The U.S. Drought Monitor from Aug. 8, 2014 indicated relief for parts of the West, Southwest and Plains; however, California and some areas of the Southwest are still impacted by significant areas of drought at the D4 or exceptional drought levels.

Irrigation water is being sold at premium prices, and much irrigated acreage is being idled, cutting into California alfalfa hay, fruit and vegetable production.

The NASS cattle report indicated little or no increase in replacement heifer inventories for either beef or dairy herds over July 1, 2012 inventories, when the last July 1 estimates were released.

This was not expected, and it indicates that any herd rebuilding is pushed into the future. At the same time, the proportion of heifers on feed is the lowest since July 2006, during the last upturn in total cow inventories.

For some context, the Jan. 1, 2014 inventory of beef replacement heifers was up almost 4 percent over Jan. 1, 2012 and was up almost 2 percent over Jan. 1, 2013.

However, all other heifer categories were lower over both 2012 and 2013 inventories. Dairy heifers showed the least percentage declines, but other heifer inventories were down by a whopping 7.5 percent over 2012 inventories and by 5 percent over 2013 inventories.

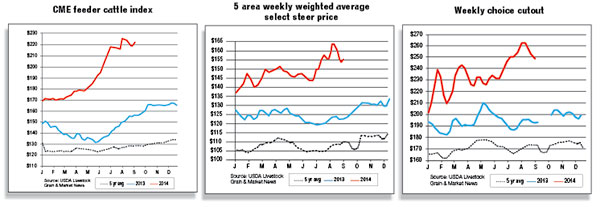

Feeder cattle prices may narrow feeding margins

Cattle feeders are experiencing positive average profit margins for cattle currently being marketed. However, prices of feeder cattle are well above $200 per hundredweight (cwt) and, even with corn below $4 per bushel, breakeven prices for cattle placed on feed this summer are escalating along with feeder cattle prices and are moving close to $160 per cwt.

Click here or on the image above to view it at full size in a new window. (PDF, 58.2 KB )

The escalating breakevens will put negative pressure on profit margins if fed cattle prices fail to keep up.

Only once since 1999 (in 2009) has the July 1 inventory of all cattle on feed been as low as the 11.6 million head on July 1, 2014. While some press has been given to increased cattle feeding by under 1,000-head feedlots, it is difficult to demonstrate as current ratios of marketings from 1,000-head-plus feedlots to total commercial steer and heifer slaughter remain relatively high.

These ratios would suggest fewer cattle are being fed in the smaller feedlots. It is possible these smaller cattle feeders are growing rather than finishing feeder cattle.

The recent disproportionately large placements of greater-than-800-pound feeder cattle in feedlots provide some evidence to support this logic, since pasture resources needed to grow lighter-weight feeder cattle to heavy weights have been drought-constrained until relatively recently.

The enthusiasm that has driven feeder cattle prices to their current record levels – along with improving pasture conditions – imply the potential for relatively large supplies of heavy feeder cattle in late summer and early fall.

The improved pasture conditions late this spring and summer have provided stocker operators with the forage they need to grow lightweight calves to heavier weights and may yet allow cow-calf producers to retain heifers for breeding.

To the extent that such heifer retention occurs, it will further reduce feeder cattle supplies for placement on feed. If heifers are not bred until next summer, it will be spring of 2016 before they calve and 2017 before the bulk of those calves will be placed on feed and marketed as fed cattle. It will take several years of heifer retention to build up heifer/cow inventories to the point of significantly expanding beef supplies.

Constrained beef supplies will provide incentive to pull feeder cattle forward, that is, to place them on feed at younger ages and at lighter weights in an effort to increase short-term beef supplies. With corn prices relatively low, similar to 2009 prices, producers could also keep cattle on feed longer, resulting in a continuation of record-breaking average dressed weights of greater than 800 pounds per carcass.

Weekly moving-average wholesale cutout values also reached record levels recently. Despite the apparent current profitability in the meatpacking sector, L&H Packing Co. in San Antonio, Texas, and Cargill Inc. in Milwaukee, Wisconsin, have announced plans to shut down due to low cattle inventories.

This news follows plant closings (Cargill plant in Plainview, Texas; National Beef in Brawley, California; and others previously) and plant downsizing (Cargill in Dodge City, Kansas) announced earlier in the year, all attributed, at least in part, to low cattle inventories and the difficulty in acquiring cattle.

At $5.94 and $5.51 per pound, retail choice beef and all-fresh beef prices moved deeper into record territory in June. However, there are some indications that consumers may begin to push back against the higher prices.

Forecast for U.S. cattle imports raised in 2014 and 2015

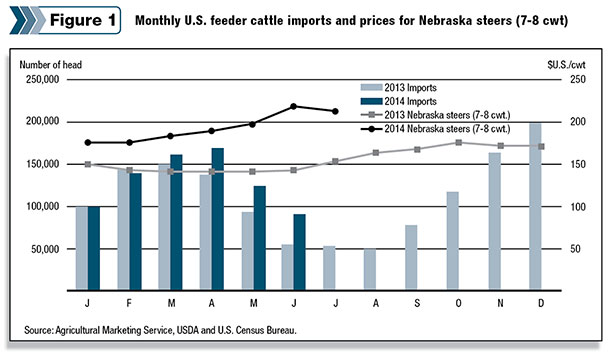

U.S. cattle imports were up 9 percent through June 2014 compared with year-earlier levels. Shipments from Canada have totaled 624,122 head in 2014, an increase of 56,423 head from the same period last year. Imports of slaughter cattle have declined this year but were more than offset by increased imports of feeder cattle.

While feeder imports averaged 26 percent of total Canadian imports between 2009 and 2013, those shipments have averaged 38 percent of total imports this year.

The average price for Nebraska feeder steers ($7 to $8 cwt) in July 2014 was 39 percent higher than a year earlier (Figure 1). Prices have also risen in Canada but at a slower rate than U.S. prices; coupled with a stronger U.S. dollar, Canadian sellers can get better prices for animals by exporting to the U.S. Imports of feeders from Mexico have also increased (+7 percent) despite low cattle inventories.

Due to stronger demand for imported feeder cattle, the forecast for U.S. cattle imports in 2014 was raised to 2.150 million head, 6 percent higher than the 2013 level. The forecast for 2015 was also raised, by 75,000 head to 2.175 million.

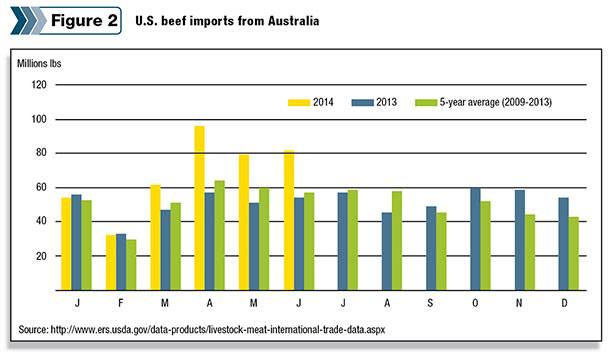

Beef imports surge from Australia

U.S. beef imports through June 2014 were up 12 percent, led by stronger imports from Australia (+36 percent), Canada (+11 percent) and New Zealand (+3 percent).

U.S. supplies of lean manufacturing beef have declined as weekly federally inspected cow and bull slaughter was about 12 percent lower through the end of July. Meanwhile, cattle slaughter has increased 10 percent in Australia, the top supplier of U.S. beef imports.

Continued drought in Australia has devastated range conditions in the predominantly pasture-based system. Lack of forage has led to record beef production and a 16 percent increase in exports.

The U.S. has benefited most from the increase in Australia’s shipments, while year-to-date Australian exports to Japan and South Korea have fallen. U.S. beef imports from Australia far exceed 2013 levels, as well as the five-year-average (Figure 2).

Shipments have increased by a smaller volume from Canada amid strong U.S. prices and a weaker Canadian dollar. The forecast for U.S. beef imports in 2014 was raised 63 million pounds to 2.584 billion pounds due to stronger demand for imported processing beef.

The forecast for 2015 was also increased to 2.6 billion pounds as U.S. beef production is expected to decline further next year.

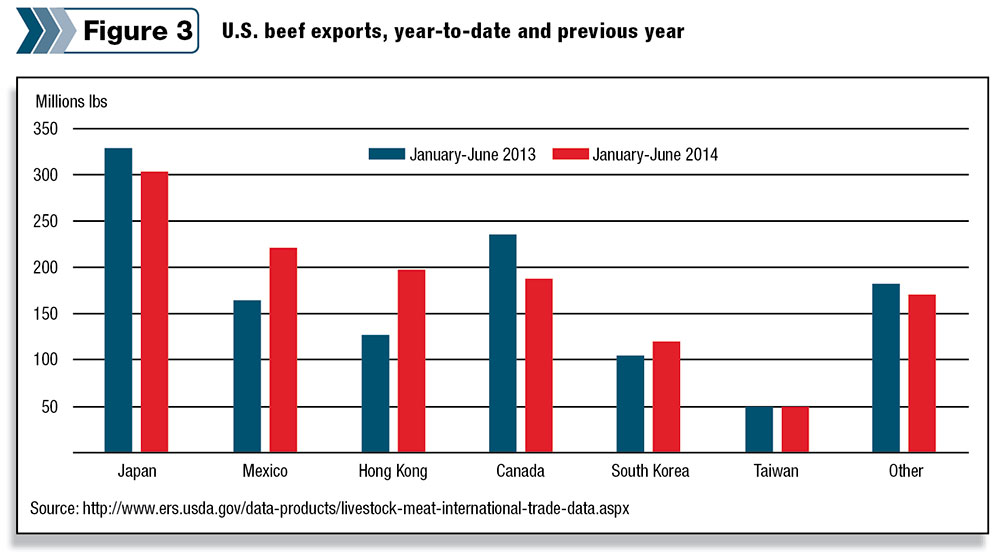

U.S. beef exports strong to Asia and Mexico

Despite higher prices for U.S. beef, export demand has remained resilient thus far in 2014. Through June 2014, U.S. beef exports have increased 5 percent, led by higher shipments to Hong Kong (+57 percent), Mexico (+33 percent) and South Korea (+21 percent) (Figure 3).

Shipments to Japan during the first and second quarter were 7 percent lower than the same period last year when exports surged following a change in Japan’s import restrictions to allow beef from U.S. cattle aged less than 30 months.

Shipments have also fallen to Canada (-21 percent) as high U.S. beef prices and a weaker Canadian dollar have cut into demand. The forecast for U.S. exports in 2014 was raised to 2.620 billion pounds due to strong demand in Asian markets. Exports are expected to fall 4 percent in 2015 to 2.525 billion pounds due to lower U.S. beef production. ![]()

Sahar Angadjivand and Lindsay Kuberka contributed to this USDA-ERS report.