Both fed cattle slaughter and carcass weights during February were above expectations. Based on the USDA Agricultural Marketing Service weekly livestock slaughter reported for the week ending Feb. 22, average dressed weights were 21 pounds (3%) above a year ago for the same week and nearly 10 pounds above the five-year average for the same period.

Steer and heifer dressed weights were up 26 pounds and 13 pounds, respectively, above year-ago levels for the same period. This was the first winter in three years in which weather events did not significantly affect cattle performance in feedlots. Further contributing to higher expected overall dressed weights is the anticipation of a smaller proportion of nonfed cattle in the slaughter mix in the first quarter.

However, for the third quarter, higher dressed weights were more than offset by a reduction in expected fed cattle marketings. Based on the February USDA National Agricultural Statistical Service (NASS) Cattle on Feed report, there were 0.3% fewer net placements in January. This was lower than expected and led to a reduction in expected marketings and fed cattle slaughter for third-quarter 2020.

Cattle prices weaker on beef production and market uncertainty

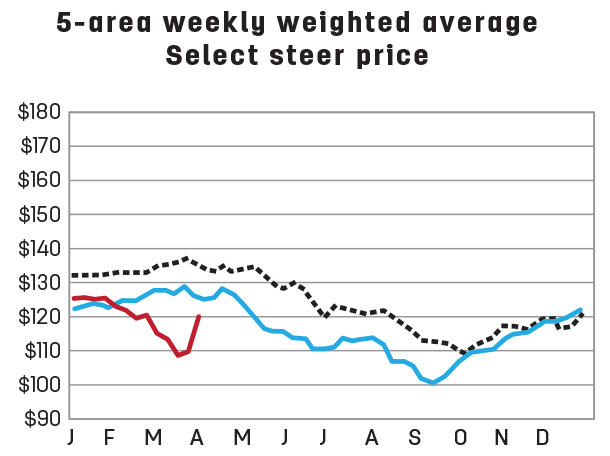

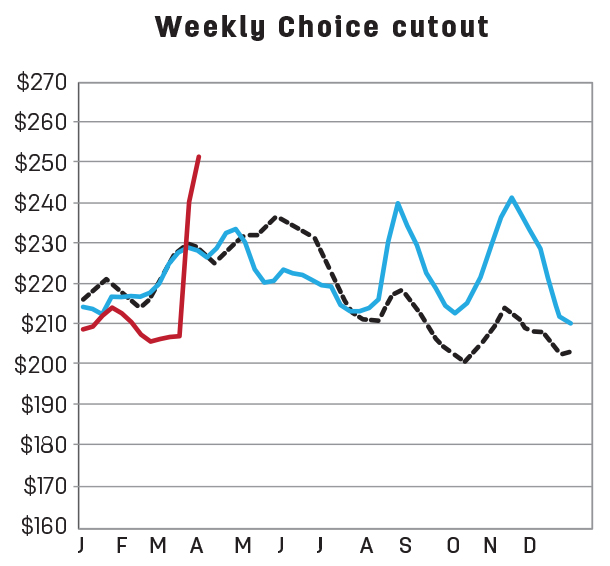

Since the February Outlook report, fed cattle prices have been trending downward when they should be trending seasonally upward; prices typically peak in the spring. Seasonally, the first quarter is normally when the fewest fed cattle are slaughtered and carcass weights begin trending lighter. However, with the current pace of slaughter combined with higher trending carcass weights, increasing supplies of beef and pressure from large supplies of competing meats are not conducive to higher boxed beef prices. In addition, buyers of wholesale boxed beef may be anticipating that prices will stay relatively low going into the grilling season.

In a normal year, it would be expected that heavier carcass weights and greater beef production might pressure fed cattle prices, absent any externalities. However, price signals indicated by the futures market may be encouraging feedlots to market cattle in as timely a fashion as possible. Packers’ margins are strong for this time of year and have likely supported the increased pace of slaughter. Fortunately, this has kept the supply of fed cattle from backing up, despite the largest number of cattle on feed on Feb. 1 since 2008.

Based on recent price data, the first-quarter 2020 average price for fed steers in the 5-area marketing region was reduced by $5 to $118 per hundredweight (cwt). This price weakness was carried over into the second and third quarters, which resulted in a 2020 price forecast of $114.50 per cwt.

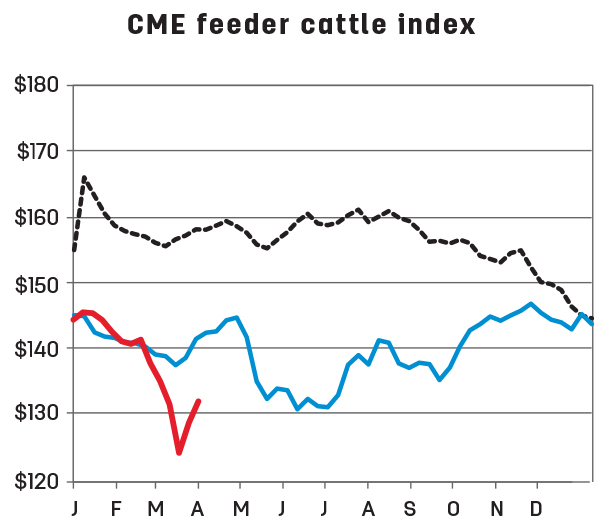

This price weakness is also spilling over into the feeder cattle markets. With lower prices received for fed cattle, feedlots are likely to offer lower prices for feeder calves. Based on current price weakness, first-quarter 2020 was reduced $7 to $138 per cwt, and weaker prices were carried through the rest of the year, resulting in an annual price forecast of $142.50 per cwt, $3.50 below the previous month.

Beef imports start the year lower than last January

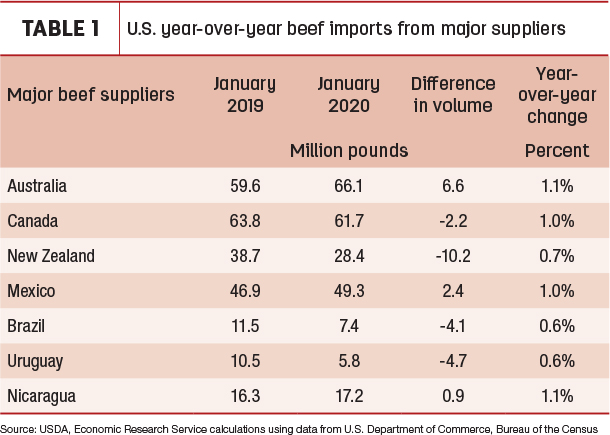

After three consecutive months of growth in U.S. imports year-over-year, January’s beef imports dropped to 244 million pounds, 3.5% below last year (Table 1).

The largest reduction in beef imports was from New Zealand, which likely diverted exports to China. Imports from New Zealand were 26% or 10.2 million pounds less than those received the previous year. January’s year-over-year beef imports from Canada were 2.2 million pounds less than January 2019. There were some increases in year-over-year U.S. beef imports from sources such as Australia, Mexico and Nicaragua, but they were insufficient to outweigh the overall lower imports from most major regions.

However, greater domestic fed cattle slaughter and strength in U.S. cull cow prices are expected to spur demand for imported lean processing beef. As a result, the first- and second-quarter 2020 import forecasts were raised by 20 and 15 million pounds to 720 and 750 million pounds, respectively.

Beef exports grow in new year, but less than expected

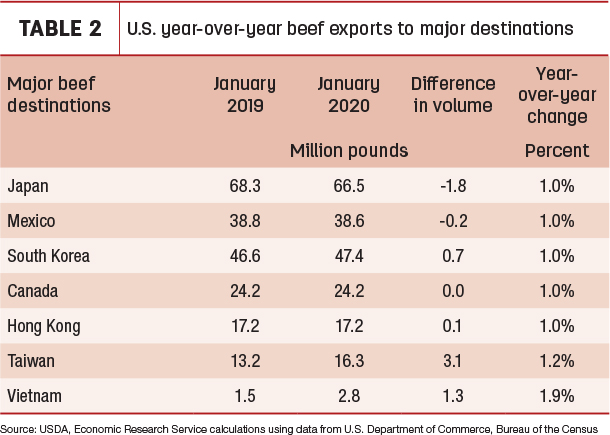

Following 12 months of year-over-year reductions, January 2020 U.S. beef exports were 3% above year-earlier levels, boosted by increased domestic supply (Table 2).

January’s beef exports amounted to 245 million pounds, the largest shipment with which the U.S. has ever started the year. For January 2020, Japan, the U.S. top beef destination, was down 3% or 1.8 million pounds year over year. U.S. exports to all other major beef destinations exceeded or equaled shipments from last year. Of the seven countries displayed below, Taiwan and Vietnam had the largest year-over-year increases.

The 2020 beef export forecasts for the first and second quarters were lowered by 25 and 15 million pounds, respectively, due to weaker expected demand in several markets. However, some of this demand is expected to shift to the third quarter, which was raised by 5 million pounds to 850 million pounds. Fourth-quarter 2020 was unchanged from the previous month. ![]()

Analyst Christopher Davis assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.