futures contract prices immediately after the report’s release. December corn futures prices dipped 18 cents per bushel in a day in response to the report, though they have regained some strength in the week following.

2. Corn prices expected to remain similar to slightly higher

Cattle producers likely remember the feed bills from the first few years of this decade when corn prices were above $6 or even $7 per bushel. Those levels are not likely in the cards again anytime soon barring some type of significant event such as a major drought. The average farm price has been in the mid-$3 range for the past few years, and current futures contract prices are only slightly higher for this year’s crop.

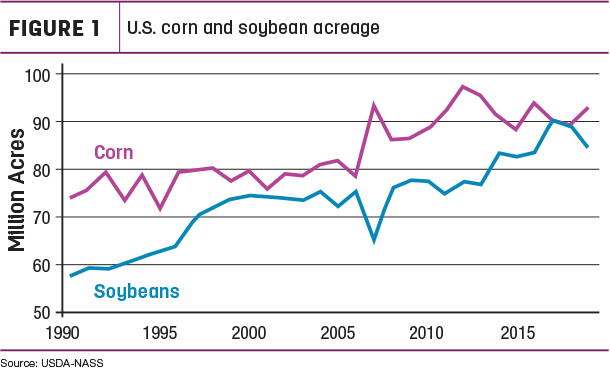

3. Soybean acreage takes a hit, but no supply concerns

The increase in corn acres comes at the expense of soybean acreage. Soybean-planted area for 2019 is estimated at 84.6 million acres, which is down 5 percent from last year. Expected profit margins for soybean producers are tight as prices continue to be pressured by large supplies and trade concerns. The USDA Quarterly Grain Stocks report estimated March 1 soybean stocks were 29 percent larger than a year ago at a record-high 2.72 billion bushels. Significant flooding in some areas since the Prospective Plantings report will probably impact planting some – but the overall story likely will stay the same.

4. Corn price and calf prices are related

So why does this matter for cattle markets? Cattle markets pay attention to corn prices because it is a primary input for adding pounds to cattle. The estimate for ample supplies of corn is positive for feedlot demand for calves because the primary costs associated with a finished steer are cost of the calf purchased and cost of the feed. Corn price is assumed to have an inverse relationship with feeder cattle prices. In other words, if the price of corn decreases, the price of feeder cattle likely increases. As the price of corn (i.e., cost of gain) declines, the price of the other major input (i.e., feeder cattle) can increase without increasing the total cost to produce a fed animal – assuming all other factors remain constant. There is recent research suggesting feeder prices have become more responsive to corn prices over the past decade.

5. The 2019 crop is far from being in the bin

Of course, planting intentions are not the same as bushels harvested, and there is still plenty of risk and uncertainty to go around as farmers navigate another crop season. Weather and crop progress will impact markets throughout the year. As is the case every year, input price risk management will be a topic for cattle producers throughout the growing season. ![]()

-

Josh Maples

- Assistant Professor and Livestock Extension Economist

- Mississippi State University Department of Agricultural Economics

- Email Josh Maples