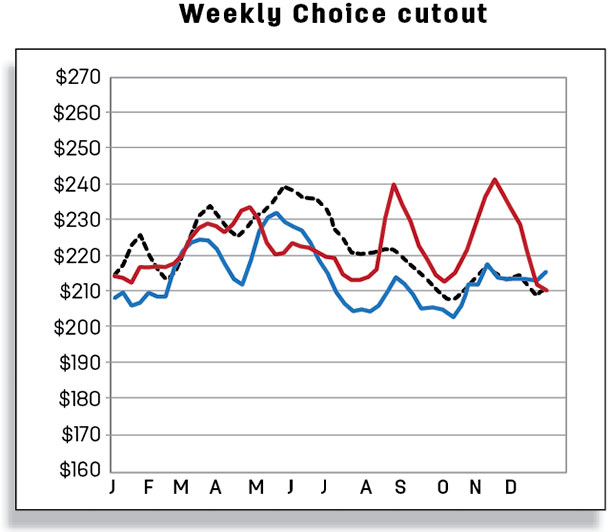

The increase was based on a faster-than-expected pace of fed and non-fed cattle slaughter in November and early December. The increase in cattle slaughter more than offset a marginal decrease in expected fourth-quarter dressed weights. Greater fed cattle slaughter may in part reflect packers’ inclination to capture stronger-than-typical margins as wholesale boxed beef prices averaged well above 2018 during November and into early December.

Feedlots also have a higher proportion of cattle-on-feed over 150 days, and the narrowing of the Choice-Select spread may also be providing incentives to bring additional cattle to market. Based on the NASS Livestock Slaughter report for October, the pace of cow slaughter, particularly beef cows, was well above year-earlier levels. The price for live cutter cows for the week ending Dec. 6 was $53.76 per hundredweight, more than 16% above year-earlier levels. This, coupled with tight forage supplies for some producers, is likely encouraging a higher culling rate.

The forecast for 2020 beef production was lowered by 35 million pounds from the previous month to 27.5 billion pounds based on the expectation of slightly lower fed cattle and cow slaughter in early 2020. Lower expected placements in late 2019 will likely result in slightly fewer cattle marketings during the first half of 2020. Increased slaughter of cows in late 2019 will likely tighten supplies of cows for culling in first-half 2020.

Strong packer margins likely boosting cattle prices

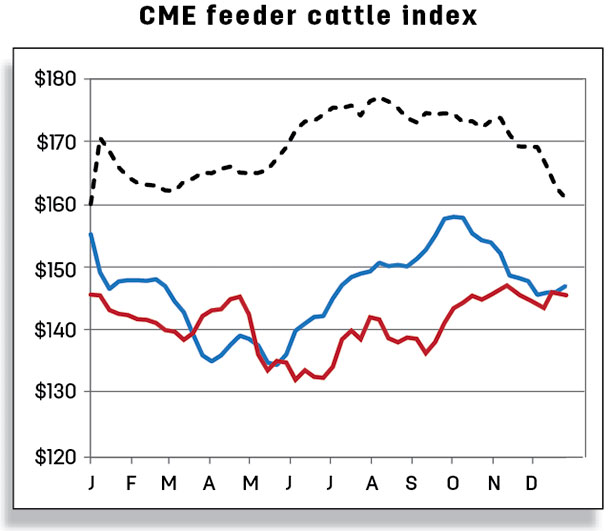

On Dec. 2 at the Oklahoma City National stockyards, sales of feeder steers weighing 750 to 800 pounds were reported at $146.48 per hundredweight (cwt). Based on recent price data, the fourth-quarter 2019 feeder steer price was raised by $3 to $147 per cwt. The 2020 annual price forecast for feeder steers was raised by $2 to $144 per cwt.

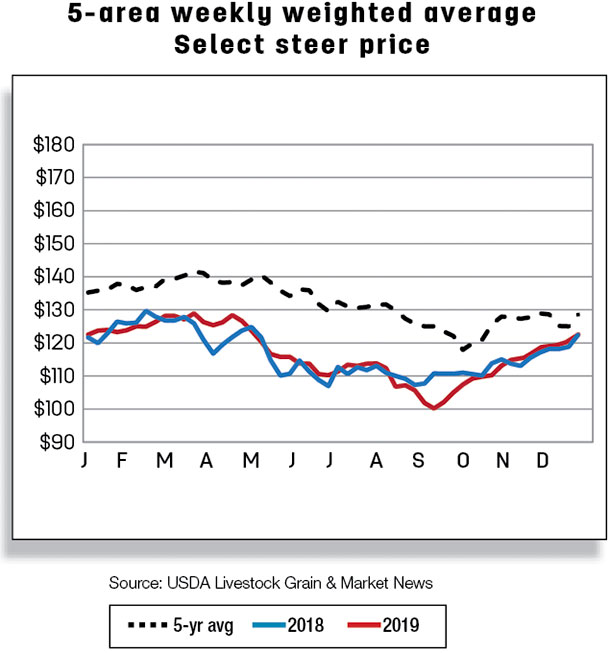

Despite wholesale prices declining from abnormally high levels in mid-November, packers continue to pay higher prices to bid cattle out of the feedlots. The price forecast for fourth-quarter 2019 was raised by $2 to $114 per cwt. That price strength was carried into 2020. The 2020 annual price forecast for fed steers was raised by $1 at $117 per cwt, with prices in the first two quarters raised to $122 per cwt and $118 per cwt, respectively.

Beef imports up in October

October beef imports were 241 million pounds, more than 6 million pounds, or 2.7%, higher than the previous year. The year-over-year increase in U.S. beef imports is largely attributable to expanded imports from two of the U.S. major suppliers, Canada and Mexico, whose shipments were up 6 and 8.4 million pounds, respectively, along with increased shipments from Nicaragua (+4.5 million pounds) and Brazil (+2.6 million pounds). Beef shipments from Australia and New Zealand were down 4.5 and 7.7 million pounds in October from a year earlier. The decline in U.S. imports from Oceania reflects, in part, increased competition with Asia for animal protein.

The 2019 fourth-quarter forecast for imported beef was raised by 25 million pounds to 700 million pounds, while first-quarter 2020 was also increased by 10 million pounds to total 700 million pounds.

The increase in beef imports during fourth-quarter 2019 and first-quarter 2020 reflects continued strength in demand for lean beef used in processing.

Beef exports down on lower shipments to major destinations

U.S. beef exports fell in October to 249 million pounds, a decline of almost 25 million pounds from the previous October. This reduction occurred among all major U.S. beef export destinations, including Japan (-16.9 million pounds), Mexico (-4.5 million pounds), South Korea (-0.7 million pounds), Canada (-1.1 million pounds), Hong Kong (-3.4 million pounds) and Taiwan (-1.5 million pounds).

Conversely, U.S. beef exports were up year-over-year for select smaller Asian markets such as Indonesia (+30%), China (+56%), Singapore (+140%) and the Philippines (+9%). U.S. wholesale beef prices increased sharply in October, which may have reduced demand for U.S. beef in a number of markets. U.S. beef exports have not been less than 250 million pounds since the beginning of the second quarter.

Despite lower beef exports year-over-year in October, exports in the remaining two months of the year are expected to average above 2018. Nonetheless, the beef export forecast for fourth-quarter 2019 was lowered to 800 million pounds. The 2020 beef export forecast remains unchanged. ![]()

Analyst Christopher Davis assisted with this report.

Russell Knight is a market analyst for the USDA – ERS. Email Russell Knight.