Non-branded USDA Choice beef saw eroding demand since its 2010 peak, as consumers apparently turned toward a premium branded alternative. Pounds of CAB product sold increased every year since 2005, but it took economic modeling and research to see the demand effect.

K-State economist Ted Schroeder and 2010 Master’s student Lance Zimmerman conducted the initial study that year. Zimmerman took a break from his role as analyst with CattleFax to update his college work with new data to characterize demand through 2012.

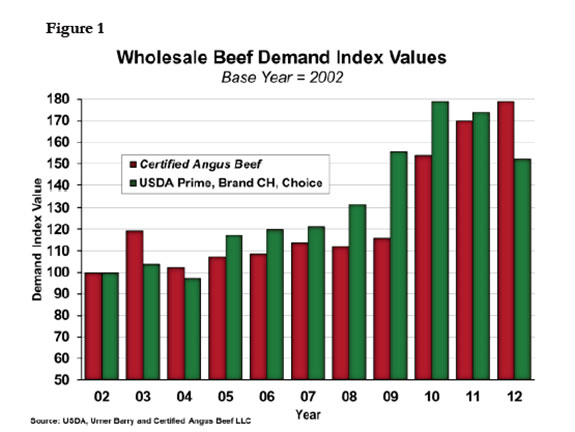

Methodology and results are explained in that research paper. That index provides a measure of demand change over time and features a new timeline comparison (Figure 1).

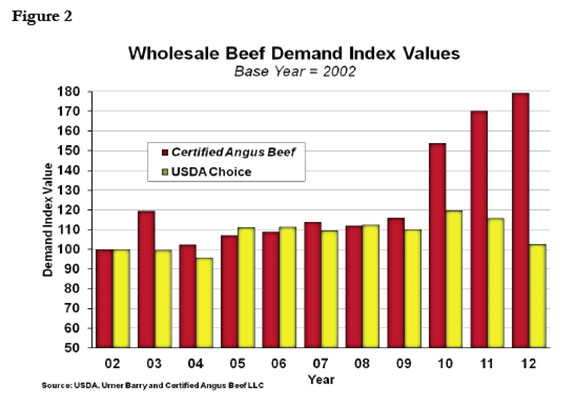

“Since CAB product is a branded subset of the USDA Choice and higher marketplace, demand for the aggregate quality category was expected to share more similarities than the non-branded USDA Choice index used in the 2010 research (Figure 2),” the paper says.

The results show three different demand growth patterns among the indexes. Demand for the aggregated Choice and higher grading product actually outpaced CAB from 2008 to 2010 before declining in 2011 and 2012, while CAB product continued its improvement. Demand growth for both categories was similar through the first nine years of the study.

“However, as much as the early growth patterns point to the similarities, the divergence of demand patterns most noticeable in the last two years of the study suggest there are perceived differences in CAB relative to its greater product category in the mind of consumers,” the paper says.

Demand eroded nearly 27 percentage points for Choice and higher beef in 2011 and 2012, while CAB demand increased 25 points.

“It is reasonable to assume that Figure 2 points to at least some of the demand differences seen lately between CAB and the Choice and higher product category. The graph shows demand for CAB has outpaced non-branded Choice consistently since 2009. Demand for CAB increased 79 percent over the 10 years, and Choice demand increased 3 percent, according to the updated paper.

The model results explain demand trends over time for each beef product as it relates to larger macroeconomic trends. Since each measure is based on wholesale demand, it includes sales to retailers, foodservice and international.

The CAB demand index had its largest year-over-year improvement in 2010 when demand improved 38 points reaching 154.8. That coincided with the 100-million pound annual increase in sales and 13 percent increase in per capita consumption even as cutout values grew.

“Beef demand remains a concern in the post-recession environment. Consumer incomes have made relatively small improvements in recent years, and incomes are a key beef demand consideration,” the paper states. Since the 2009 recession lows, the CAB cutout value has improved 6.6 percent annually and per capita consumption improved each year as well. In the other categories, boxed beef values improved at the expense of per capita consumption. ![]()

—From Certified Angus Beef news release