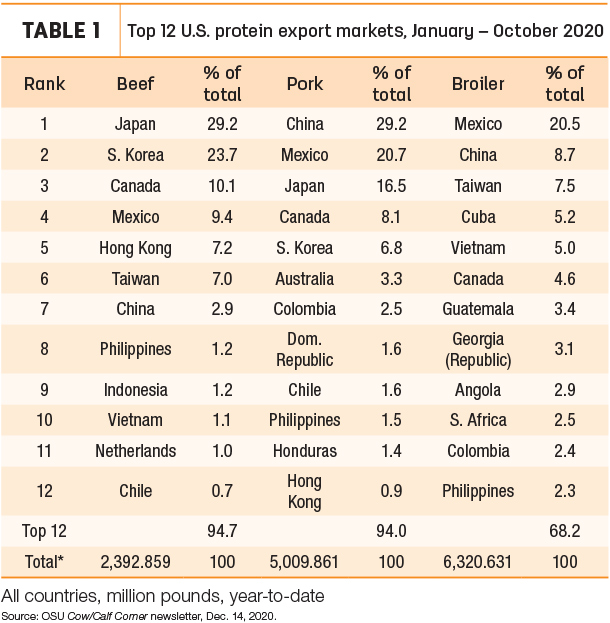

Table 1 shows the top 12 export markets for beef, pork and broilers for the first 10 months of 2020, their share of total exports and the year-to-date export total for the major meat proteins.

Beef exports for the year-to-date through October are down 5.3% year over year after dropping sharply in May and June and then recovering from July to October. Total pork exports in 2020 are up 19.9%, driven by exceptionally strong exports to China, along with Taiwan and Hong Kong. Broilers exports so far in 2020 are up 4.2% year over year, with exports to Mexico, the largest market nearly unchanged from one year ago, but up sharply to China.

Mexico is arguably the market most impacted by COVID-19 from a U.S., and specifically a beef, perspective. Exports of beef to Mexico are down 37.9% year over year, with declines from last year every month in 2020. Mexico is suffering a devastating recession, the result of current federal policies aggravated by the pandemic.

The biggest changes across all meat markets relate to China. China has dramatically increased protein imports in 2020 after suffering from the devastating loss of pork production due to African swine fever (ASF) in 2018-19. So far this year, China has accounted for nearly 30% of U.S. pork exports. This follows a 16% share of U.S. pork exports to China in 2019. Pork exports to China represented less than 7% of total pork exports from 2014-18 but previously peaked at nearly 13% of annual exports in 2011.

China is the No. 2 market for broiler exports in 2020. Broiler exports to China have been very low in recent years, though China did account for 10% to 11% of U.S. broiler exports from 2006-09.

China has been a rapidly growing market for global beef imports in recent years and is the largest beef importing country since 2018. This reflects underlying growth in beef demand in China, accentuated by the protein shortages due to ASF. China has been a minor market for U.S. beef but is growing rapidly. The China share of U.S. beef exports exceeded 1% for the first time in 2019 and is the No. 7 beef export market at 2.9% of total beef exports thus far in 2020. Beef consumption in China is expected to continue growing and, assuming no additional political disruptions, China could be one of the top exports markets for U.S. beef in the next couple of years.

Broiler meat exports are heavily dominated by Mexico, with China increasing from zero exports in the first 10 months of 2019 to the No. 2 market in 2020, to supplement ASF-related protein shortages. Broiler meat is exported to a vast array of smaller markets. It is interesting for example, that broiler exports to Cuba in 2020 have exceeded exports to Vietnam and Canada. The top 12 broiler export markets only account for about 68% of broiler exports (compared to 94%+ of beef and pork exports).

Global protein trade is expected to improve in 2021with pandemic control anticipated and more stability generally in world economies. However, recessionary impacts of the pandemic will continue to present challenges in many countries, including the U.S. At this time, U.S. exports of beef, pork and broilers are all expected to show at least modest growth in the coming year. ![]()

This originally appeared in the Dec. 14, 2020, OSU Cow/Calf Corner newsletter.

-

Derrell S. Peel

- Livestock Marketing Specialist

- Oklahoma State University Extension