Managing risk is one of the many components of any farm enterprise. Leasing assets, rather than purchasing them, is a form of risk management, as it typically requires less capital. Cash leasing or share arrangements between farm operators and property owners have long been used to share land assets.

A USDA publication, “Trends in U.S. Farmland Values and Ownership,” reported that the distribution of rented farmland varies across regions, with the highest proportions in Illinois, Iowa, Kansas and the Mississippi Delta. (A copy of the full report can be found at USDA ERS-Trends)

According to the 2012 Census of Agriculture, 50.8 percent of all agricultural land in Kansas is operated on a leased basis.

Given the capital-intensive nature of agriculture today, the increasing number of absentee land owners, the fluctuation in agricultural markets and the competition to acquire land for leasing, it is important for producers and landowners to make informed decisions based upon sound economic principles and reliable information.

Determining a fair and reasonable cash rent that will benefit both the landlord and the tenant can be quite challenging and is not an exact science. Unlike cash and share rental arrangements for cropland, the terms of pasture rental arrangements are not generally known.

Local demand and supply conditions, anticipated market conditions and even long-standing working relationships can have some bearing on rental rate negotiations.

The quantity and quality of the grass and the effective stocking rate, along with other features including fence, corrals and water availability, will also all affect the value of the pasture.

It is in the best interests of both landowners and renters to establish and record rental agreements that are equitable. The success of the lease depends on meeting the needs of all parties.

Furthermore, the quality of pastureland varies widely. An arrangement used by a farmer for improved pasture likely is not appropriate for a neighbor who has non-improved pasture partially covered in brush and trees.

Pasture rental rates and terms thus may vary widely within the same locale yet still be acceptable to both landlord and tenant.

Sources for leasing information are fairly limited for area producers. Landowners and tenants frequently turn to land-grant universities across the nation for information on the “going rates” of pasture and cropland leases.

Several local K-State research and extension districts have recognized the value of local rental rate information to have available for their clients and began conducting annual lease surveys.

Three K-State research and extension districts have developed publications that are a compilation from the local surveys returned and do not represent a random, scientific survey. The information was taken from the Phillips-Rooks district (western), River Valley district (eastern) and Post Rock district (north-central).

The objective of this project was to provide local data for all landowners and tenants of north-central Kansas and to educate them on the different types of leases and equitable leasing arrangements through the resulting publications and lease meetings.

Questions on the survey included lease rates, types of arrangements, characteristics of landlord/tenant relationships and much more.

The University of Nebraska – Lincoln collected data for the 2014 Nebraska Farm Real Estate Market Survey. Land values and rental rates presented in this report are averages of survey panel members’ responses by district.

Actual land values and rental rates may vary depending upon the quality of the parcel and local market for an area. Complete results from the survey are available electronically via the Nebraska Farm Real Estate website.

The Iowa State University website (Computing a pasture rental rate) provides information on factors in developing equitable leases along with average rental rates.

The Illinois Society of Professional Farm Managers and Rural Appraisers conducted an annual survey that included the results concerning trends, land prices and rental levels. A copy of the “2014 Illinois Land Values and Lease Trends” report can be found online.

Included are some of the trends based on the survey information received in the last two consecutive years (2012 and 2013). Surveys for 2014 are now being compiled and publications will be out soon.

Cash rents

Pasture is typically rented on a cash basis (dollars per acre) for a grazing season. Some arrangements may use dollars per pair for a grazing season, dollars per day or dollars per animal unit month (AUM).

When pasture is priced on a dollars-per-head or dollars-per-acre basis, the cattle owner incurs all the performance (gain) risk, while the landowner is guaranteed a fixed income.

Pasture priced on a dollars-per-acre basis may provide an incentive for the cattle owner to aggressively graze, especially if they view it as a short-term lease. Thus, landowners may want to stipulate a maximum stocking density to ensure against overgrazing.

Trends

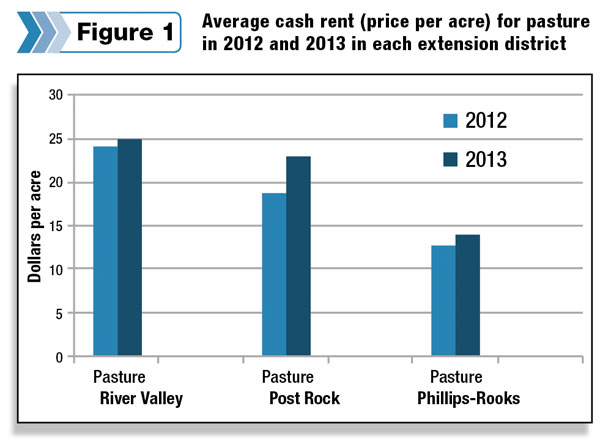

The limited data indicates a steady increase in pasture rents (Figure 1). However, over five years, according to the Kansas Agriculture Statistics Service (KASS), a steady increase in pasture leasing rates has also been seen.

This is not only dependent on the cattle market but also in competitively “bidding” or obtaining pastureland or grass amongst producers.

KASS data indicated pasture rent values in the Kansas north-central cropping district increased from $16.50 per acre in 2008 to $21.50 per acre in 2013. Of note, pasture rental rates tended to decrease toward the western part of the state.

If the current market rate information is not available from public or private sources, then pasture owners and tenants can use the “KSU Graze” Excel spreadsheet from K-State research and extension to estimate a cash rental rate for a specific situation based on historical market values, landowner costs and livestock owner returns.

Pasture maintenance practices

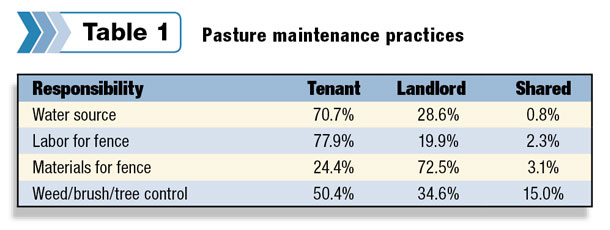

Pasture maintenance practices are an important part of a pasture lease with typical arrangements designating tenants’ primary responsibility for the water source and labor for establishing or maintaining the fence for the pasture with half of the responsibility for controlling weeds/brush and tree control.

The landowner or landlord is primarily responsible for the materials of the fence with about one-third of the cost of weed/brush and tree control (Table 1).

Pasturing crop residue

Crop residue is also a feed source for livestock during fall and winter. Like grass pasture, grazing growing crops and crop residues may be priced on a flat-rate basis, but often these forages are priced on a time, weight or gain basis.

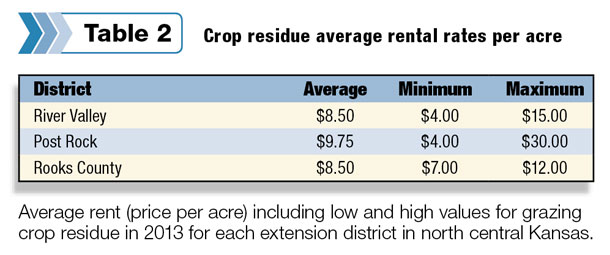

The majority of the respondents of the survey indicated a flat rate per acre with an average of $8.92 per acre among the three districts (Table 2).

The majority of the respondents indicated that the crop residue was grazed for approximately three months dependent on the amount of residue present and the number of livestock.

Stocking rates

Stocking rates have stayed fairly steady. Of all the management tools, stocking rate has the largest impact on animal performance and forage resources because it directly influences so many factors of pasture productivity.

Therefore, a proper stocking rate is vital to maintain grazing operations under changing conditions, optimize forage and animal performance, and sustain renewable land resources over the long term.

According to the K-State Research and Extension Districts Survey, 63 percent of respondents felt there would be no change in their current stocking rates, while 37 percent indicated that an “increase” in stocking rates may occur in the coming year.

The average stocking rate was 7 acres per pair with a range from 4 acres to 9 acres per pair depending on rainfall amounts and pasture conditions.

Written leases

The study indicated written leases are becoming more common. A written lease is encouraged to spell out specific terms of the lease. While a written lease may help defuse some legal questions that could arise in a lease agreement, it is not a guarantee that it will solve all legal issues.

Nevertheless, a written lease can be very valuable as it helps landlords and tenants document the terms of the lease. This is especially important as leases become more complicated and as tenants routinely rent from more landowners.

People tend to selectively recall only those portions of conversations that reinforce their point-of-view. A written lease protects not only the original parties but also assignees and heirs in case either party should die or the farm is sold.

The primary benefit of a written lease is that it forces both parties to identify issues that are relevant and this increased communication can help avoid potential problems in the future.

According to our K-State research and extension district surveys, approximately one-third of respondents have from 50 percent to 100 percent of their lease agreements in writing.

Communication

Communication is important for any type of leasing arrangement, but a constant stream of communication is particularly important for pasture leases, especially with the current cattle market. Communication at the beginning of the relationship is critical to ensure the goals and priorities of each party are understood and addressed in the lease agreement.

Communication is also important during the lease term to aid the development of a long-term relationship, boost the confidence in each of the parties to tenure security and promote awareness of any weaknesses and modifications needed in the lease arrangement.

Remember, a sustainable lease is only beneficial so long as it meets the needs of both parties. ![]()

K-State Research and Extension has a publication, “Frequently Asked Questions: Pasture Leases in Kansas” available online along with the K-State Research and Extension Agriculture Economics website with many spreadsheets and sample leases and other publications on leasing.

- Sandra L. Wick

- Crop Production Agent K-State Research and Extension

- Post Rock District