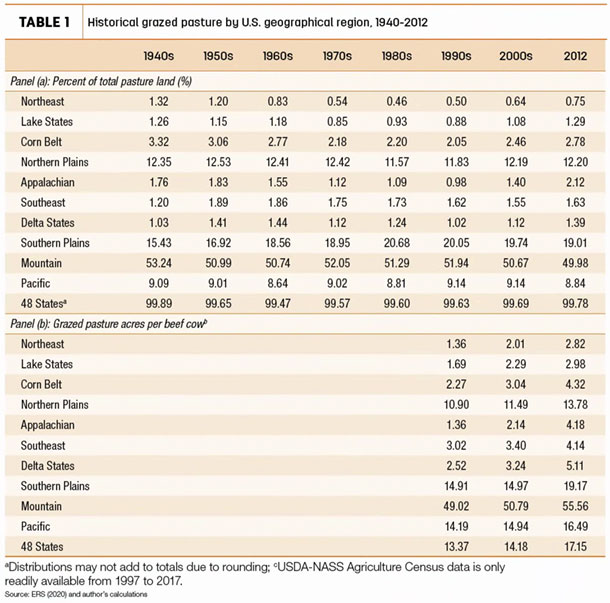

The most recent Drought Monitor map confirms the Mountain region and parts of the Northern Plains region are currently the most affected by drought conditions. The USDA Pasture and Forage Conditions report has confirmed these findings recently, indicating that the amount of U.S. range and pasture rated as either poor or very poor was much higher than the five-year average and well above conditions in 2020. There are regional differences in range and pasture ratings, and one reason this number is so high is that more than 70% of the total grazed range and pasture in the U.S. is currently rated at a D1 (moderate drought) level or higher (see Table 1 panel (a)).

One of the direct impacts of drought is: It reduces available range and pasture, causing stocking rates (grazed acres per cow) to increase. The stocking rate is one standard measure that indicates how efficient an area is where a lower ratio suggests greater efficiency (i.e., fewer acres required per cow). Table 1 panel (b) shows stocking rates by region and by decade for the continental U.S. While the Mountain, Southern Plains and Northern Plains have both the largest amount of grazed land and beef cows, these regions also have the highest stocking rate on average.

The Mountain region required approximately 50 grazed acres per beef cow, by far the highest of any region. The Southern Plains region required 15 acres per beef cow, and the Northern Plains region required 11 acres per beef cow. The most efficient regions, at least from the stocking rate measure, were the Northeast, Lake States and Appalachian regions. On average, these regions required 1.5 grazed acres per beef cow. As previously mentioned, these stocking rates are in part reflective of the climate, feed resources and pasture improvements but have important implications when a drought occurs. Further, the degree to which drought impairs the range and pasture’s potential for future forage production depends on the intensity, frequency and timing of grazing.

What does the stocking density tell us about the potential impacts of beef cow herd liquidation due to drought? Areas with high stocking rates are generally in areas that have less crop production, increasing the reliance on either seasonal or harvested feed resources to sustain a beef cow herd. As the forage production season slows down, producers will need to make decisions either to maintain or decrease current levels of stocking density to not damage the long-term potential of their land. There are two primary decisions: destock or depopulate. Depopulation means selling cows, heifers, yearlings and calves to fit the available forage. Destocking means not selling animals – rather cattle are either moved to newly obtained pasture, rented or purchased, or hay is purchased for the current herd size.

Partial herd liquidation vs. buying feed

What strategy should producers use who are wanting to maximize profits given the drought has occurred at the trough of the cattle price cycle? Work by Wyoming agricultural economists have modeled the producer profit-maximizing decision in a drought conditional on where the industry is at in the cattle price cycle and length of drought.

They modeled three- and four-year drought conditions using a producer strategy for either partial herd liquidation or purchase of additional hay as a management strategy, given either a peak-to-peak or trough-to-trough cattle price cycle. They find that in the short run, partial liquidation of cattle tended to provide better returns than purchasing feed to overcome constrained forage supplies, and that partial liquidation tended to be less risky and create potentially less financial stress than purchasing feed.

Further, purchasing additional feed only provided positive returns when prices were stronger overall during a trough-to-trough cattle price cycle as compared to the peak-to-peak cattle price cycle scenario. Thus, given we are at the trough of the price cycle, risk-averse producers are more likely to partially liquidate their beef cow herd rather than to buy feed resources. However, if producers believe prices are likely to be stronger, on average, during the upcoming trough-to-trough cycle, then they will buy feed resources.

Given the increasing volatility in the cattle markets, I believe most producers are more likely to liquidate their beef cow herd, at least partially, than buy feed resources. This of course assumes no indemnity payouts from Pasture, Rangeland, Forage (PRF) insurance. A producer who has already protected forage with PRF is more likely to buy additional feed resources than to partially liquidate their herd.

Implications for cull cow and feeder cattle prices

What this potential partial beef cow herd liquidation means for cull cow and feeder cattle prices will likely differ based on geographical region. If producers decide to liquidate, then the cull cow prices will decrease mostly in the Mountain and Northern Plains regions. Cull cow prices are likely to be unaffected in other regions because beef cow markets are generally assumed to be regionally based on cow genetics rather than subject to market arbitrage. With the U.S. beef cow herd peaking in 2019 and beginning its liquidation process, increasing drought pressure could accelerate this liquidation process – a similar experience as in 2012-13.

More feeder cattle will enter feedlots earlier than expected due to lack of feed resources lowering feeder cattle prices. With the influx of liquidated feeder cattle from the Mountain and Pacific regions, Northern and Southern Plains feedlots will fill yards with relatively cheaper feeder cattle. Thus, feedlot demand for feeder cattle in the Southeast and Appalachian regions would likely decrease.

A drought combined with elevated corn and soybean prices is a worst-case scenario for feeder cattle producers. Elevated feed costs increase feedlots’ cost of gain and they have incentives to delay placements of feeder cattle, especially freshly weaned calves. This would put further downward pressure on lighter feeder cattle. Risk management in the form of USDA-RMA Livestock Risk Protection or CME futures and options can help mitigate some of these potential downward price movements and likely merit a closer look by producers this production year if not already purchase.