Feeder cattle receipts at the Oklahoma National Stockyards on April 4, 2016, were higher than either week-earlier or year-earlier receipts and were followed with another big run on April 11, 2016. The majority of the feeder cattle sold weighed greater than 600 pounds, were likely coming off graze-out wheat and could contribute to a potential April bulge in 800-pound-plus placements in 1,000-plus-head feedlots.

This will create a potential for increased marketings of fed cattle from these feedlots and increased supplies of beef by early fall, which will likely exert downward pressure on fed-cattle and beef prices.

Feeder cattle placed on feed this month will likely be marketed in the late third or early fourth quarters at relatively high carcass weights – a result of low grain prices and only modest discounts for heavy carcasses. This will contribute to the increased beef supplies and downward pressure on prices in the latter part of 2016.

Feeder cattle placed on feed this month will likely be marketed in the late third or early fourth quarters at relatively high carcass weights – a result of low grain prices and only modest discounts for heavy carcasses. This will contribute to the increased beef supplies and downward pressure on prices in the latter part of 2016.

Already, cumulative beef production is running more than 2 percent greater year-over-year than at this time in 2015, while cumulative cattle slaughter for the same period is just more than 0.5 percent higher year-over-year.

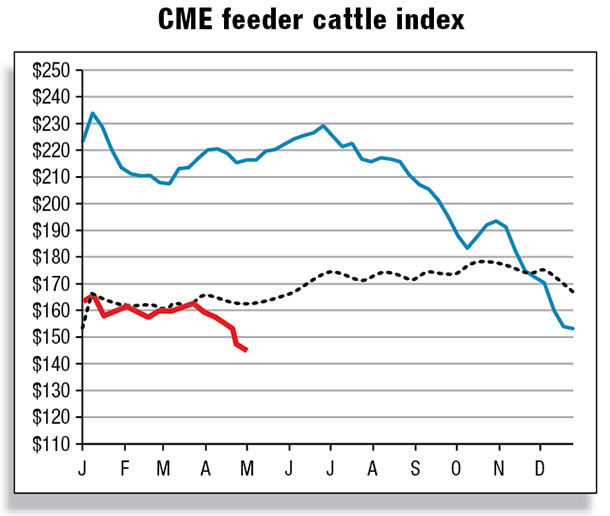

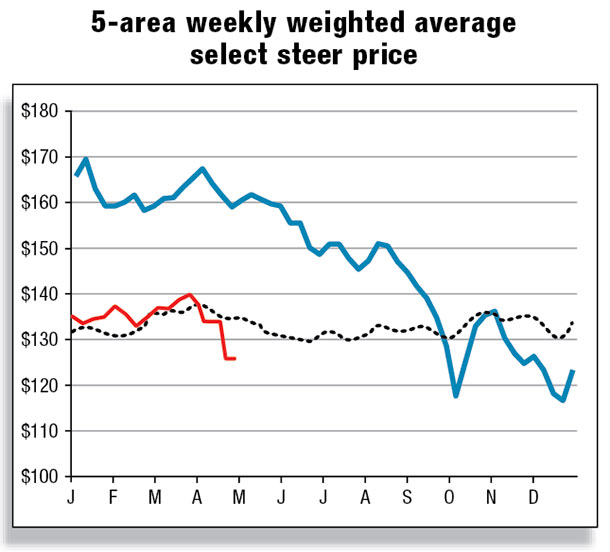

For the week ending April 4, 2016, 5-area, all-grade fed steers were $133.83 per hundredweight (cwt), roughly $35 lower than year-earlier fed-steer prices (5 area weekly weighted average) but high enough to provide potential for positive cattle-feeding margins in April – cattle feeders’ first shot at the black since fed cattle were marketed in November 2014.

First-quarter 2016 5-area direct total, all grades steer prices are projected to be $134.81 per cwt, down greater than $28 compared with first-quarter 2015.

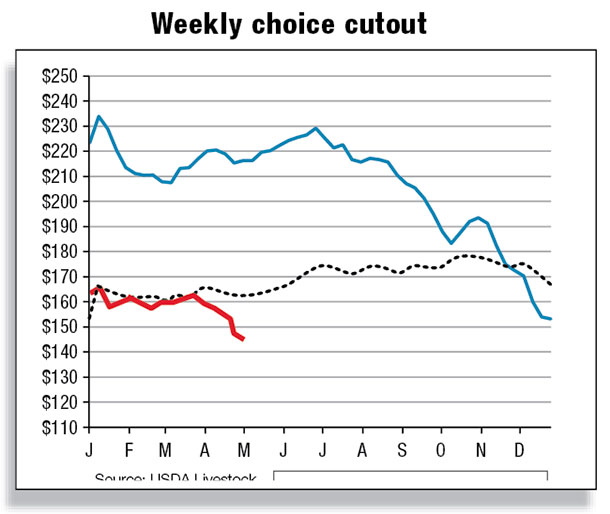

The beef complex remains under pressure as a whole, giving the impression that post-Easter strength in beef demand has been delayed. For the week ending April 8, the choice and select beef cutout values declined for the third consecutive week.

The most recent weekly choice beef cutout value was reported at $216.21 per cwt (down $41.29 per cwt year-over-year), while the weekly select beef cutout value currently stands at $206.78 per cwt (down $44.46 per cwt).

According to the USDA-AMS Estimated Weekly Meat Production report for the week ending April 8, year-to-date beef production for 2016 is approximately 2.4 percent higher than the previous year.

Year-to-date cattle slaughter was reported only about 0.6 percent higher; thus, a key factor supporting higher beef production is heavier cattle and dressed weights. Recently reported weekly average cattle dressed weights (for the week ending April 2) were at 830 pounds, 1 pound heavier than the previous week but still 15 pounds heavier than last year.

This suggests that the extra gain in weight continues to supply the wholesale market with ample supplies of beef. In the near-term, it appears that both supply and demand fundamentals are bearish for the beef complex.

Nonetheless, there is a seasonal tendency for beef prices to strengthen during the spring quarter as warmer weather supports grilling activities, and this should support cutout values in the weeks ahead.

Nonetheless, there is a seasonal tendency for beef prices to strengthen during the spring quarter as warmer weather supports grilling activities, and this should support cutout values in the weeks ahead.

U.S. beef exports show signs of growth in early 2016, imports down significantly

Although the February 2016 beef export total (172.3 million pounds) was reported below the previous year’s 177.9 million pounds, expectations of stronger global demand appears promising for U.S. beef producers.

Readily available supplies of U.S. beef and declining wholesale prices should prove to be a favorable combination for foreign buyers in the months ahead, boosting global interest in U.S. beef products. The U.S. is also expected to gain market share in top markets as Australia continues to experience a downturn in cattle slaughter and export shipments.

Second-quarter beef exports are forecast at 635 million pounds, nearly 5 percent higher year-over-year. Third- and fourth-quarter export forecasts are 660 and 635 million pounds, respectively – increases of 22 and 7 percent, year-over-year.

Total U.S. beef exports are forecast at 2.45 billion pounds, 8 percent higher than 2015. Beef imports are expected to show further declines on lackluster demand for lean processing beef from Australia.

U.S. beef imports through February were approximately 6 percent lower year-over-year. Through February, U.S. beef imports from Australia were approximately 16 percent lower year-over-year, while imports from New Zealand are about 9 percent higher. Through February, beef imports from both Canada and Mexico were higher.

Nonetheless, the volume of decline in beef imports from Australia, coupled with declines from Nicaragua, continued to overshadow the gains in beef imports from other countries. Total beef imports for 2016 are forecast at 2.9 billion pounds, 14 percent lower than the previous year. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.