For March 2022, the annual forecast for commercial beef production was raised 195 million pounds to 27.57 billion pounds from the previous month, on stronger expected non-fed and fed cattle slaughter. During February, based on actual and estimated figures, cow federally inspected slaughter was up 12.2% compared to the same time last year. Most of the increase was due to weather disruptions for the Feb. 20, 2021, weekly slaughter, which produced extremely low weekly slaughter for a non-holiday week. Compared with 2020 and 2019, monthly cow slaughter for February 2022 was down 9.5% and 12.4%, respectively.

Feeder cattle entering feedlots during January were below 2020, and placements for the quarter are expected to be below a year earlier, although deteriorating pasture conditions and wheat prices might encourage a more rapid placement rate than previously assumed. Fed cattle marketings are expected to be slightly higher in the second half of 2022 than the previous month, reflecting a larger number of placements in the first quarter as well as that higher feed prices will likely encourage feedlot operators to be as current as possible in cattle marketings.

Fed steers up, feeder steer prices down

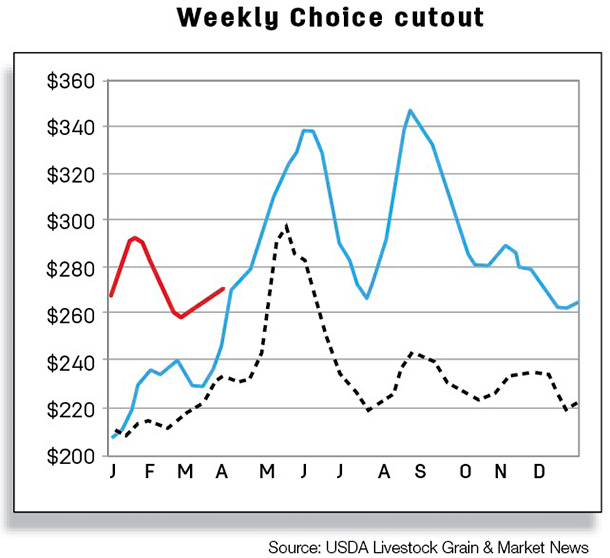

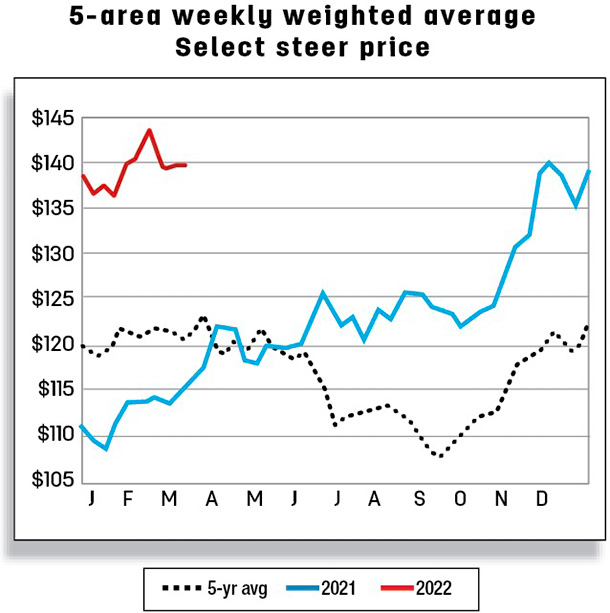

The average price for all grades of live steers sold in the 5-area marketing region in February 2022 was reported at $141.32 per hundredweight (cwt), up 24.1%, or $27.42, from February 2021. For the week ending March 6, the fed steer price was up from the week ending February 6 but down from February 27. The 2022 annual forecast for fed steer prices was increased by $1.75 to $139.25 per cwt from the previous month due to anticipated strong packer demand and tightening feedlot inventories moving forward. The fed steer forecasts for the first and second quarters were raised $1 and $3 to $140 and $139 per cwt, respectively. The third-quarter forecast was raised $1 to $136, while the fourth-quarter forecast was revised up $2 to $142 per cwt.

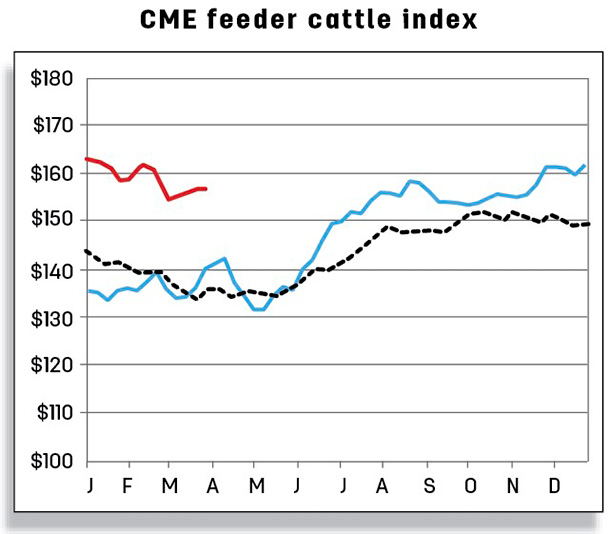

Feeder steers weighing 750 to 800 pounds sold at Oklahoma City National Stockyards in February had an average price of $157.25 per cwt, up 19.3%, or $25.43 per cwt from a year ago. On March 7, the feeder steer price averaged $149.14 per cwt, $13.52 above the price recorded in the same week last year.

The first-quarter forecast was lowered $2 from the previous month to $156, but the second-quarter forecast was raised by $1 to $159 per cwt from the previous month on tightening feeder cattle supplies and higher forecast fed cattle prices. However, due to higher anticipated feed prices in the second half of 2022, the feeder steer forecasts for the third and fourth quarters were reduced by $1 to $161 and $166 per cwt, respectively. The 2022 annual forecast for the feeder steer price was lowered from the previous month to $160.50 per cwt.

Beef exports continue record pace in new year

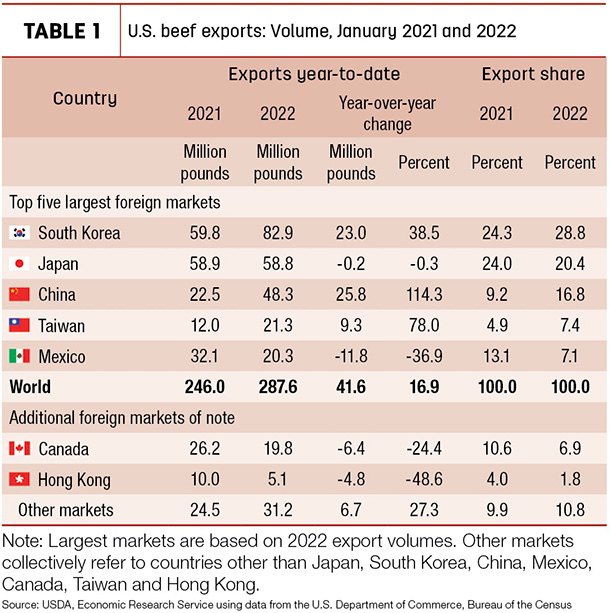

In January 2022, U.S. beef exports set a record for the month at 288 million pounds, about 17% above a year earlier and 21% above the five-year average. Larger year-over-year shipments to China, South Korea, Taiwan and a number of other markets more than offset reduced purchases from Mexico, Canada, Hong Kong and Japan.

Table 1 shows that South Korea took an early lead in 2022 as the top destination for U.S. beef. Further, shipments to South Korea set a record for the month of January and the second-largest volume on record to May 2021.

U.S. beef sales to Japan were even with a year ago at 59 million pounds but accounted for a smaller share of U.S. exports given the larger volumes to China and South Korea.

China, which bought over 48 million pounds in January, double the volume in 2021, was the third-largest destination for U.S. beef exports. After the meteoric rise in exports in mid-2020 due to tight supplies of pork in China and reduced competition from Australia, shipments to China leveled off. Over the last 11 months, U.S. beef exports to China have averaged just over 49 million pounds. The next-largest percentage gain year-over-year in January was in Taiwan purchases, which were a record for the month and the second-largest behind May 2020.

U.S. exports to both Mexico and Canada in January were down 37% and 24%, respectively, from a year ago. Shipments to Mexico and Canada for the month of January were the lowest since 2004 and 2007, respectively.

With this record start to the new year, the beef export forecast for the first quarter was raised by 30 million pounds. However, beef exports are expected to moderate in the remaining quarters due to increased competition from Oceania in Asian markets and softer demand from North America. As a result, the rest of the year was left unchanged for an annual forecast of 3.3 billion pounds.

Record-high beef imports from Brazil

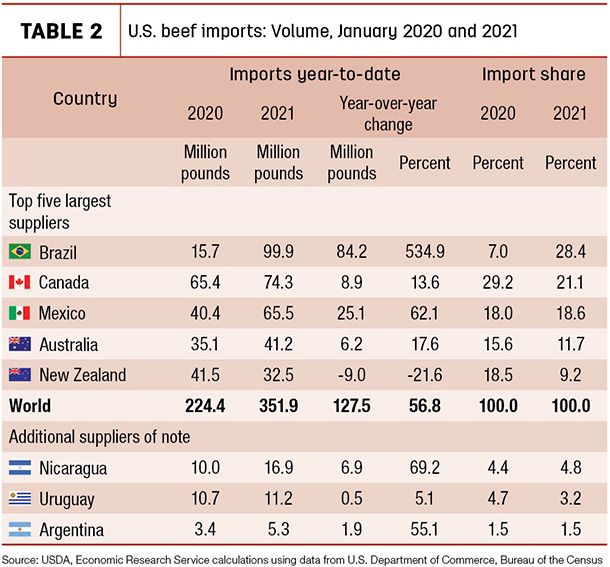

Beef imports in January totaled 352 million pounds, nearly 57% higher year-over-year and 47% above the five-year average (Table 2).

This was a record for the month of January and the fourth-largest monthly import overall. Driving this year-over-year increase were imports from Brazil, up over 500% from the previous year and accounting for two-thirds of the increase in total imports. Imports from Mexico, Australia and Canada also increased 62%, 17% and 14% year-over-year, respectively.

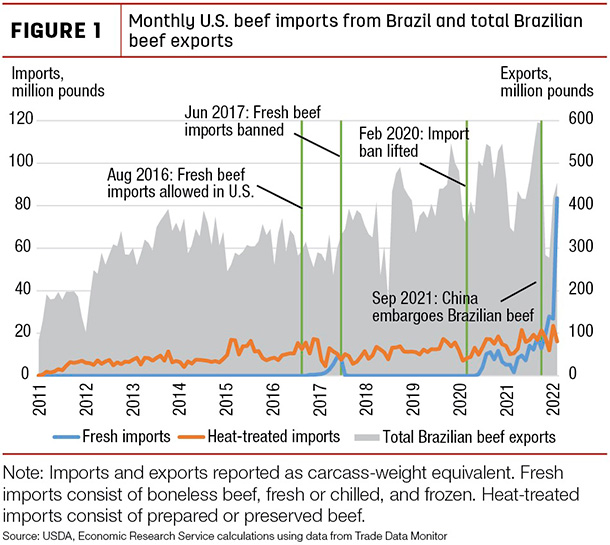

Imports from Brazil have been elevated in the last few months, driven by increases in imports of processing-grade beef. Historically, beef imports from Brazil have been primarily heat-treated beef products. In August 2016, the USDA Food Safety and Inspection Service (FSIS) determined that fresh (chilled or frozen) beef could be safely imported from Brazil. In June 2017, however, fresh beef imports from Brazil were suspended due to concerns about food safety and animal health.

In February 2020, FSIS again determined that raw intact beef from Brazil was eligible for import into the U.S. Imports have risen significantly since then. As Figure 1 shows, the majority of the increase is in fresh beef.

Fresh beef imports from Brazil consist mostly of frozen boneless trimmings destined to be ground into hamburger. The volume of fresh beef imports has spiked rapidly since November 2021, in January accounting for 84% of U.S. beef imports from Brazil.

In September 2021, China embargoed beef imports from Brazil on animal health concerns. As China has been the major destination for Brazilian beef, the embargo caused a large reduction in Brazil’s total exports. Some of Brazil’s beef was redirected to other markets, including the U.S.; this may have accounted for some of the spike in U.S. imports in recent months. China lifted the embargo in December 2021.

Imports to the U.S. of fresh beef are subject to a tariff-rate quota. Brazil falls under the U.S. quota open to other countries that do not have a country-specific quota. This is set at 65,005 metric tons (or about 143 million pounds) for the calendar year 2022. It is possible Brazil will fill the quota within the first quarter of this year. Once the quota is filled, imports of fresh beef from Brazil and other countries under this quota will be subject to a higher tariff, increasing from $4.4 cents per kilogram to 26.4% of the value of the imports.

The first-quarter import forecast was increased 90 million pounds to 890 million, reflecting recent data. Forecasts for the outlying quarters were decreased slightly based on smaller shipments from South America. The annual import forecast was raised 50 million pounds to 3.42 billion.