Dan Halstrom, president and CEO of the U.S. Meat Export Federation (USMEF), and Kent Bacus, director of international trade and market access for NCBA, led the discussion on how U.S. beef is performing globally and how the current political climate is helping – or hindering – U.S. exports.

According to the latest USMEF data, the U.S. made over $8.5 billion in global export sales in 2018. The U.S. also exported record amounts to Korea and Japan, specifically. “Virtually every major market around the world has seen growth in 2018,” said Halstrom. He said the biggest driver of growing exports to Asia is increasing disposable incomes and a growing middle-class population. Declining self-sufficiency is also a factor. “As their spending power increases, their ability to supply their own product decreases.” The U.S. has an international reputation for safe, high-quality beef. The biggest niche market for global imports is grass-fed beef.

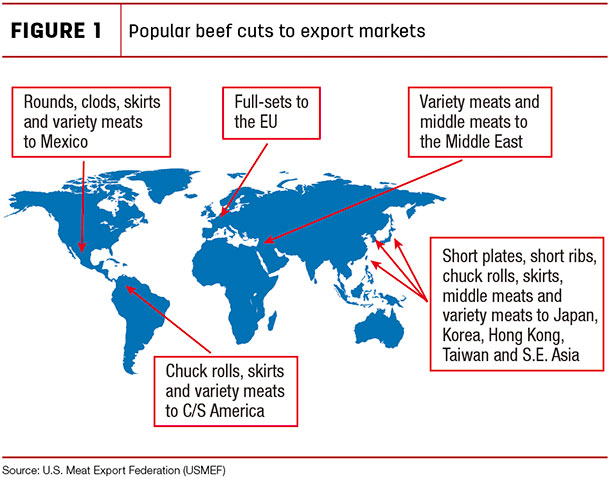

Halstrom said the key to keeping export values high is providing the right cuts of meat to the right market (see Figure 1).

He used the example of marketing beef tongue to Japan. Many popular Japanese dishes call for beef tongue, so demand is strong. The price of beef tongue in Japan is more than $5 a pound. If the same volume of beef tongue were on the U.S. market, the price would be well under a dollar a pound. “We’re not out there trying to market tongues to Egypt or to other places that have no cultural affinity for tongues; we’re putting the right cut in the right market with the culture with the demand,” he said.

Competition

The U.S. is not the only country to learn how to market certain beef cuts to certain countries, and we have a lot of aggressive, skilled competition in the beef market, Australia being the biggest. The U.S. supplies 42 percent of Japan’s imports with a 38.5 percent tariff rate, while Australia supplies 48 percent at a 29.3 percent tariff rate. The U.S. supplies 49 percent of Korea’s beef, but Australia is not far behind at 43 percent. The U.S. supplies 83 percent of Mexico’s imported beef, but that rate has dropped from 90 percent in the past few years due to the renegotiation of NAFTA.

U.S. imports to China and Hong Kong only amount to 7 percent of the import shares in that market. Brazil is the dominant player there with 40 percent. Halstrom said China will surpass the U.S. as the world’s largest importer of beef. Their growing middle class, which is larger than the entire U.S. population, is ready and willing to pay for good beef.

Bacus said the biggest trade obstacles are in both tariff and non-tariff barriers. BSE-related age restrictions, restrictions regarding growth hormones, beta-agonists, antibiotics and animal welfare all make the list, and while many of them may be non-science-based and mostly political in nature, they still provide a sizable barrier to certain markets. He said threatening – and in China’s case, enacting – higher tariffs is President Trump’s method of getting trade discussions started.

“The whole reason behind this is to use tariffs to create an incentive for these other countries to come to the table, because a lot of these countries don’t have any other incentive to work with the U.S., and the world has started to respond,” he said. “They’re not going to just back down easily either, like with the TPP (Trans-Pacific Partnership); the U.S. withdrew, and the other countries moved on without us.”

Those countries – Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam – all signed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership in 2018.

He also explained agricultural products have borne the brunt of tariff retaliation because ag producers are a key part of Trump’s political base. “Other countries think if they can put leverage on President Trump’s political base, then maybe he’ll back off, and that’s essentially backfired in many cases,” Bacus said. “He’s not going to back off (tariffs) any time soon.”

Japan – a critical market

Japan is currently the largest value market for U.S. beef. The U.S. did $2 billion in sales there in 2018 and 2017. Halstrom said the Japanese market has gained a lot of traction since the mid-’80s. “There is a protein boom going on in Japan.” Japanese consumer habits foster a high demand for quality beef. “It’s a very efficient supply chain that demands high value.” He said Japan also has the highest savings rate per capita in the world, so consumers are willing and able to pay for high-quality product.

In order to keep maximizing the value of U.S. imported products, Bacus said it is important to keep focusing on bilateral trade agreements with other countries, especially Japan. “Our concern is that, if we aren’t able to secure a trade deal (with Japan), if we just leave the status quo as it is, then our annual export losses by 2023 are estimated at $550 million. That will exceed $1.2 billion by 2028,” he said. “That’s why this is so important to us. We have a lot to lose.”

Korea – a success story

Korea is one of the fastest-growing countries in the world economically and a prime market for U.S. beef. Halstrom said at some point, Korea might even have the capacity to surpass Japan. A key influence in that situation is grocery retail giant Costco, which is a major player in Korea. Globally, Costco has 740 warehouses around the world. The first- and third-busiest meat-moving warehouses are in Korea. “It’s amazing,” he said. “When you go to these places, if you’re standing in front of the meat case and not paying attention, you can get run over by a Korean housewife with a shopping cart.”

After the BSE outbreak in 2003, Australia stepped in as the primary provider of beef to Korea. “We spent the next 15, 14 years scratching to get back in there,” Halstrom said. “Australia had the corner on business with Costco until last year.” In 2018, the U.S. became the sole provider of beef to Korean Costcos and, overall, surpassed Australia as the leading source of beef imports in Korea. Halstrom said year-to-year sales are reflecting consumer approval of the change. “This is one of the single big success stories in 2018,” Halstrom said. “We definitely want to keep that running.” ![]()

PHOTO: Dan Halstrom (center) and Kent Bacus (right) explain the current U.S. global export situation at NCBA. Photo by Carrie Veselka.

-

Carrie Veselka

- Associate Editor

- Progressive Cattleman

- Email Carrie Veselka