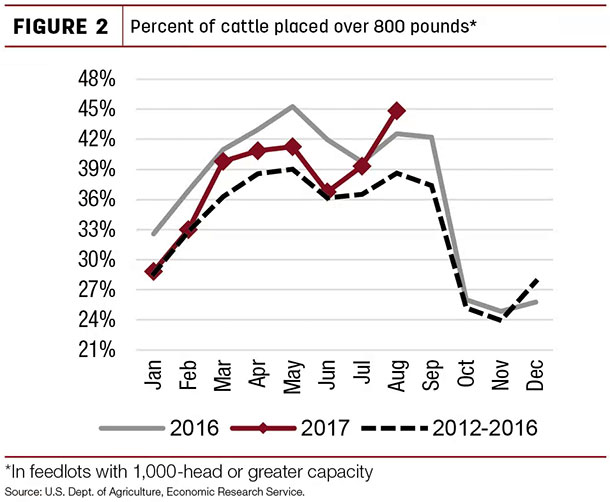

These heavier weights largely reflect the likelihood of increased overall placements of heavier cattle because forage conditions in some parts of the country are expected to offer cow-calf operators and backgrounders more flexibility in timing the sales of calves.

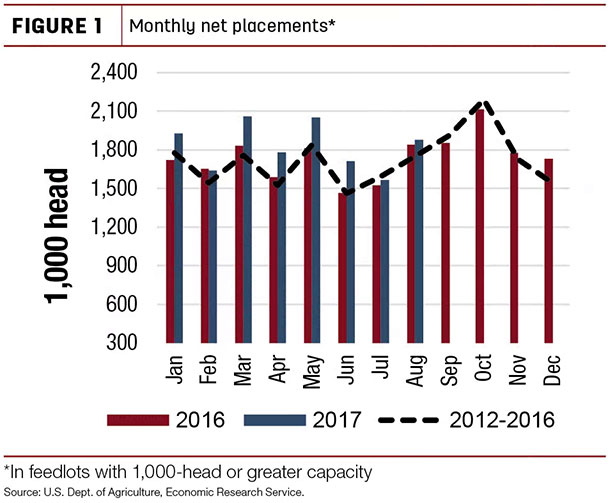

According to the NASS Cattle on Feed report for August, placements were up about 3 percent, and marketings were 6 percent higher year-over-year. The placement of calves over 800 pounds was up 8.1 percent, and the proportion of these heavier weights to all cattle placed was the highest for August since the series began in 1996.

The availability of winter pasture is expected to shift some fall placements to late winter and spring 2018. These first-half placements are likely to be marketed in the second half, supporting larger year-over-year second-half beef production. Placements during the first half of 2018 will likely be above 2017, as supplies of cattle outside feedlots are relatively large.

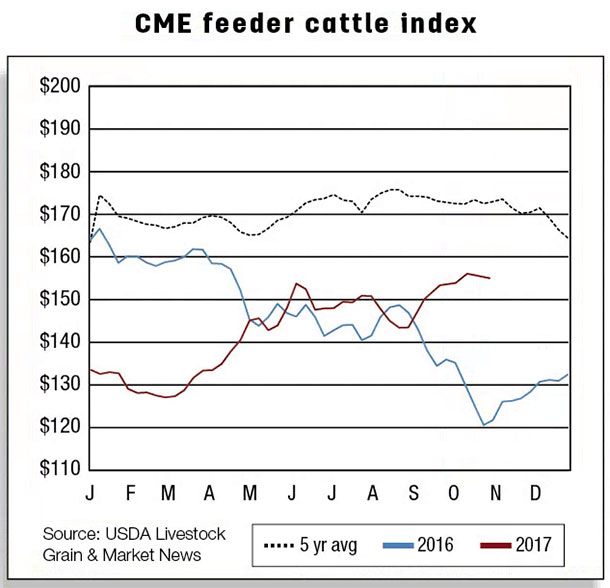

Winter forage options support feeder calf prices

Despite the sizable number of cattle outside feedlots, medium-frame feeder steers in Oklahoma City averaged $148.12 per hundredweight (cwt) in the third quarter, which is $7.48 higher than the same period last year. Winter grazing opportunities in the Southern Plains are likely encouraging increased demand by stockers, which should support feeder calf prices.

Fourth-quarter prices are raised from the previous month to $143 to $147 per cwt, reflecting firm demand by both backgrounders and feedlots. First-half 2018 prices are raised from the previous month as well.

Large fourth-quarter marketings to pressure fed cattle prices

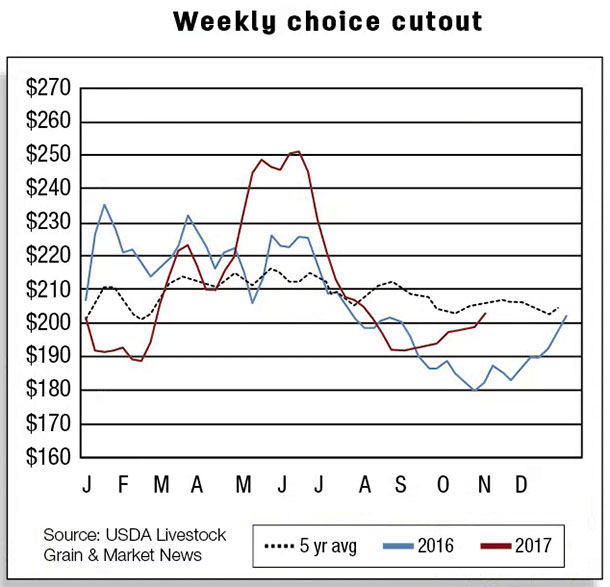

For the week ending Oct. 6, wholesale Choice beef prices (LM_XB 459) averaged $197.39 per cwt, almost 7 percent above 2016 levels. However, prices still remain below 2014 and 2015 levels, reflecting more beef production and competition from abundant supplies of pork and poultry.

Large numbers of fed cattle and increases in carcass weights are expected to result in just over 7 percent more beef year-over-year in the fourth quarter of 2017. This will likely pressure wholesale Choice beef prices.

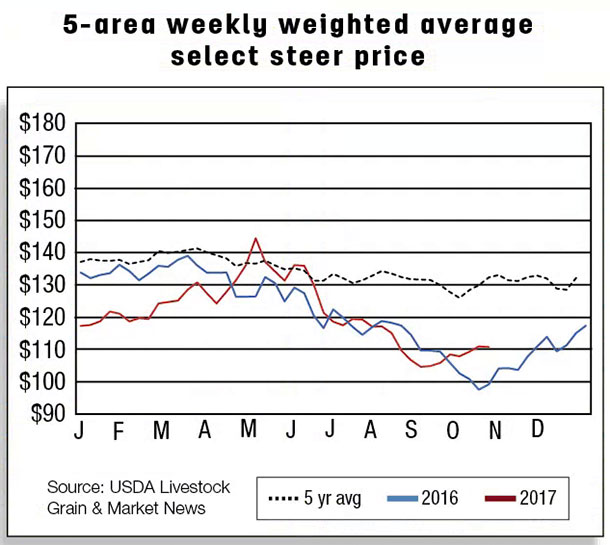

Recent large supplies of market-ready cattle have prevented the USDA 5-area fed steer price from rebounding off recent lows. In July, the monthly weighted average price for fed steers was $118.45 per cwt and trended lower through September to $107.11 per cwt for a quarterly average of $112.46 per cwt.

The third-quarter estimate is slightly below prices last year, but the latest weekly price of $109.45 per cwt (as of Oct. 6) is about 8 percent higher than the same week last year. As a result, fourth-quarter fed steer price is unchanged from the previous month to $108 to $112 per cwt, staying above 2016 for the quarter. The forecast for 2018 fed steer prices also remains unchanged.

U.S. beef exports for 2017 and 2018 revised upward

The volume of U.S. beef exports in August 2017 was up 14.7 percent (+34 million pounds) from the same period last year to 264 million pounds. Shipments to major export destinations – Japan, Hong Kong, Canada and Mexico – were higher during this period. Moreover, cumulative beef exports for January through August 2017 have maintained the pace from the previous month of 14.5 percent above year-earlier levels.

The USDA/FAS Export Sales report indicates a continuation of this export pace in September. U.S. beef exports to Japan during August 2017 were 39 percent higher than the same period last year, despite the implementation of the frozen beef safeguards in August. Japanese importers are more than likely substituting frozen beef with chilled beef during the implementation of the safeguards.

The forecast for beef exports for 2017 is increased by 50 million pounds from the previous month to 2.83 billion pounds on stronger-than-anticipated demand from major export destinations. Beef exports in 2018 are also adjusted higher from the previous month to 2.91 billion pounds based on the continued competitiveness of U.S. beef.

U.S. beef imports exhibit strength in August

August 2017 U.S. beef imports increased 8 percent (+21 million pounds) to 282 million pounds relative to the same period last year. Increases in Australia (+10 million pounds), New Zealand (+7 million pounds) and Mexico (+6 million pounds) offset the decline from Brazil (-3 million pounds).

Third-quarter 2017 beef imports are forecast higher (+105 million pounds) from the previous month to 815 million pounds based on the strength of an increased pace of July and August imports and continued relatively strong processing-grade meat prices in September.

The “Weekly Imported Meat Passed for Entry” (WIMPE) AMS report shows strong beef import data for September. The fourth-quarter 2017 forecast was also increased by 20 million pounds. As a result, the 2017 annual import forecast is 2.96 billion pounds. The 2018 U.S. beef imports forecast is also revised upward from the previous month to 3.03 billion pounds.

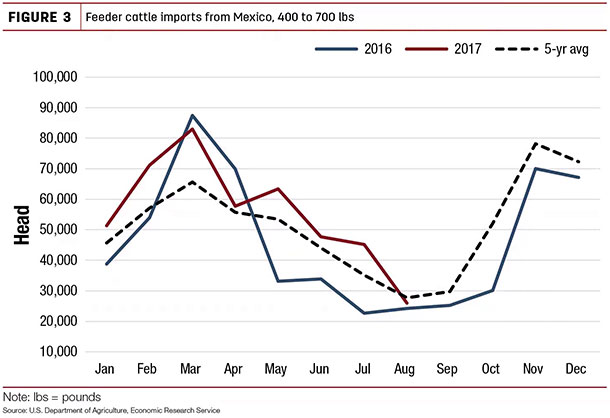

U.S. cattle imports at seasonal lows

U.S. cattle imports tend to exhibit seasonal patterns whereby the third quarter is the lowest. Although imports during August were only slightly higher year-over-year, the cumulative pace of imports (January-August) remain about 4 percent ahead of 2016. With larger cattle supplies and relatively high feeder calf prices in the U.S., feeder cattle imports from Mexico (400 to 700 pounds) are expected to be beyond typical fourth-quarter increases for the rest of this year.

Moreover, Canada will likely supply more cattle for the remainder of 2017 and 2018 because drought conditions in western Canada are tightening forage supplies. As a result, cattle imports are revised upward from the previous month to 1.82 million head in 2017 and 1.92 million head in 2018.

Moreover, Canada will likely supply more cattle for the remainder of 2017 and 2018 because drought conditions in western Canada are tightening forage supplies. As a result, cattle imports are revised upward from the previous month to 1.82 million head in 2017 and 1.92 million head in 2018. ![]()

Analyst Lekhnath Chalise assisted with this report.

References omitted but available upon request. Click here to email an editor.

Russell Knight is a market analyst with the USDA – ERS. Email Russel Knight.