As a result of the updated slaughter mix for fourth-quarter 2018, the anticipated average dressed weight was adjusted slightly lower for the quarter.

The 2019 beef production forecast was raised by 190 million pounds to 27.9 billion pounds. The adjustment reflects a greater number of cattle expected to be placed in feedlots in second-half 2018 and in first-half 2019, equating to more fed cattle marketed and slaughtered in 2019.

The 2019 beef production forecast was raised by 190 million pounds to 27.9 billion pounds. The adjustment reflects a greater number of cattle expected to be placed in feedlots in second-half 2018 and in first-half 2019, equating to more fed cattle marketed and slaughtered in 2019.

The expected higher number of fed cattle to be slaughtered was partially offset by an expectation of lower dressed weights in early 2019.

Feeder sales and cattle imports support higher placements

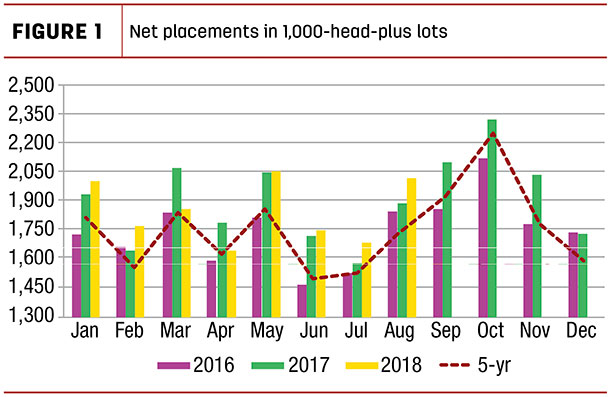

As noted, the higher beef production forecast for 2019 is largely a function of an increase in expected placements in second-half 2018 and first-half 2019. Based on the latest USDA National Agricultural Statistics Service Cattle on Feed report, net placements in August in feedlots with 1,000 head or greater capacity reached 2.1 million head, 7.2 percent above year-earlier levels.

For the first two months of second-half 2018 (July-August), net placements were 7.2 percent higher year-over-year. As depicted in the figure, placements typically increase seasonally month-over-month from July through October.

The figure also shows net placements in September, October and November 2017 exhibited large year-over-year growth from the same period in 2016. Last fall, dry conditions in much of the Southern Plains affected potential winter forage availability. It is likely much of the year-over-year increase in placements in fall 2017 was the result of calves that might have gone on winter pasture instead going directly into feedlots.

This year, increased availability of winter forage and a larger calf crop and higher cattle import volume than last year likely support the availability of feeder cattle to go to both pen and pasture.

The number of feeder cattle marketed in July to September was up 5.6 percent, based on the USDA Agricultural Marketing Service National Feeder & Stocker Cattle Summary report. Feeder calf imports for July and August were 26.2 percent higher than for the same period last year.

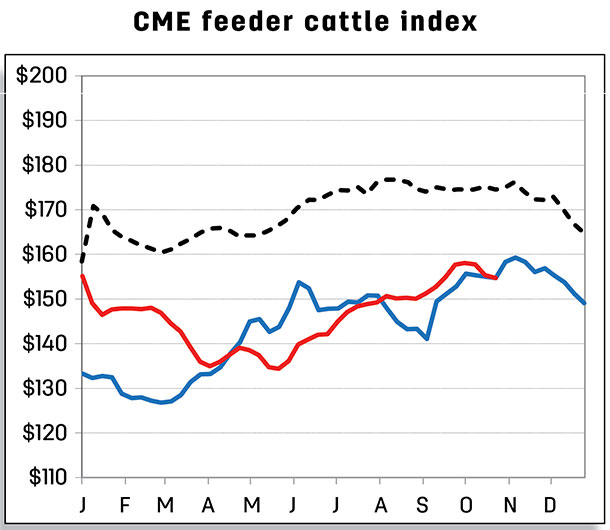

Not all imports and feeder cattle sales go directly to feedlots, but weekly feeder prices trending higher counter-seasonally in September and into October imply more cattle are moving through the cattle production system.

As a result, placements into feedlots in second-half 2018 are expected to be higher, continuing in first-half 2019. This implies a greater number of steers and heifers to be slaughtered next year, boosting the beef production forecast for 2019. However, feedlot placements are unlikely to exhibit the same year-over-year gains for September through November reported last year.

Demand sustains feeder calf prices

Price information from the Oklahoma National Stockyards for feeder steers weighing 750 to 800 pounds suggests there is competition for ownership of these animals. Coupled with counter-seasonal gains in prices for lighter-weight feeder cattle, this may suggest winter forage conditions have improved over last year – and also that feedlots are taking advantage of possible positive returns in 2019.

As a result, on continued expected strong demand, the fourth-quarter 2018 feeder steer price forecast was raised to $150 to $156 per hundredweight. The annual price for 2019 was also raised to $141 to $152 per hundredweight.

Feedlot operations hold out for higher prices

The reduced pace of fourth-quarter 2018 fed cattle slaughter reflects a slower expected pace of marketings in the fourth quarter. The slower pace is likely in part a reflection of lighter placement weights during the spring months but may also reflect a desire by feedlots to capture premiums implied by October and December futures.

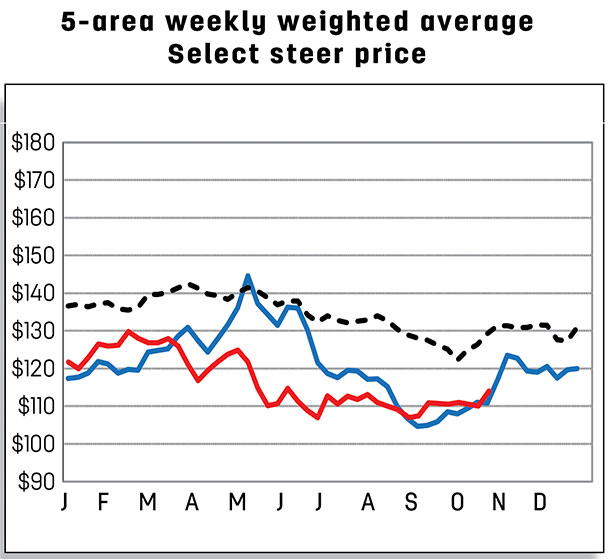

Although fed steer prices in the 5-area marketing region for September averaged above year-earlier levels, expected increased supplies of cattle available for slaughter in fourth-quarter 2018 are likely to pressure prices relative to last year.

Although fed steer prices in the 5-area marketing region for September averaged above year-earlier levels, expected increased supplies of cattle available for slaughter in fourth-quarter 2018 are likely to pressure prices relative to last year.

Taking into account recent price data, and that feedlots may be holding cattle longer for higher prices, the fourth-quarter price forecast for fed steers was raised slightly to $110 to $114 per hundredweight. The 2019 price forecast remains unchanged from the previous month.

U.S. beef import forecast revised downward

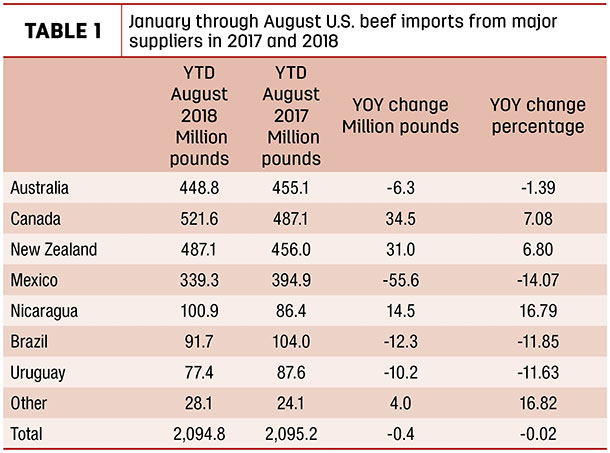

U.S. beef imports declined year-over-year by 9.7 million pounds in August 2018 (-3.4 percent), to 272 million pounds. Among the major suppliers, declines from Australia (-9.2 million pounds), Uruguay (-4.2 million pounds) and Mexico (-3.9 million pounds) more than offset the increases from Nicaragua (+4.4 million pounds) and Brazil (+3.9 million pounds).

Year-over-year imports from New Zealand and Canada were also slightly lower in August. Cumulative imports for January-through-August 2018 were fractionally lower than year-earlier levels (see table). There was a notable decline in volume from Mexico, with imports lower year-over-year in each month of 2018 through August.

Year-over-year imports from New Zealand and Canada were also slightly lower in August. Cumulative imports for January-through-August 2018 were fractionally lower than year-earlier levels (see table). There was a notable decline in volume from Mexico, with imports lower year-over-year in each month of 2018 through August.

Drought in Australia increased slaughter in mid-2018, increasing the exportable supply of beef. However, despite increased supplies, attractive prices in a number of other Asian countries likely supported a shift in Australia’s exports from the U.S. to Asia.

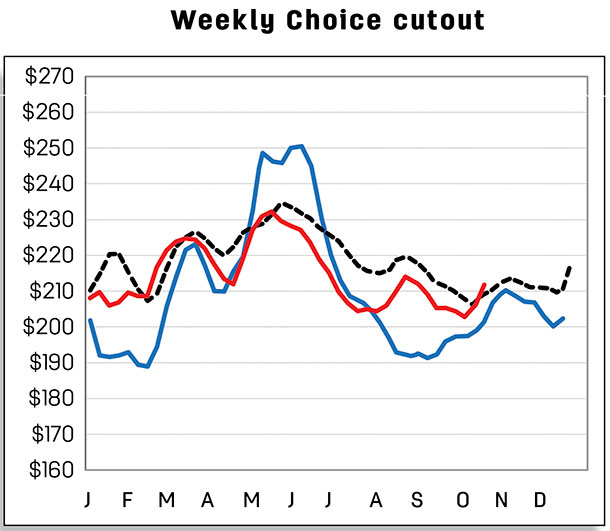

Meanwhile, higher cow slaughter in the U.S. has increased production of fresh lean, which is likely placing downward pressure on prices of imported frozen lean.

Relatively weaker U.S. lean beef prices may provide less incentive to suppliers to increase shipments of their limited supply to the U.S. Based on these grounds and a lower-than-expected import volume in August, the third-quarter 2018 import forecast is revised downward by 10 million pounds to 820 million pounds, setting the 2018 forecast at 3.027 billion pounds.

With lower drought-diminished cattle numbers at the beginning of 2019, beef production in Australia is expected to be lower; to the extent any improvements in forage supplies support herd rebuilding, slaughter cattle numbers may be further reduced. With lower expected exportable supplies of beef in Australia in 2019, exports of beef to the U.S. will be affected. The 2019 beef import forecast is revised downward by 40 million pounds to 3.1 billion pounds.

Year-over-year August 2018 U.S. beef exports were up 9 percent to 287 million pounds. Among major destinations, August exports were very strong over those from year-earlier to South Korea (+21.6 million pounds), Taiwan (+6.5 million pounds) and Japan (+5.2 million pounds) due to continued demand. Export growth was moderate to Mexico (+1.4 million pounds). August exports declined to Hong Kong (-8.0 million pounds) and Canada (-3.2 million pounds).

Exports to Hong Kong began declining year-over-year in first-quarter 2018. The 2018 export forecast is unchanged from the previous month’s forecast at 3.164 billion pounds. Higher year-over-year weekly export sales estimates for September continue to support the 2018 forecast. The 2019 exports are also unchanged from the previous month’s forecast at 3.245 billion pounds.

Cattle exports higher

The volume of U.S. cattle exports in August was 19,095 head, up 7,507 head from year-earlier levels. Most of the cattle were shipped to Canada. Higher exports in most months in 2018 resulted in a year-to-date increase in exports of over 39,000 head or 48 percent. Increased feedlot activities in Canada and recent widening in U.S.-Canada feeder price spreads have supported greater feeder cattle movements from the U.S. to Canada.

However, the 2018 cattle export forecast is unchanged from the previous month’s forecast at 190,000 head. Based on expectations of sustained Canadian demand, U.S. cattle exports in 2019 have been revised upward by 15,000 head to 195,000 head.

The volume of U.S. cattle imports in August 2018 was 119,865 head, about 22,000 head above year-earlier levels. Through August 2018, year-over-year imports were about 37,000 head higher (+3.1 percent), with increased imports from Mexico more than offsetting the decline from Canada.

The cattle import forecasts for 2018 and 2019 were left unchanged from the previous month’s forecast at 1.885 million and 1.960 million head, respectively. ![]()

Analyst Lekhnath Chalise assisted with this report.

Russell Knight is a Market Analyst with the USDA – ERS. Email Russell Knight.