The Northern Plains and Rockies are expecting early snowfalls with near-average or below-average temperatures. At the same time, California and the Southwestern U.S. remain in a serious drought.

Not only have the weather conditions given relief to most cattle-producing areas, but a record-breaking corn harvest is apparent. As a result, this year’s harvest has lowered corn and soybean meal prices, and producers have the option to keep cattle on feed or pasture for longer periods of time.

The Cattle on Feed report, released October 2014, showed the second-lowest placements for the month of September since the recorded series began in 1996. However, placement weights are up, likely a result of improved pasture conditions making it possible to keep cattle on pasture longer.

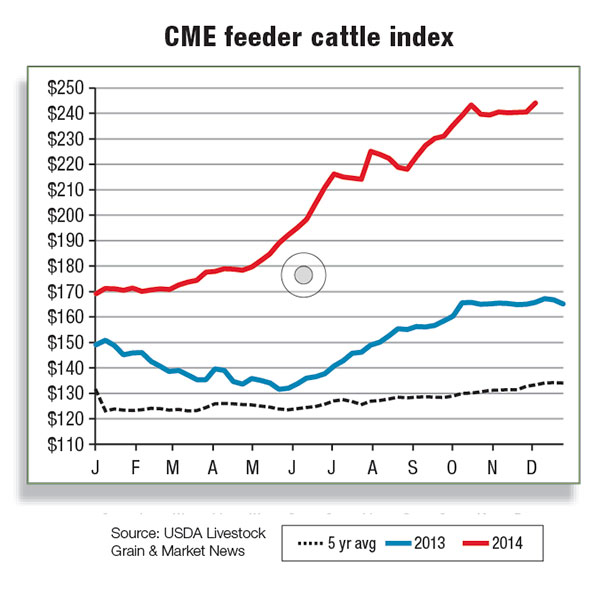

Further, feeder cattle prices have been trending upward into $220-plus- per-hundredweight (cwt) territory, contributing to a clouded horizon for cattle feeders, who could face costs of owning and feeding cattle valued at $170 per cwt or more later this year and into 2015.

While recent record fed cattle prices reached the $170-per- cwt level, fed cattle prices have begun showing signs of weakening.

The Cattle on Feed report also revealed a 3 percent drop in heifer and heifer calves and a 1 percent increase in steers and steer calves in feedlots of 1,000 head or more in October 2014 compared with the same time last year. These data may indicate that some producers are interested in herd expansion by keeping heifers back for breeding purposes (forgoing very high returns by not sending them to the feedlot now).

According to the Livestock Slaughter report released October 2014, there were slightly fewer cattle being slaughtered even though September 2014 contained one more weekday than September 2013. For 2014, beef production is forecast to drop slightly compared with last year, which is consistent with the even tighter 2014 cattle inventory.

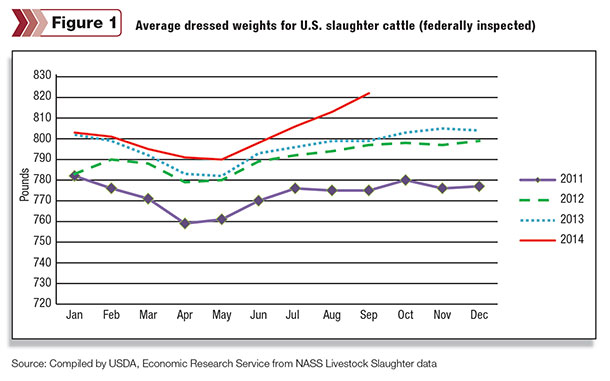

With heifers contributing a smaller proportion of total slaughter (see figure), an increasing proportion of steers in feedlots than in the past, combined with longer feeding periods for both steers and heifers, is resulting in heavier average weights of all animals coming out of feedlots. The reductions in feed costs, available feedlot capacity and high cattle prices have caused average dressed weights of all cattle slaughtered to exceed 800 pounds, partially offsetting decreased cattle slaughter numbers.

As with cattle, veal calf slaughter has slowed (with cumulative weekly slaughter down 23 percent through the week ending Nov. 1 compared with the same period in 2013), and live weights have increased roughly 50 pounds from last year.

Calf slaughter has declined in part as a result of the extremely high value calves have as feeder calves. The higher-than-average live weights are likely due to both lower feed prices and to keeping calves on feed longer.

Also, as with cattle, the increased weight of veal calves has offset the decline in calf slaughter to the extent that veal production is down by only 13 percent. The 2014 market for calves (carcass-hide off) has trended higher, reaching $550-plus per cwt at the beginning of November (Agricultural Marketing Service, www.ams.usda.gov/mnreports/lswveal.pdf).

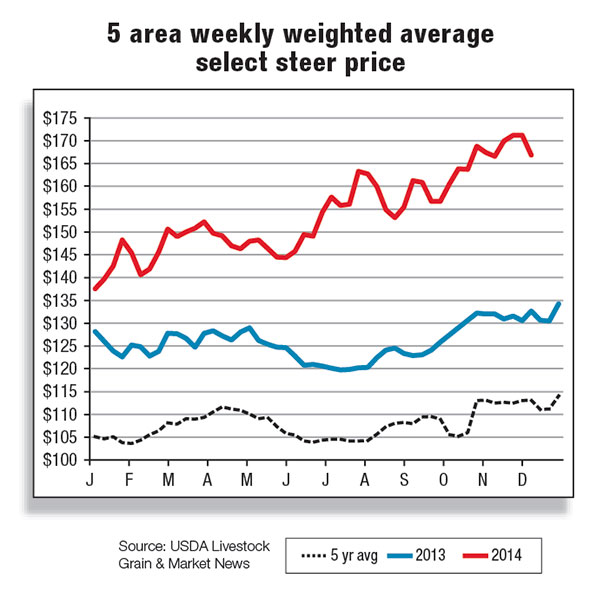

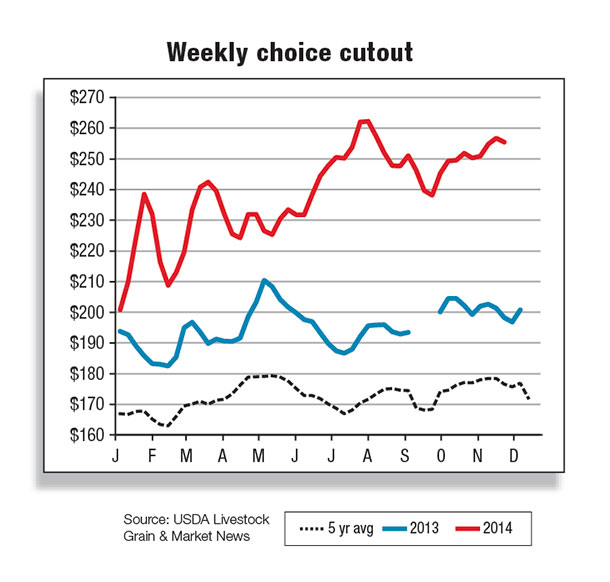

The third-quarter 2014 five-area price of steers averaged $158.49 per cwt and is expected to average $163 to $167 in the fourth quarter. Packers are still feeling the pinch from these prices, making it difficult to see much profit at any time in the near future.

Third-quarter 2014 composite prices for retail choice beef climbed to $6.15 per pound, boosted by September’s record $6.26 per pound, while the third quarter All-Fresh averaged $5.76 per pound, both new record quarterly averages.

U.S. cattle imports higher through September

U.S. cattle imports during the typically slow third quarter were 34 percent higher than last year. Combined with higher imports during the first half of the year, cumulative-year imports were up 17 percent from Mexico and 12 percent from Canada.

Record-high feeder cattle prices continue to draw cattle from north and south of the border despite historically low inventories in both Canada and Mexico.

AMS-reported prices of weekly cattle imports from Mexico were almost 50 percent higher than last year during the first three quarters of this year. AMS-reported prices for Alberta feeder cattle were about 35 to 40 percent higher during the same period.

Imports of Canadian feeder cattle were up 30 percent through September and have fueled much of the increase in overall shipments from Canada. Cattle for immediate slaughter, which accounted for 61 percent of total imports from Canada in 2013, were up only 3 percent.

The forecast for U.S. cattle imports in 2014 was raised 50,000 head to 2.250 million, 11 percent higher than 2013. Imports are expected to remain stable in 2015, unchanged at 2.250 million head.

Economic conditions are not expected to drastically change in 2015; demand for cattle is expected to remain robust, but growth in imports will be challenged by already tight cattle stocks in Canada and Mexico.

Beef imports rise from Australia, exports strong to Asia

U.S. beef imports were up strongly during the third quarter of 2014, totaling 764 million pounds – 48 percent higher than the third quarter of 2013. Imports have accelerated as demand for processing beef has risen.

The price of frozen 90 percent chemical lean beef was about 24 percent higher during the first three quarters, increasing demand for less-expensive imported processing beef. Cumulative-year imports through September were up 23 percent from a year earlier, and shipments were up from nearly all sources.

Imports rose significantly from Australia (+58 percent), Canada (+12 percent), New Zealand (+12 percent) and Mexico (+19 percent). Australia remains the top source for U.S. beef imports, accounting for 34 percent of all imported beef this year. Monthly shipments have been well above the five-year average since the spring, including a total of 115 million pounds in September.

The forecast for U.S. beef imports in 2014 was raised to 2.823 billion pounds.

While stronger demand was anticipated this year due to declining domestic cow and bull slaughter, higher U.S. imports have been made possible by a 10 percent increase in Australian beef production through September. With more than half of its annual production exported, the country’s exports of beef have risen 17 percent.

The majority of the increase has been in shipments to the U.S., while shipments have been lower to China and Japan, the other major buyers of Australian beef. U.S. demand for imported processing beef is expected to remain robust through the end of the year, and weekly customs data indicate that shipments have remained elevated through at least the first week of November. The forecast for U.S. beef imports in 2015 is 2.7 billion pounds, 4 percent lower than 2014 as beef supplies among U.S. suppliers are likely to be lower.

U.S. beef exports were up 1 percent from last year through September 2014. While exports during the first half of the year were up 5 percent from the same period a year earlier, third-quarter exports were 5 percent lower than last year. Exports have remained robust to Hong Kong (+57 million pounds), Mexico (+53 million pounds) and South Korea (+39 million pounds).

Japan remains the largest buyer of U.S. beef, but shipments were down 3 percent from last year. Japan is the world’s second-largest beef importer after the U.S. but has marginally lower imports of beef this year due to the country’s sluggish economic growth and higher global beef prices.

Canada has also reduced its purchases of beef this year amid higher prices and a weaker exchange rate with the U.S. dollar. While Canada has increased its purchases of Australian beef, overall Canadian imports were down 9 percent through September. The forecast for U.S. beef exports in 2014 is 2.599 billion pounds. Exports are expected to fall 3 percent in 2015 to 2.525 billion pounds as lower U.S. beef production will constrain exports. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.