The exception was placements of feeder cattle weighing 800-plus pounds. While most wheat-pasture cattle were removed from wheat in mid-March in order to prevent damage to the wheat joint or growing point, unseasonably large numbers of relatively heavyweight feeder cattle continue to be sold at auction, suggesting continued movement from wheat pasture.

Anecdotal evidence also suggests not all cattle in Texas have yet been moved off winter wheat. Recent increases in feeder cattle prices could lead to some wheat being grazed out.

Further, some cattle may have been carried through the winter in growing lots, a strategy for which there is also anecdotal support. Drylot backgrounding becomes feasible when corn prices are as low as they have been recently, and it has the added advantage of accustoming feeder cattle to eat from feedbunks, which is helpful when they are moved to feedlots.

It is also a way for producers to market their corn at increased value. Some replacement heifers may also have been grown in backgrounding lots through the winter to get them physically and physiologically ready for breeding this summer.

Weekly veal prices (carcass-hide off) reached more than $570 per hundredweight (cwt) in February 2015, roughly $100 per cwt above February 2014 prices and nearly $150 per cwt higher than the 2010-2014 average (AMS, weekly veal market summary).

These price increases reflect the significant downward trend in year-to-date veal production – down 23 percent compared with February 2014 – and the increased value calves have as feeder cattle. However, average liveweights of veal calves in February, at 293 pounds, were up 26 pounds from weights in February 2014.

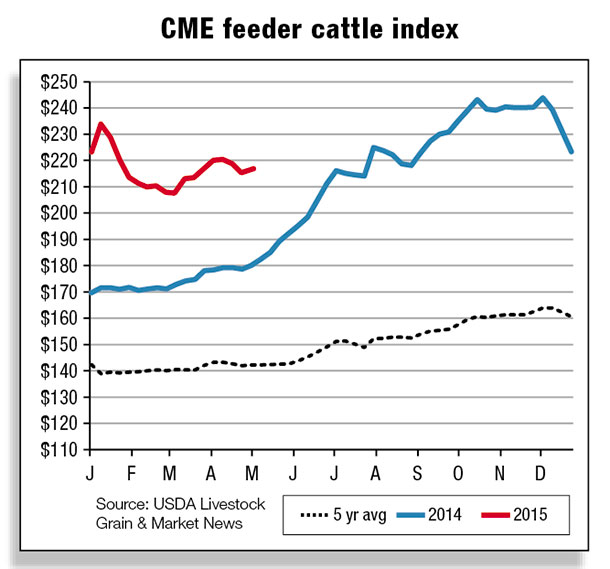

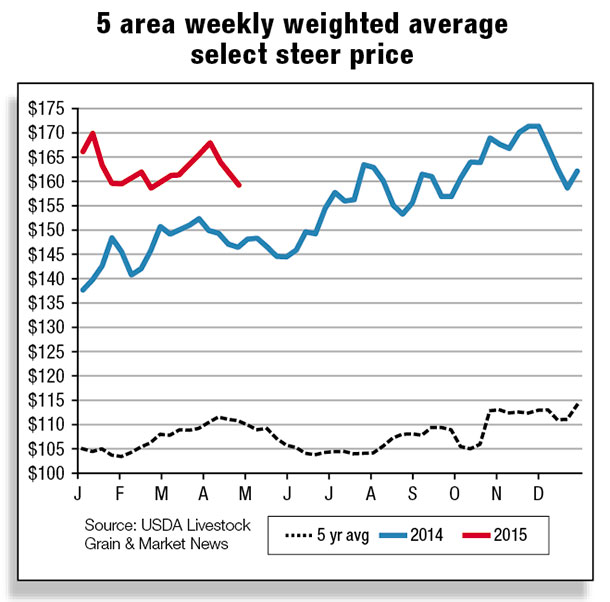

Feeder and fed cattle prices have been volatile for most of this winter. Cow prices have continued steady-to-higher, with anticipated seasonal decreases in cow slaughter; the prices have held despite increasing boneless cold storage stocks from increased supplies of imported processing beef and held-over stocks from earlier West Coast shipping issues.

Following their winter volatility, prices for feeder and fed cattle picked up during the last half of March. Feeder cattle prices have increased despite large numbers of cattle crossing the scales at heavy weights on their way to feedlots.

Despite the heavier dressed weights due to longer feeding periods and near-term expectations of more red ink for cattle feeders – mostly due to high feeder cattle prices when the cattle were placed in feedlots – cattle feeders appear to have the upper hand in the ongoing tug-of-war with beef packers over fed cattle prices.

Further, moderate corn prices and strength in fed-cattle prices have improved the potential for positive cattle-feeding margins later in 2015.

However, with dressed weights following a muted seasonal pattern of decline thus far into late winter/spring, which can result in undesirably large cuts at retail counters, cattle feeders could encounter additional discounts for heavy carcasses from beef packers.

Offsetting negative price pressures from heavier dressed weights, and to the extent that cow-calf operators continue to hold back heifers in an effort to rebuild the nation’s beef cow herd, supplies of fed cattle will remain constrained, which should provide support for wholesale beef prices at their historically high levels.

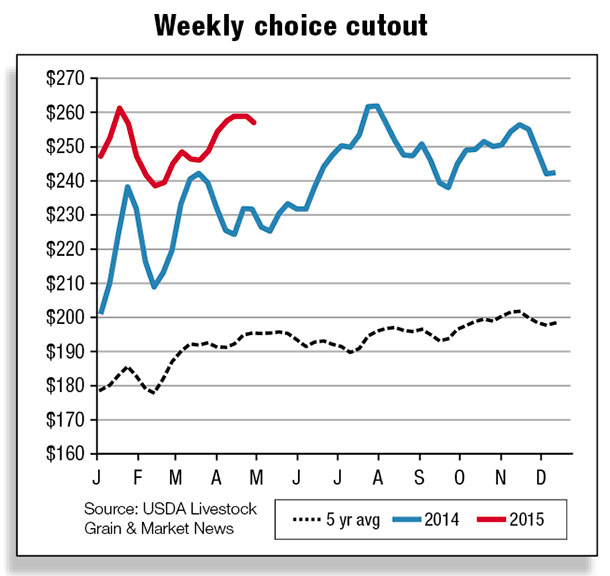

Wholesale beef cutout values appear to be strengthening into the spring quarter. Both choice and select cutouts are pushing toward new record-highs from the combination of tight supplies and seasonal demand strength.

Weekly choice cutout values advanced from a mid-February weekly low of $238.69 to $257.50 on April 10, while select cutout values gained almost as much over the period. Based on the weekly boxed beef cutout data, the choice cutout value has gained $8.59 since the first week of March, while the select cutout has gained $5.45 over the same period.

The gains in the boxed beef cutouts over the last five weeks are the result of significant gains in beef middle meats (i.e., the rib and loin primals).

This is not surprising given the tendency for both choice and select beef cutouts to gain momentum heading into the spring grilling season, when these more expensive cuts become popular.

Nonetheless, less expensive wholesale prices for both pork and poultry will continue to be problematic for the boxed beef industry as a whole. Although beef cutout values remain historically high, beef packers continue to pay higher prices for cattle.

This has led to packer margins being constrained – and in some instances stuck in negative territory – through most of the first quarter.

However, packers could experience some improvements in their margins during the second quarter as the spring grilling season takes center stage and near-term demand increases, supporting higher cutout values.

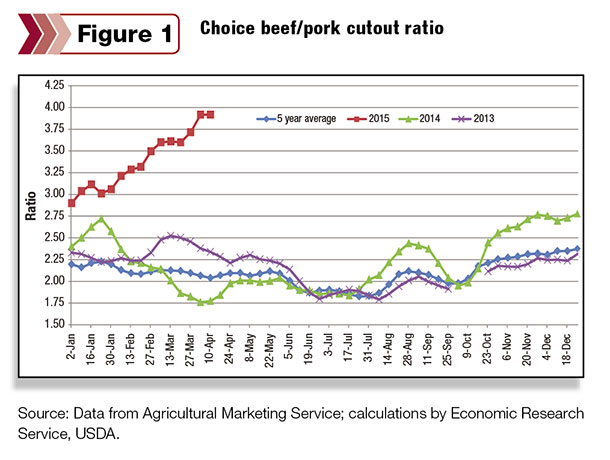

Pork product values, on the other hand, have fallen sharply due to rapid recovery in production and weakening export demand this year. Combined with firm pricing in the boxed beef market, this has resulted in record price spreads between beef and pork cutout values.

As seen in the figure, the price spread between the two cutouts has continued to widen sharply since the beginning of the calendar year.

As a result, beef prices will likely be met with some resistance at the retail level as retailers increasingly feature pork and poultry in an effort to recapture any margin losses in the beef case.

Retail beef prices reached record-high levels in February, averaging $6.028 per pound, up approximately 14 percent year-over-year. The pork-beef price spread should begin to narrow heading into the summer quarter as seasonally smaller hog supplies underpin the pork cutout and beef cattle supplies expand modestly (on a seasonal basis).

Cattle imports down in February

February cattle imports fell 6.2 percent compared with a year earlier. Imports from Mexico were up 3.5 percent over last February, but imports of Canadian cattle were down 15.2 percent below a year earlier.

Feeder cattle imports were up for both Mexico (+3.6 percent) and Canada (+18.4 percent), but the decline in fed cattle and slaughter cow imports from Canada was large enough to move the total into negative territory.

The forecast for U.S. cattle imports in 2015 is down 50,000 head from March and is expected to total 2.250 million head. The decline is due to lower-than-expected imports of fed cattle from Canada; however, demand for imported cattle is expected to remain strong through the year due to tight U.S. cattle inventories and expected heifer retention.

Beef imports rise in February

U.S. beef imports were up 48.8 percent in February compared with a year earlier. Imports rose by the greatest volume from Australia (+114.9 percent), Brazil (+309.1 percent), Mexico (+44 percent) and New Zealand (+16.9 percent).

Demand for imported processing beef expanded rapidly in 2014 due to lower domestic supplies of lean beef and is expected to continue through 2015. The largest increase in beef shipments in February came from Australia, with U.S. imports totaling 69.9 million pounds.

A strong U.S. dollar and relatively cheaper prices of imported products have encouraged aggregate U.S. imports of beef, which totaled 2.947 billion pounds in 2014. Imports in 2015 are forecast at 2.910 billion pounds.

Beef exports decline in February

At 178 million pounds, U.S. beef exports in February fell 2.6 percent compared with a year earlier. February 2015 exports were down to three major markets: Hong Kong (-18.2 percent), Canada (-17.8 percent), and Mexico (-16.4 percent).

Japan remains the largest market for U.S. beef, and February shipments were up 9.3 percent compared with a year earlier. Exports are forecast to fall in 2015 to 2.420 billion pounds due to lower expected U.S. beef production, high prices and a strong dollar.

![]()

On April 21, page 4 of the Livestock, Dairy, and Poultry Outlook, the weekly choice beef cutout value was corrected to report that the values advanced to $257.50 on April 10.

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.