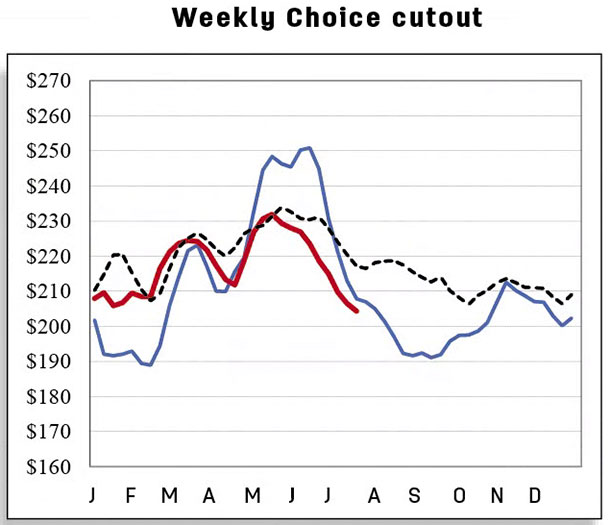

A faster marketing pace of steers and heifers also contributed to lower estimated cattle dressed weights. The beef production forecast for third-quarter 2018 is raised on higher cow and bull slaughter. As a result, the full-year forecast for 2018 was raised by 25 million pounds to 27.2 billion pounds.

Continuing drought conditions in parts of the Great Plains and the intermountain region likely supported strong placements of calves in feedlots in May, indicated in the latest NASS Cattle on Feed report.

To the extent earlier-than-expected placements may be reflected in slower placement in the third quarter, first-quarter 2019 marketings and fed beef slaughter were reduced. However, cow slaughter in 2019 was adjusted higher. As a result, the production forecast for 2019 was reduced by 25 million pounds to 27.7 billion pounds.

Robust feedlot placements in May

According to the latest NASS Cattle on Feed report, net placements in feedlots with a capacity greater than 1,000 head were 2.05 million head in May, fractionally higher than reported last year. On the ERS web page Livestock & Meat Domestic Data is a table entitled “Feeder Cattle Supplies Outside Feedlots” that estimates on April 1 there were 2.8 percent less calves available for placement into feedlots.

The placement volume in May relative to the availability of cattle outside feedlots was likely the result of regional drought conditions. The USDA released the Cattle report on July 20, providing an opportunity to calculate the percent of cattle outside feedlots in July.

Throughout the winter and extending into the summer months, drought conditions have plagued the Great Plains area, squeezing hay and roughage supplies. During the winter, many calves directed to feedlots might have otherwise stayed on pastures until the spring. This limited the expectation for strong cattle placements in feedlots this spring.

However, as the drought has expanded into the intermountain region, available summer pastures may have become restricted as well. As a result, some stocker operations may have placed cattle in the second quarter instead of waiting until third quarter. This is likely observed in the year-over-year increase in both volume and percentage of total placements of calves weighing under 600 pounds in May 2018.

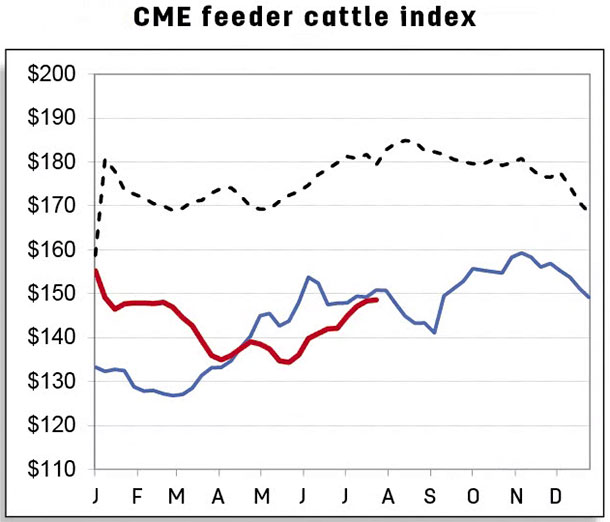

Feeder cattle prices to find support from lower feed inputs

In the first four months of the year, monthly prices for feeder steers weighing 750 to 800 pounds sold at the Oklahoma National Stockyards were above year-earlier levels. However, the trend for monthly prices January through May ran countercyclical to seasonal norms. Prices did improve in June, even as feedlot margins were weak to negative for selling fed cattle.

Despite firm feeder cattle prices in June and early July, the projected feedlot margin for feeding out a 750-pound calf purchased today appears to have improved and, with lower corn price forecasts for the current and following marketing years, demand for calves for finishing may increase, supporting higher feeder calf prices.

With these improved feeding prospects, the price forecast for feeder steers was raised for third- and fourth-quarter 2018 to $139 to $145 per hundredweight and to $134 to $145 per hundredweight, respectively. The forecast of the 2019 annual price was raised to $136 to $148 per hundredweight.

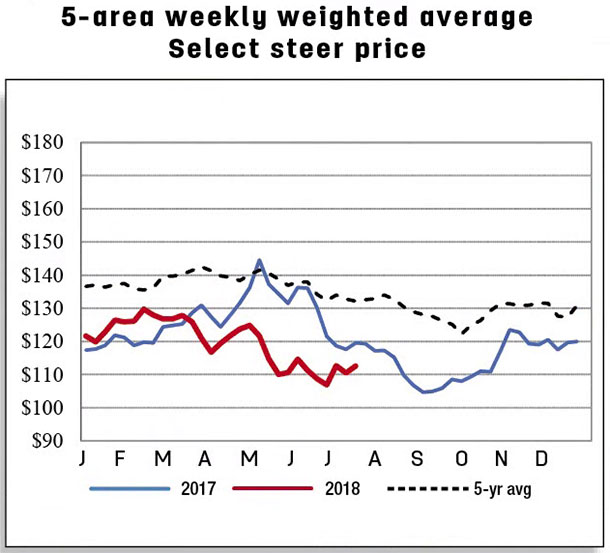

The third-quarter 2018 price forecast for fed steers was adjusted slightly lower to $107 to $111 per hundredweight based on June and early July price data. The price forecasts for fourth-quarter 2018 and 2019 remain unchanged.

Strong Asian demand drives exports higher

U.S. beef exports in May 2018 were 273 million pounds, up 47 million pounds (+20.7 percent) from the year-earlier level. Shipments to all major destinations increased except for a slight decline to Hong Kong (-1.8 percent). Exports were higher in each month of 2018 through May compared to year-ago levels. For the month of June, weekly estimates from USDA, Foreign Agriculture Service Export Sales reports also indicate a year-over-year increase.

Based on the higher April-May pace and higher weekly export estimates for June, the second-quarter 2018 export forecast was revised upward by 20 million pounds from the previous month to 765 million pounds. This resulted in a higher 2018 forecast of 3.07 billion pounds. Beef exports in second-quarter 2019 were raised by 15 million pounds to 785 million pounds, which resulted in the 2019 export forecast of 3.165 billion pounds.

Greater exports in May to three major Asian markets, South Korea, Japan and Taiwan, contributed 37.4 million pounds or about 80 percent of the total May increase. Among the major export destinations, exports to South Korea were exceptionally high in each month, reaching a 40 percent year-over-year increase through May.

A relatively large U.S. beef supply is likely to support the continuation of robust overseas shipments to those markets. In addition to strong demand, a relatively weaker U.S. dollar against the Korean won, and lower tariffs compared to competitors have likely enhanced exports to South Korea during this period.

Beef import forecast remains unchanged after May imports

In May, U.S. beef imports were up 3.9 percent year over year to 278 million pounds. Higher imports from New Zealand (+28.7 percent), Australia (+14.9 percent), Nicaragua (+31.2 percent) and Canada (+3.8 percent) more than offset the declines from Brazil (-40.8 percent), Mexico (-13.2 percent) and Uruguay (-33.1 percent). Beef import forecasts were unchanged from the previous month’s forecasts at 3.052 billion pounds for 2018 and 3.14 billion pounds for 2019.

On the supply side, extended drought in Australia and lower dairy prices in New Zealand are likely to increase cow culling rates, which will increase exportable supplies in the short term. On the demand side, U.S. demand for lean meat is expected to remain strong, as supplies of 50 percent lean meat will reflect increased fed cattle slaughter in the coming months.

Cattle exports revised upward on Canadian demand

Cattle exports were strong in May, with nearly 15,000 head exported, almost double year-earlier levels. Lower feeder cattle prices in the U.S. relative to those of Canada likely supported greater demand. Given this increase, the cattle export forecast for 2018 was revised upward by 10,000 head to 170,000 head. The 2019 export forecast was also adjusted higher by 10,000 head to 160,000 from the previous month’s forecast.

Cattle imports in May totaled 169,763 head, an increase of 11,033 head year over year. The import forecasts for 2018 and 2019 are unchanged from the previous month’s forecast at 1.885 million and 1.96 million head, respectively. ![]()

Analyst Lekhnath Chalise assisted with this report.

References omitted but are available upon request. Click here to email an editor.