However, if you take a longer look back, you will see why there is frustration in the statement. 2014 and 2015 posted the highest beef prices on record. Almost anything with four legs and some muscle brought an unbelievable amount of money.

This article will discuss why the prices were so high, why they fell so rapidly, and where the crystal ball is pointing.

The 2010-2011 drought in Texas and the Southwest brought the cattle industry to its knees. In addition to the Texas drought, the high cost of feed was compounded by the Midwest drought of 2012 – leading to historic prices of corn and other grains. Feed was not available for the cattle, and herd liquidation was necessary in many parts of the country.

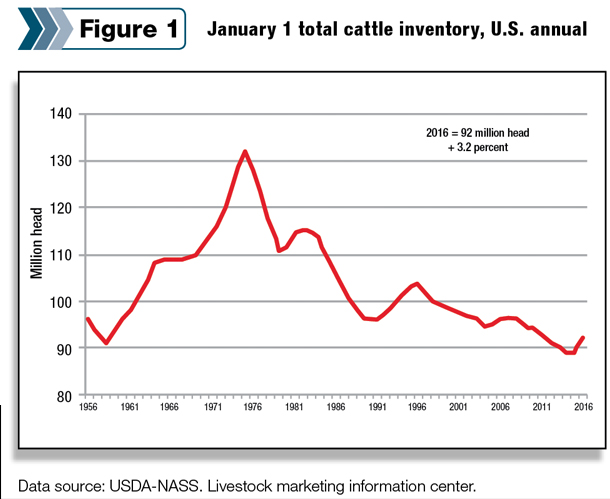

It took a couple of years of drought to see the lowest number of cattle in the nation’s cow herd since 1956 (Figure 1).

This decrease in the cow herd, along with a relatively weak dollar overseas, made for the perfect storm to cause high prices. The weak dollar encouraged record beef exports while, at the same time, the demand for beef in the U.S. stayed strong. These conditions brought about the high prices we experienced in 2014 and 2015. Of course, what goes up must come down.

The perfect storm for the price increase brought about the conditions to allow for the precipitous price drop. The tables turned, and the U.S. dollar became stronger, making U.S. beef more expensive to import.

U.S. beef exports dropped, and imports sharply increased as beef from other countries became relatively cheaper. Also, fed cattle for slaughter reached an all-time high in weight during 2015, causing heavy discounts at the packer.

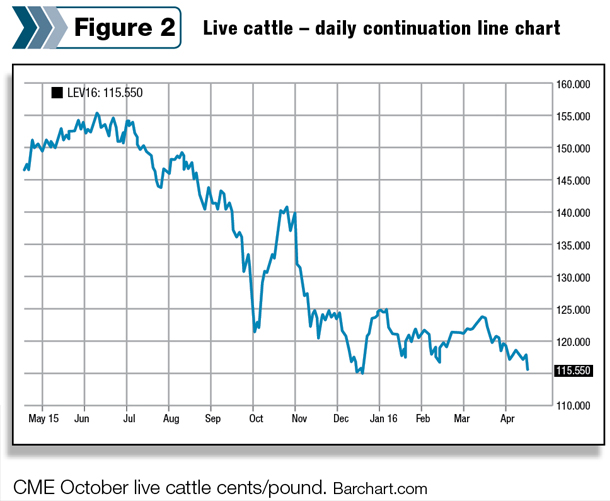

Even though cattle numbers were still low, the lack of exports, the increase of imported beef and the excess slaughter weights took the wind out of the beef market sails (Figure 2).

However, this doesn’t mean the market is necessarily “bad.”

However, this doesn’t mean the market is necessarily “bad.”

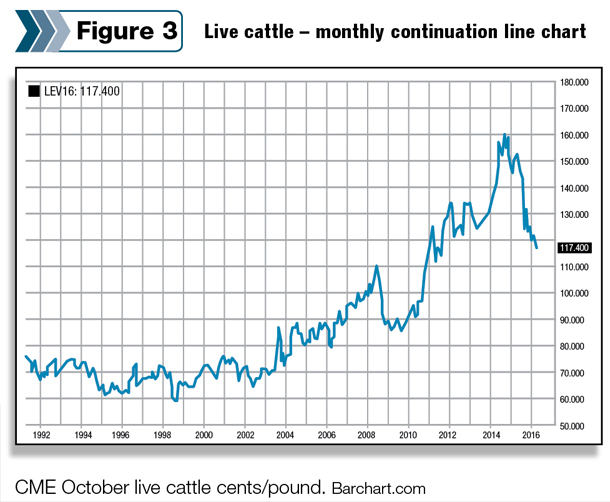

A closer look at the beef market is very revealing as to how bad the current beef price really is. If you look at the same graph as Figure 2 but open the time frame since 1992, you can readily see the market is still high, not counting the last two years (Figure 3).

The spike of the last two years is really the big story within this story. The cattle numbers are still not where they should be to really increase the amount of fat cattle hitting the market. Our demand is still very good with the grilling time of year approaching.

So with these market conditions, the price is still excellent and appears to be fairly safe into 2017. As we enter 2017, heifers held as replacements at the end of 2015 and into 2016 will have calves ready for slaughter at the end of 2017 and into 2018.

The 3.2 percent increase of the cow herd (as shown in Figure 1) will have an effect on the price of cattle – especially if the dollar is still strong. At this point, we would expect the beef market to soften, pushing the beef price lower.

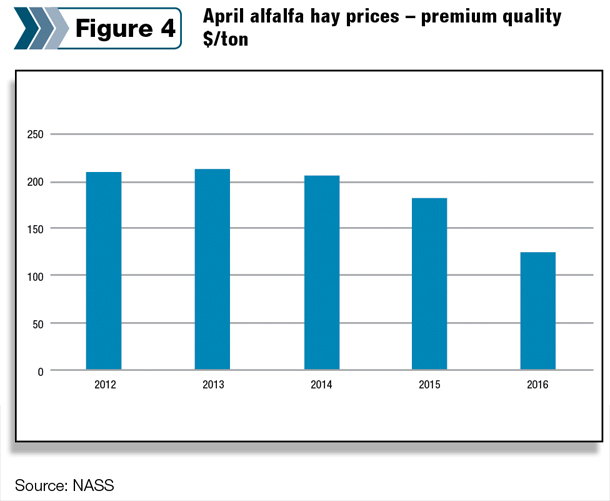

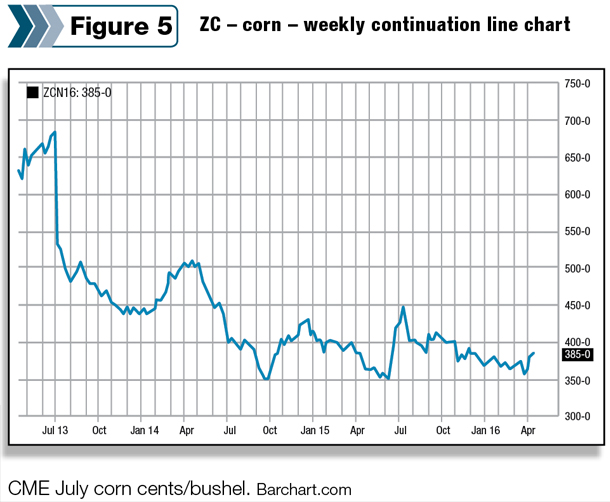

One of the bright spots for the beef industry is the decrease in the cost of most farm inputs. Feed prices have dropped dramatically in the past few years (Figures 4 and 5). Fuel has also been a part of these descending prices.

This gives the beef producer an advantage that allows a positive profit margin even when the price of cattle is on a downward trend.

It may be that profit margins in the beef industry are very close to previous years when considering input costs.

The beef market is one of the few agricultural markets in the Pacific Northwest that appears to be “in the black” in 2016. It also appears that the beef market will soften more as we move into 2017-2018.

Demand appears to be steady, but cow numbers are rising and more beef will be moving to market in the next two years.

For now, the inputs are cheaper and low-cost producers are still making money.

The far future may not be so rosy. Is the price good now? Not if you consider the last two years – it really is a matter of perspective. ![]()

-

Joel Packham

- University of Idaho Extension Educator

- Cassia County

- Email Joel Packham