This marks the first year of contraction for cattle producers, and most of the decline was attributed to fewer beef cows, 392,400 below last year at 31.3 million head. The states that experienced the largest reductions in beef cows included Kansas (-96,000 head), Texas (-85,000), Oklahoma (-51,000), South Dakota (-45,000), Illinois (-27,000), Colorado (-21,000), and North Dakota and Montana (-20,000 head each).

Compared to last year, beef cattle producers are indicating their intentions to retain 2% fewer heifers for beef cow replacement, and the number of those heifers expected to calve during the year is down 1%. This is the third consecutive year of fewer heifers retained in the herd. A similar pattern is reflected on the dairy side, with milk cow numbers fractionally lower and heifers for milk cow replacement estimated down 1%.

The 2019 calf crop estimate was 36.1 million head, revised lower by about 240,000 head from the July 2019 Cattle report. This revision to the 2019 calf crop estimate reduces the pool of cattle that might be expected to be placed in feedlots in 2020. Further, the total number of cattle on feed was estimated at 14.7 million head on Jan. 1, 2020, 2% higher than last year and second only to 2008’s record. These two factors contributed to fewer cattle outside feedlots, which were 0.4% below last year at this time.

Growth in beef production in first-quarter 2020

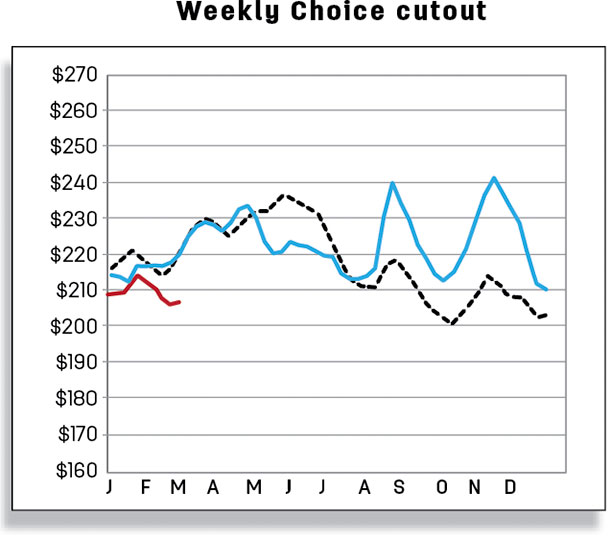

The forecast for beef production in first-half 2020 was raised based on a faster pace of fed and non-fed cattle slaughter. Average dressed weights were raised in both the first and second quarters. However, the beef production forecasts for third- and fourth-quarter 2020 were reduced on lower anticipated steer and heifer slaughter in the second half of the year. This reflects lower forecast placements in 2020 due to the smaller number of cattle outside feedlots on Jan. 1.

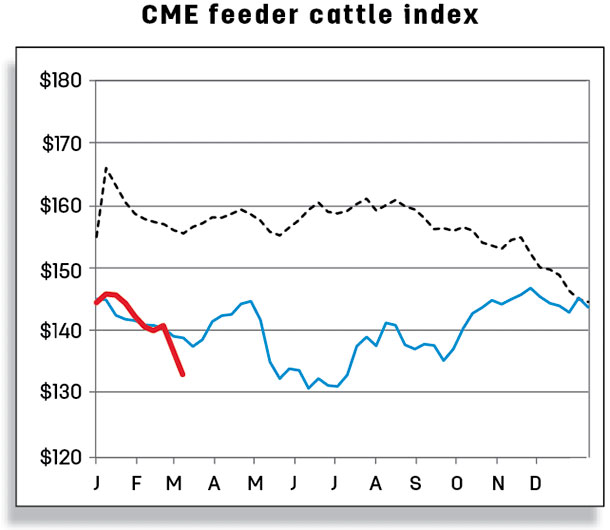

Feeder steer price revised up in 2020

The 2020 feeder cattle forecast was raised by $1 due to a January price of $144.36 per hundredweight (cwt) and fewer cattle outside feedlots available in 2020. The lower year-over-year 2019 calf crop will reduce the number of steers and heifers available for slaughter in the second half of the year and place upward pressure on feeder steer prices.

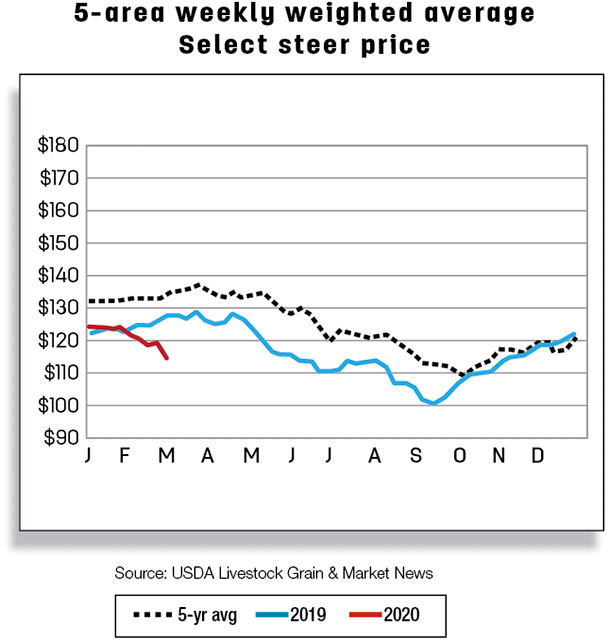

The first-quarter 2020 fed steer price was revised lower to $123 per cwt on recent price weakness, while the outlying quarters remain unchanged from the previous month.

The first-quarter 2020 fed steer price was revised lower to $123 per cwt on recent price weakness, while the outlying quarters remain unchanged from the previous month.

Live cattle trade increased in December and 2019

U.S. live cattle imports for December 2019 totaled 212,625 head, about 9.2% (or 17,991 head) over a year earlier. In December, Mexico accounted for 75% of total U.S. cattle imports, and Canada accounted for the remaining 25%. Annually, the U.S. imported 2.043 million live cattle in 2019, exceeding 2018 live cattle imports by 143,777 head. The 2020 annual forecast for live cattle imports is unchanged at 2.065 million head.

In December, live cattle exports totaled 27,552 head, up 33% (or 6.826 head) from a year earlier. Canada and Mexico received the largest shipments of live cattle in December at 25,244 head and 1,681, respectively. Annually, the U.S. exported 305,157 head of live cattle in 2019, 61,362 more than last year. Over 89% of U.S. live cattle shipments were to Canada. The live cattle export forecast for 2020 is unchanged at 285,000 head.

December beef imports remained strong

U.S. beef imports in December totaled 228.4 million pounds, up 7.6% (or over 16 million pounds) from a year ago. Year over year, U.S. beef imports rose from major suppliers such as Australia (+18 million pounds), Nicaragua (+8.5 million pounds), Mexico (+7.3 million pounds), Argentina (+1 million pounds) and Brazil (+707,000 pounds). However, shipments from New Zealand in December were 12.3 million pounds lower year over year. Lower shipments from New Zealand reflect, in part, the increased competition with Asia for animal protein. Shipments were also lower in December relative to a year ago from Canada (-5.4 million pounds) and Uruguay (-2.9 million pounds).

The U.S. imported 3.057 billion pounds of beef in 2019, exceeding 2018 beef imports by 59 million pounds. The 2020 beef import forecast is unchanged at 2.880 billion pounds.

December beef exports fall

In December, beef exports totaled 255 million pounds, 2.3% (or 6.1 million pounds) lower than December 2018. U.S. beef exports to Japan (+1.1 million pounds) were up from a year earlier. Japan continues to be the largest U.S. beef export market, accounting for 24.4% of U.S. total exports in December 2019. Along with Japan, several other major destinations experienced positive growth year over year in December, including South Korea (+8 million pounds) and Canada (+227,000 pounds).

The U.S. was also able to capitalize on China’s strong demand for animal protein by shipping more than 5.5 million pounds of beef, the largest-ever beef shipment to China. These expansions in U.S. beef exports were offset by reductions in shipments to Hong Kong (-12 million pounds), Mexico (-4.9 million pounds) and Taiwan (-1.2 million pounds).

Fourth-quarter beef exports totaled 748.4 million pounds in 2019, about 52 million pounds less than a year earlier. Cumulatively, the U.S. exported 3.022 billion pounds of beef. The 2020 beef export forecast for first quarter was lowered by 5 million pounds to 760 million pounds due to weaker demand in several markets. ![]()

Analyst Christopher Davis assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.