However, they have recouped much of the lost slaughter capacity in a very timely manner since hitting the lowest levels at the end of April. At the lowest point, steer and heifer slaughter fell by as much as 41% below a year ago, and the slaughter of cows and bulls dropped to 9% below a year ago. Based on USDA Agricultural Marketing Service estimated weekly slaughter for the week ending June 13, steer and heifer slaughter recovered to 4% below the same week a year ago, and cow and bull slaughter improved to 7% above the same week last year.

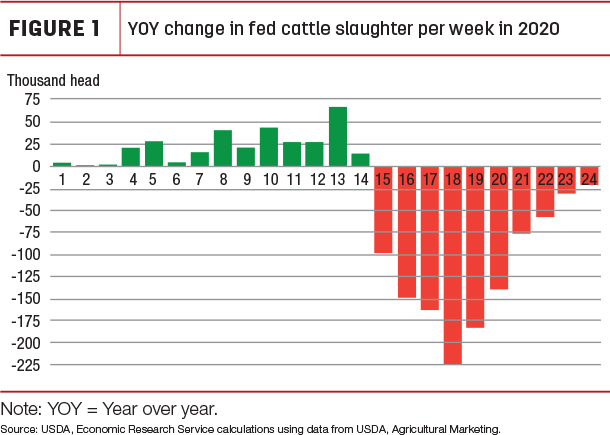

Figure 1 illustrates the volume difference in fed cattle slaughtered year over year through the first 24 weeks of 2020.

In the face of gains by meat-packing facilities in recovering capacity utilization at their plants, this chart would suggest that many market-ready cattle likely remain in feedlots since the first week of April, waiting to be slaughtered.

2020 beef production raised on pace of slaughter

As mentioned, packing facilities have recovered much of their capacity from last year’s levels, and this has occurred faster than projected in the previous month’s analysis. Accordingly, the anticipated pace of slaughter for 2020 was raised for the remainder of this quarter and the second half of the year. The beef production forecast for second-quarter 2020 was raised by 370 million pounds to just over 6 billion pounds, 12% below last year and the lowest for the quarter since 2015. The production forecast for second-half 2020 was raised from the previous month on the expectation that beef packing facilities will maintain capacity just below year-ago levels. As a result, the annual beef production forecast for 2020 was increased 910 million pounds from the previous month to 26.7 billion pounds, about 2% below 2019 levels.

As more fed cattle are expected to be marketed in second-half 2020, it is anticipated that feeder cattle placements will also increase during that time. This adjustment in the analysis increased fed cattle slaughter in the first half of 2021, which was partially offset by fewer fed cattle slaughtered in the second half. Beef production in 2021 is forecast marginally higher at 27.6 billion pounds, up 85 million pounds from the previous month.

Cattle prices adjusted on price strength

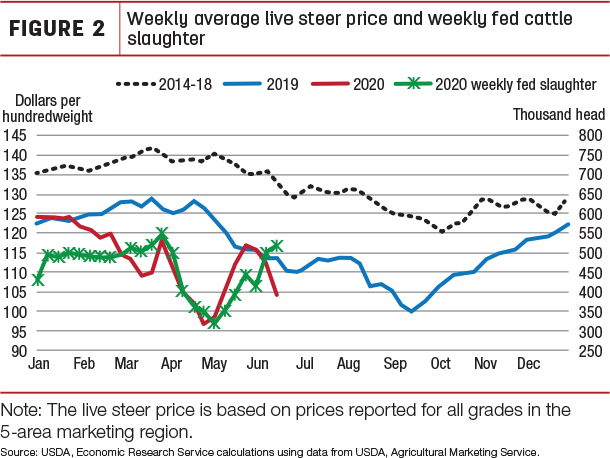

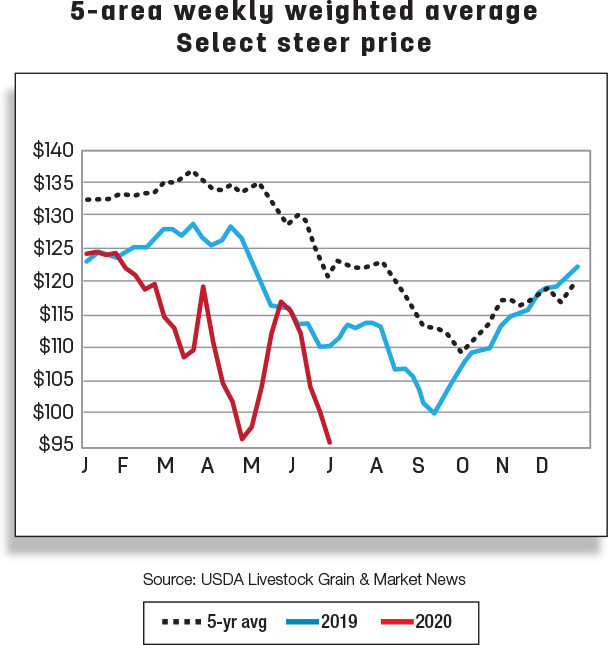

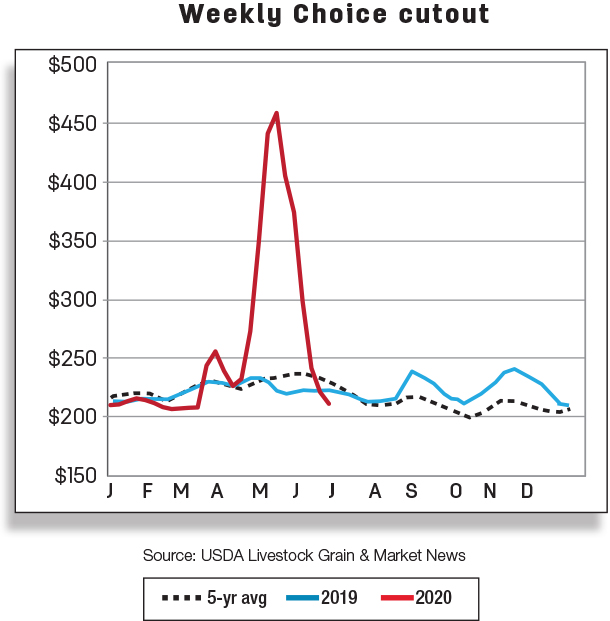

In the second quarter, the capacity of beef packing plants to slaughter fed cattle was reduced by as much as 41%, which prompted lower prices for fed cattle. As beef production declined, wholesale beef prices skyrocketed, which greatly expanded packer margins. However, as packers’ capacity to slaughter began to rebound at the beginning of May, increasing demand for cattle, it likely increased their willingness to pay higher prices for cattle (see Figure 2).

Currently, wholesale beef prices have declined rapidly from recent peaks, as suggested by the comprehensive beef cutout value (down 27% for the week ending June 5 from its peak). This would result in declining packer margins as fed cattle prices rose over the same period. As the volume of fed cattle slaughter has risen close to year-ago levels, analysis suggests that prices should weaken seasonally, particularly given the volume of market-ready cattle that have backed up in feedlots in the second quarter.

Based on the May price of $111.53 per hundredweight (cwt) for fed steers marketed for slaughter in the 5-area marketing region – up more than 9% above April – and price strength in early June, the second-quarter 2020 price forecast for fed steers was raised $3 to $104 per cwt. With the expectation of increased demand for slaughter cattle, the price forecast for both the third and fourth quarters was raised $6 to $105 and $106 per cwt, respectively. Further, the first-quarter 2021 price forecast was raised by $3 to $104 per cwt.

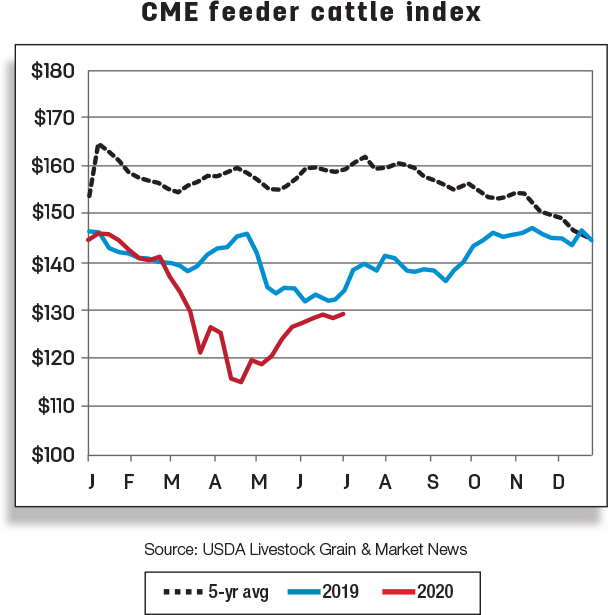

With higher anticipated fed cattle slaughter in 2020, feedlot marketings will increase. A faster pace of marketings and higher forecast fed cattle prices than the previous month will likely improve feedlot demand for feeder cattle. Based on recent price data, the second-quarter 2020 feeder steer price was raised by $5 to $126 per cwt. The third-quarter 2020 price forecast was raised $9 to $132 per cwt, and the fourth-quarter 2020 price was raised $13 to $131 per cwt.

As a result, as the time of this writing, this month’s annual price forecast for 2020 was $131.40 per cwt, almost $7 above last month’s forecast. This price strength was carried over into first-quarter 2021 for a forecast of $129 per cwt, up $4 from the previous month. The 2021 annual feeder steer price is forecast at $133 per cwt.

Beef imports fell slightly in April but are up January to April

U.S. beef imports in April were down 0.8% from a year earlier to 270.7 million pounds. After two consecutive months of increase, U.S. imports fell, partly due to low shipments from Canada and Australia. Beef shipments from Canada have been down 13% year to date, largely due to lower beef production in Canada. In April, shipments from Canada declined 26.5% from April 2019, which partially reflects COVID-19 outbreaks in federal processing plants in western Canada. Beef import volumes from Canada were the lowest since 1996 for both the month and overall since January 2017. Fewer beef shipments from Australia were likely driven by a reduction in beef production, as the country is in the process of rebuilding its domestic cattle herd.

In contrast, April U.S. beef imports from New Zealand were up 28.2% year over year. Beef shipments from Mexico were also higher in volume than a year earlier, by 8.9%. New Zealand’s and Mexico’s increases in beef shipments to the U.S. were not enough, however, to offset the reductions in beef shipments from Canada and Australia.

Despite all the disruptions of COVID-19 coupled with a weakened economy in April, beef imports were still 3.3% higher from January to April than they were over the same period in 2019. Some of the key trading partners contributing to the growth in beef imports from January to April were Australia, New Zealand, Mexico and Nicaragua. A strong U.S. dollar and less demand in Asia earlier in the year due to COVID-19 shutting down the economies helped redirect some beef to the U.S. Of the four key beef importers mentioned, New Zealand was the largest source of increased imports for January to April, followed by Mexico, Australia and Nicaragua. Combined, these four countries accounted for 66.8% of total U.S. beef imports from January to April 2020.

The forecasts for the second and third quarters were revised up to 785 (+50 million pounds) and 730 (+20 million pounds), respectively, on stronger expected demand for processing-grade beef as a result of a higher revised forecast of fed cattle slaughter in those quarters.

Beef exports down largely on lower exports to Mexico, but up January to April

U.S. beef exports in April were 235.2 million pounds, down 3.4% from a year ago. Most of the decline came from lower exports to Mexico. Not since March 2004 after the discovery of bovine spongiform encephalopathy (BSE) in December 2003 has the U.S. exported less than 14.4 million pounds of beef to Mexico. The Mexican economy has weakened, and the depreciated Mexican currency has made U.S. beef more expensive to Mexican consumers. As a result, 23.2 million pounds less beef were exported to Mexico in April 2020 than a year earlier. In addition, the U.S. exported about 8.4 million pounds less beef to South Korea in April relative to a year ago.

Conversely, U.S. exports to Japan in April totaled 88 million pounds, up 26.6 million pounds from the same month a year ago. Beef exports to Japan were the largest volume recorded since August 2018, partially due to reduced tariff rates starting with the new Japanese fiscal year. In addition to Japan, the U.S. exported 9.1 million pounds more beef to Canada than a year earlier, but these increases were not large enough (in volume) to offset the reductions in beef exports to Mexico, South Korea and several other trade partners.

Conversely, U.S. exports to Japan in April totaled 88 million pounds, up 26.6 million pounds from the same month a year ago. Beef exports to Japan were the largest volume recorded since August 2018, partially due to reduced tariff rates starting with the new Japanese fiscal year. In addition to Japan, the U.S. exported 9.1 million pounds more beef to Canada than a year earlier, but these increases were not large enough (in volume) to offset the reductions in beef exports to Mexico, South Korea and several other trade partners.

From January to April, U.S. beef exports were 6.9% higher than the previous year. The destinations with the largest beef shipments from January to April were Japan, Mexico, Canada, South Korea and Taiwan. Collectively, these five trading partners accounted for 81.7% of the U.S. total beef exports from January to April in 2020.

The second-quarter beef export forecast remains unchanged at 675 million pounds, while the third-quarter beef forecast was revised up to 750 million pounds, reflecting an increase in the pace of slaughter and available exportable supplies. The beef export forecast for 2021 was unchanged. ![]()

Analyst Christopher Davis assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.