This pressure came after ten straight weeks of higher calf prices; since early November when the market began its vertical trajectory to all-time record highs. The following three weeks of the shortest month of the year saw three major wintry systems move across the Heartland of the United States and most of the nation’s major cattle production areas. Virtually every major livestock auction market was forced to close or operate on extremely limited receipts for at least one of their weekly sales in February. Record low temperatures (as much as 30-below zero in Oklahoma and Kansas) and record snowfall (well over 20 inches across much of the Midwest) put cattle markets in a holding pattern as few marketing areas had enough receipts to fully test prices.

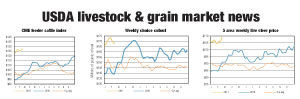

The latter-part of February experienced the “Big Thaw” as record low temperatures were replaced by record highs in less than a week and some spots in the lower Midwest recorded a 100-degree swing within just a few days. Feeder cattle demand returned in all its splendor with stocker cattle and calves gaining $5.00 to $10 by month’s end and feedlot replacements selling firm to 45.00 higher. The rapid warm-up put buyers in a spring-like state of mind as backgrounders began scrambling to acquire their spring grazing cattle with price levels continuing to break new ground. Feedlots also became more aggressive with help from sharply higher CME Live Cattle futures allowing hedging opportunities, even at current yearling prices and $7/bushel corn. Top feeder sales around the country included a 200 head string of 966-pound steers at the Lexington, Nebraska Livestock Market that brought $122.10. But, perhaps the best feeder demand was shown for two-way cattle weighing from 600 to 750 pounds that are heavy enough for the feedlot but have a thin-enough flesh condition for compensatory gain on early spring grazing. These types routinely sold and no longer raised eyebrows at levels from $135.00 to $150.00/cwt.

Although still over $1/pound, finished cattle sales were lackluster in late January. However, brisk export wholesale beef orders (especially to our Asian markets) spurred short-bought packers in mid-February to post an all-time record five-area feeding region weekly weighted average slaughter cattle price for live steers and heifers fob at $109.75. Slaughter cows and bulls also sold at record high levels in many parts of the country. High dressing cull cows in auction rings around the United States topped $80 with some heavy-muscled bulls as high as $100 per cwt. Higher ground-beef prices are starting to hit home as many restaurants including McDonalds have announced plans to raise menu prices. All this, as 2010 marked the lowest per capita beef consumption in the U.S. since records started being kept in the 1950s with the average American now only eating 59.7 pounds annually.

Now with cattle and beef prices sitting at all-time record highs at every stage of production, we enter the time of year when these markets typically get higher. Consumers will soon be dusting off their backyard grills and packers will increase production to keep the meat counters fully stocked. At the same time, cattle feeders and backgrounders will be trying to fill pastures and empty feedlot pens before offerings dry up. Cattle producers just hope that markets remain aligned to supply and demand, without interference from political unrest in the Middle East or some other unnamed spoiler. ![]()