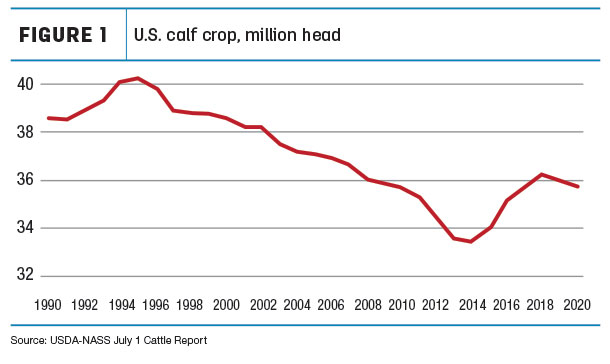

The midyear July 1 Cattle report estimated 103 million head of total (beef and dairy) cattle in the U.S. This included just over 32 million head of beef cows that have calved. The total cattle number is up 100,000 head (or 0.1%) from a year ago, while the beef cow total is down 250,000 head (0.8%) from July 2019 levels. One of the key numbers in the July report to watch is always the updated calf crop estimate. The 2020 calf crop was estimated to be down about 260,000 head (0.7%) from 2019. This would be the second consecutive slight decrease in the annual calf crop since the peak in 2018 (see Figure 1). Heifers for beef cow replacement were unchanged from 2019 levels at 4.4 million head.

Despite the challenges during the first half of 2020, the implications of this report tell a similar story to the Jan. 1 Cattle report. There still appears to be a very slow contraction of beef cow numbers occurring. The level beef replacement numbers also suggest no indication of expansion. The increase in total cattle may appear to be a surprise – however, it is important to consider the lower cattle processing totals in April-June. This report is a snapshot of estimated supplies on July 1. The processing disruptions led to more fed cattle supplies this summer than would have likely occurred with normal processing conditions.

The next Cattle on Feed report will be released Aug. 21 and will provide an updated look at the recovery from the processing disruptions during the spring. Prior to this report, the July Cattle on Feed report estimated 11.44 million head on feed, which was essentially the same as the July 1, 2019, level. Feedlot placements during June totaled 1.8 million head, up 2.1% from a year ago. Placement of cattle into feedlots continue to recover following the sharp declines in March and April. Weekly cattle processing totals have been very near 2019 levels during July and August. The July Cattle on Feed report suggested a reduction in the backlog of market-ready cattle as compared to previous months. Marketings of cattle out of feedlots during June 2020 were 1.3% above June 2019 levels. Further declines in the backlog of fed cattle will be another key piece of information to watch when the August report is released.

Overall, these two reports provide an overview of the short-term and long-term dynamics of the cattle supply cycle. Shorter term, the cattle industry is continuing to recover from the massive disruptions during the spring months. Longer term, the overall trend of the cattle cycle has not changed significantly. Beef cow numbers remain steady to slightly decreasing. As always, fall calf prices will play a key role in producers' inventories and culling decisions and the trajectory of beef cattle supplies moving forward. ![]()

-

Josh Maples

- Assistant Professor and Extension Economist

- Mississippi State University