In addition, based on the Feb. 21, 2017, U.S. Drought Monitor, areas of severe drought have increased across much of Oklahoma, southeast Kansas and eastern Colorado. The Drought Monitor notes Oklahoma continues to experience “extremely warm and dry weather” on top of last year’s warm and dry weather, according to the latest NASS Crop Progress report. This may be affecting some winter wheat pastures in these areas.

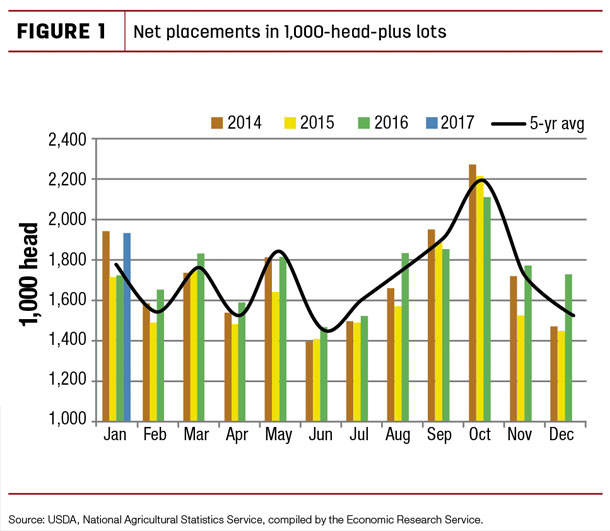

The Jan. 1, 2017, Cattle report indicated cattle outside feedlots totaled 26.6 million head, up 2.17 percent from 2016. Based on the Feb. 24, 2017, NASS Cattle on Feed report, placements in feedlots in January were up 11 percent compared to the same period in 2016 and almost at the same level as 2014.

The higher year-over-year net placements of cattle on feed and the decline in placement in the average placement weight in January may have reflected concerns about pasture availability.

Production continues to show strength

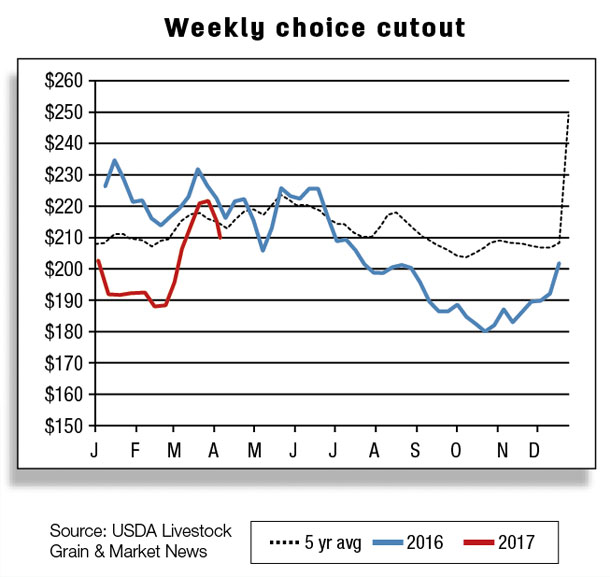

Weekly federally inspected beef production through the last week of February is estimated above the levels of a year ago and above the five-year average. Producers are marketing their cattle in a timely manner, and the more rapid pace of slaughter was a contributing factor in the increase in the USDA’s forecast for first-quarter commercial beef production.

However, the increase in slaughter is conditioned by lower carcass weights as feedlot operators remain current in their marketings. Thus, forecasts for commercial beef production in the first quarter of 2017 are projected to be 2.5 percent higher than the same period in 2016.

Stable prices across the cattle and beef complex

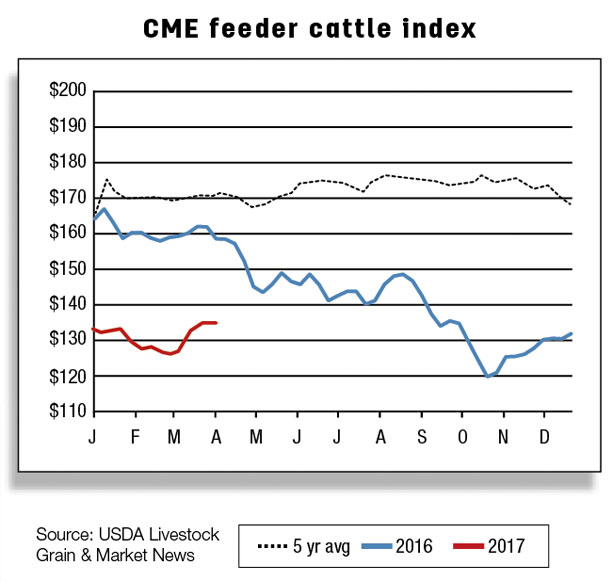

Feeder cattle prices bottomed in October 2016 and have since seen a slow rebound that appears to have stalled the last two months. This is likely due to the relatively large supply of feeder animals available to place. The 11 percent increase in January placements likely reflected this increased supply of feeder animals (Figure 1).

Feeder Steers, Medium & Large No. 1 750 to 800 pounds declined 43 cents per hundredweight (cwt) in January, followed by a $2.94 decline for February 2017 to $127.36 per cwt. The first-quarter 2017 feeder cattle price is forecast to average from $127 to $131 per cwt, $1.20 up from fourth-quarter 2016.

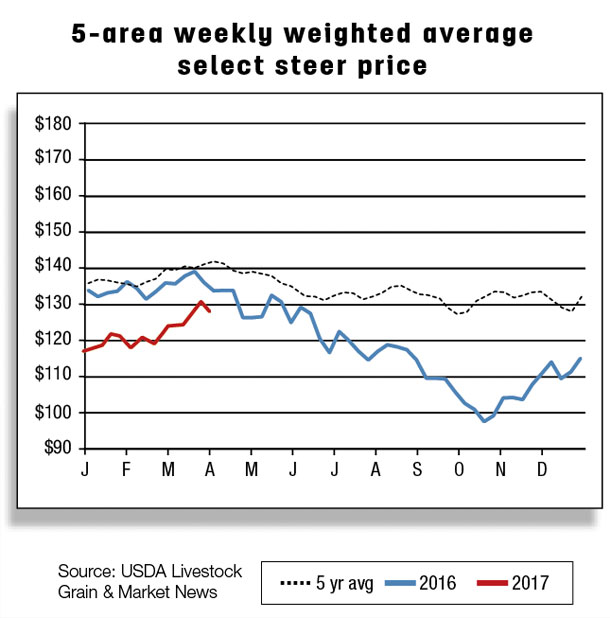

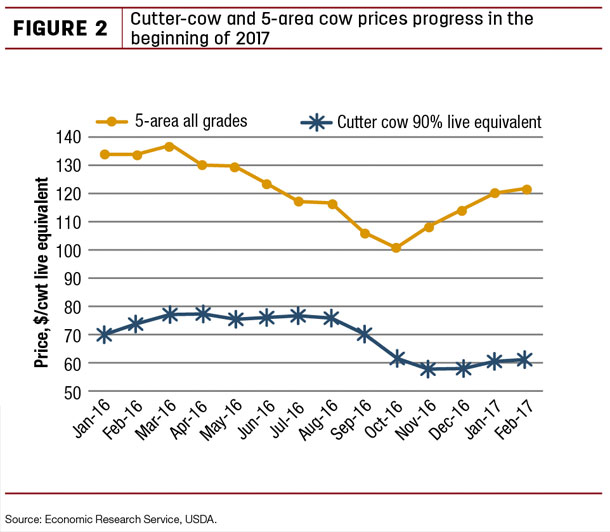

The 5-area all grades fed steer price also bottomed in October 2016 but has recovered in the face of higher fed cattle slaughter. Although remaining below year-earlier levels, the January and February 2017 prices have increased to $119.99 and $121.54 per cwt, respectively. The first-quarter 2017 5-area fed steer price is forecast in the range of $121 to $124 per cwt.

The price of beef cutter cow (Figure 2) live equivalent 90 percent lean, 500 pounds and up in January 2017 increased by $2.58 per cwt from the previous month to $59.86 per cwt, although it was $9.73 lower than the same month a year ago.

Cutter cow prices increased $1.21 per cwt in February 2017, signaling an increase in demand for lean beef. The first-quarter 2017 cutter cow price is forecast at $60 to $61 per cwt.

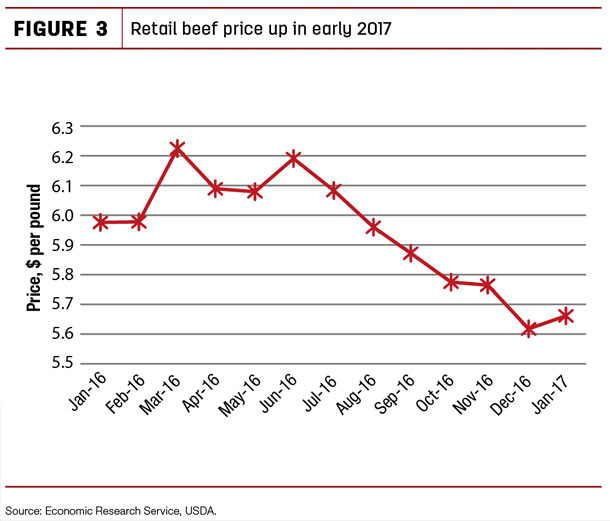

The retail price of choice beef has also shown a muted recovery (Figure 3), likely due to the abundant supply of meat across the animal protein complex. The January 2017 price was 4 cents up from the previous month, to $5.66 per pound, but still 22 cents per pound lower than year-earlier levels.

The February 2017 price of choice beef is also estimated to be slightly up from the January price.

Imports reflect declines from major suppliers

U.S. beef imports in January 2017 declined 21 percent relative to the same period last year. Imports from Australia fell 47 percent, at least partly due to the country’s continued tight supplies. Declines were also seen in imports from New Zealand (-31 percent) and Canada (-17 percent).

Some of the import losses from these countries were made up with significant increases from Mexico (+53 percent) and Nicaragua (+23 percent). Imports from Mexico and Nicaragua have become attractive, at least partly due to the relative currency strength of the U.S. dollar.

The beef imports trade-weighted U.S. dollar index has recently been at its highest levels since February 2015. This index reflects the dollar value against currencies of the major countries from which the U.S. imports beef and veal.

Nine countries make up 99 percent of U.S. beef imports (Australia, Canada, New Zealand, Brazil, Uruguay, Mexico, Nicaragua, Argentina and Costa Rica).

Despite the potential tailwinds from the strength of the dollar, tighter supplies of processing beef from Oceania and relatively high prices for imported lean beef relative to domestic lean beef, the first-quarter 2017 beef import forecast was maintained at 700 million pounds. Imports for 2017 are forecast at 2.7 billion pounds.

U.S. beef exports up despite dollar strength

First-quarter 2017 U.S. beef exports were raised 10 million pounds, largely due to the strength of export sales to Japan, other Asian countries and our North American partners.

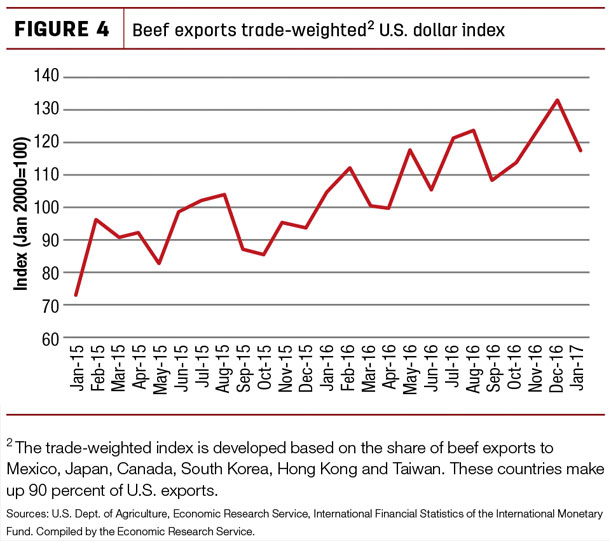

January exports (Figure 4) showed a 21 percent year-over-year increase. Export increases were seen in Japan (+40 percent), South Korea (+38 percent), Mexico (+41 percent), and Canada (+11 percent). Export sales continue to exhibit strength despite potential headwinds from the strength of the dollar.

The beef exports trade-weighted U.S. dollar index is at its highest levels since 2015. This index reflects the dollar value against currencies of the major countries to which the U.S. exports beef and veal.

These six countries’ exports (Mexico, Japan, Canada, South Korea, Taiwan and Hong Kong) make up 90 percent of U.S. beef. Increased beef exports to Mexico were rather surprising in the face of the significant decline in the value of the peso. First-quarter 2017 exports are forecast at 635 million pounds, with the full-year forecast at 2.7 billion pounds. ![]()

Analysts Lekhnath Chalise and Keithly Jones contributed to this report.