- Potentially reduces estate taxes

- May generate an immediate income tax deduction and a state income tax credit

- Provides a vehicle to diversify assets for retirement income

- Help support your favorite church or charities

- Allows you to leave behind a lasting legacy

How it works

A donor establishes a CRT and then transfers appreciated assets (e.g., land, livestock, equipment) to the trust, removing the assets’ values from the donor’s estate. The trust then sells the assets and, since it is a tax-exempt entity, there are no taxes due upon the sale. The proceeds from the sale are then invested within the trust in a manner designed to provide a lifetime income for the beneficiaries.

Two sets of beneficiaries are established, the income beneficiaries (generally the donor and his or her spouse) and the remainder beneficiaries (the charity or charities that will receive the principal, or “remainder,” of the trust after the income beneficiaries die).

One does not have to contribute their entire farm or ranch in a CRT. A portion of land or livestock and equipment may be contributed to and sold by a CRT with the rest of the property sold for cash, or through a 1031 Exchange. Combining a CRT with a direct sale and a 1031 Exchange may offer the best combination of benefits.

Tax savings are one of the main benefits of charitable remainder trusts. These trusts can provide the following tax benefits on contribution of land to a CRT:

An immediate income tax deduction

Donors of land to a CRT receive an immediate income tax deduction based on the present value of the charity’s remainder interest. The amount of the tax deduction depends on factors such as the value of the trust property donated to the CRT, the amount of income or the percentage of principal paid annually by the CRT, the age of those receiving income generated by the CRT and discount rates set by the IRS.

The charitable deduction can be used to offset income in the year of the gift, and any unused deduction can be carried forward up to five years. If appreciated property is donated, the deduction is limited to 30 percent of the donor’s adjusted gross income.

State income tax credit

In some states, such as Montana, donors may also be eligible for a state income tax credit. Montana’s tax credit, called the Montana Income Tax Credit for Endowed Philanthropy, provides a credit against state income tax liability in the amount of 40 percent of the present value of any planned gift to a permanent endowment of a Montana charity up to a maximum amount of $10,000 per year per taxpayer. [Applies to individual or business entity taxpayers.]

Taxes bypassed on sale

Assets contributed to a CRT can be sold free of any income tax and the Medicare surtax to the donor. This is particularly significant if there are highly appreciated assets involved such as real estate. By saving capital gain taxes, the money that would have gone to paying tax can be used to generate income for retirement.

Federal estate and gift tax savings

Assets contributed to a CRT are removed from the donor’s estate, thereby reducing the value of the donor’s estate for estate tax purposes. Since the assets are not part of the donor’s estate, future estate tax may be reduced or avoided entirely. Also, the CRT is not subject to executor’s fees or other probate costs.

CRT is income tax-exempt

A CRT itself is tax-exempt and pays no income tax or Medicare surtax on interest, dividends, rents or capital gain. Thus, a CRT does not pay any federal income tax.

Illustration of using a CRT in the sale of a ranch

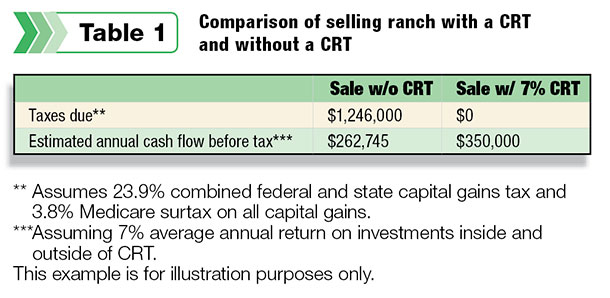

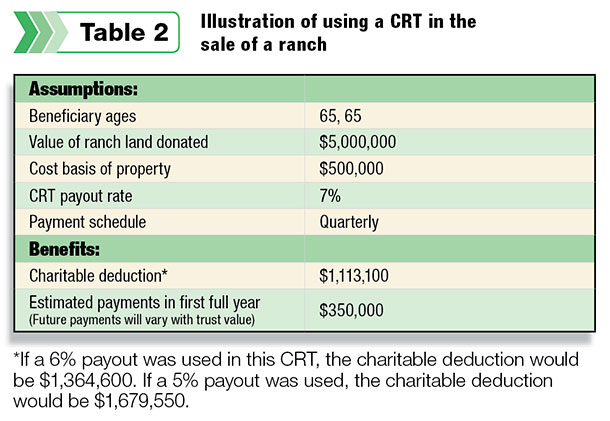

Tables 1 and 2 are a hypothetical example of a married couple in Montana both age 65 selling a highly appreciated $5 million ranch through a CRT. The tables compare the sale of this ranch with and without a CRT. ![]()

Chris Nolt is the owner of Solid Rock Wealth Management and Solid Rock Realty Advisors, LLC, sister companies dedicated to working with families selling a farm or ranch and transitioning into retirement. For more information, call (406) 582-1264 or visit his websites.

- Chris Nolt

- Owner

- Solid Rock Wealth Management