As packers have bid higher for fed cattle for slaughter in the first and second quarters of 2017, feedlots experienced positive returns from marketing calves bought at relatively low prices during the second half of 2016.

The price for feeder steers weighing 750 to 800 pounds sold at the Oklahoma City National Stockyards averaged $128.30 per hundredweight (cwt) in the fourth quarter of 2016 while the 5-area price for fed cattle marketed at an average of $132.76 per cwt in the second quarter of 2017.

Feedlots’ positive returns likely contributed to feedlots being willing to bid higher for feeder calves to keep their inventories current.

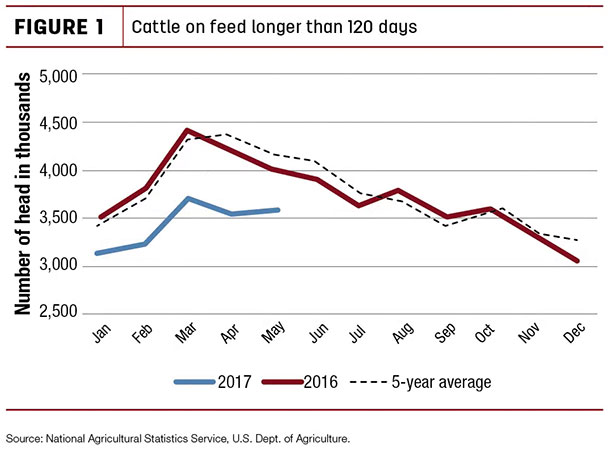

According to the June 2017 USDA-NASS Cattle on Feed report, feedlot operations with more than 1,000-head capacity indicated year-over-year net placements during May increased by 12.9 percent to 2.05 million head, which surpasses marketings totaling 1.95 million head.

Cattle on feed for longer than 120 days also rose to slightly above April levels but well below the five-year average and the same time last year (Figure 1).

Feedlot demand bolstered calf prices in the second quarter of 2017 to an estimated $147.37 per cwt, but prices in the fourth quarter, when most of these calves will likely be marketed, are expected to average $113 to $121 per cwt.

The USDA forecasts feeder calf prices to peak in the third quarter at $152 to $158 per cwt and to decline slightly in the fourth quarter at $145 to $155 per cwt. However, relatively large feedlot placements should provide an abundant supply of fed cattle from which meatpackers can purchase as needed.

The increased slaughter volume in June is likely a function of meatpackers taking advantage of their good margins and feedlots’ accepting of lower bids in anticipation of declining cash prices for live cattle.

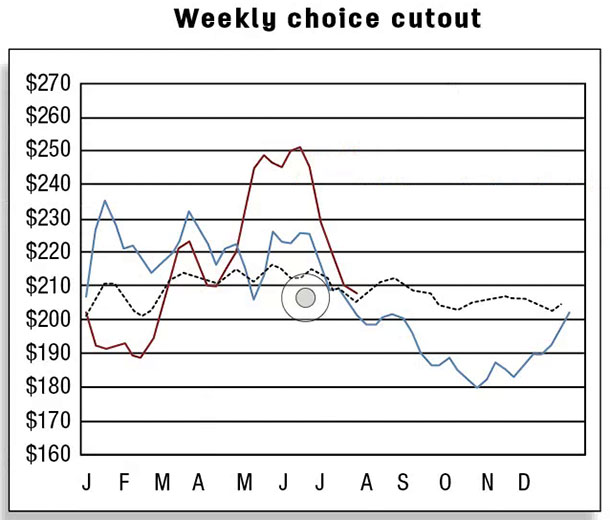

Supply of Choice beef to grow as demand wanes

Volumes of cattle slaughtered through spring and early summer have been above a year ago, but dressed weights were below 2016. According to the USDA-NASS Livestock Slaughter report released in June, commercial cattle slaughter in May was up by 237,300 head over last year, and dressed weights for both steers and heifers slaughtered under federal inspection were down 25 pounds year-over-year.

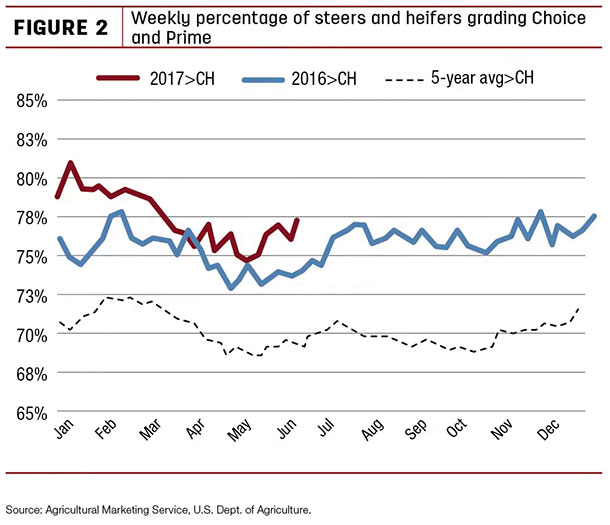

Despite lower weights, the USDA-AMS report of the weekly percentage of steers and heifers indicates carcasses grading Choice or higher have remained above year-ago levels (Figure 2).

This would indicate, despite lighter carcass weights, supplies of Choice grade beef were above last year. Thus, it would appear strong demand for Choice beef helped pull the spread between wholesale prices of Choice and Select beef to historic levels. The spread has narrowed considerably in the last week, and demand for grilling-type cuts will likely diminish post-July 4.

The USDA-AMS report on beef production under federal inspection for the week ending June 24 indicates average dressed weights for cattle have rebounded above 800 pounds for the first time since early April.

As carcass weights increase seasonally and slaughter is expected to be above year-earlier, Choice beef supplies are expected to increase. Anticipated lower seasonal demand for middle meats will likely put additional pressure on the wholesale price of Choice beef in the coming weeks.

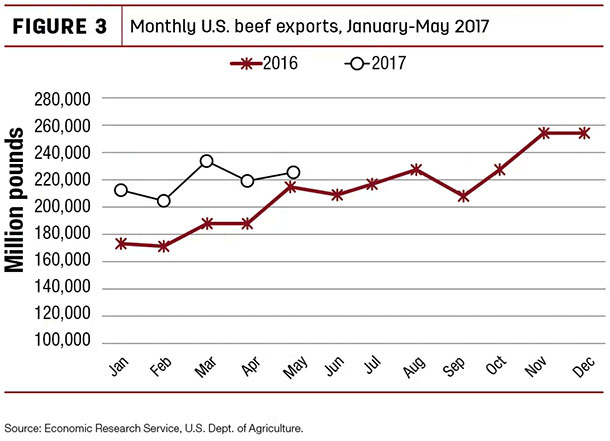

Beef exports up in May 2017

U.S. beef exports in May 2017 increased by 3 percent from the same month a year ago to 226 million pounds ( Figure 3).

Increased exports to Hong Kong (+29 percent), Japan (+10 percent) and Taiwan (+23 percent) offset export declines to Canada (-30 percent), South Korea (-6 percent) and Mexico (-3 percent). Beef exports during January through May were 16 percent higher than the same period a year ago, totaling 1.1 billion pounds.

Increased exports are supported by higher domestic production, lower prices and a relative weakening of the U.S. dollar against trading partners during the period.

Second-quarter 2017 U.S. beef exports were revised downward by 15 million pounds to an expected 695 million pounds due to a slowing pace of exports in May year-over-year.

Further, a recently concluded U.S.-China trade deal included reopening the Chinese market to U.S. beef for the first time in almost 14 years. Market access is provided for chilled, frozen, bone-in and deboned beef as well as a broad scope of offal products derived from cattle less than 30 months old.

Although shipments commenced in June, immediate and short-term gains may be constrained given China’s market requirements such as traceability and its zero tolerance at ports of entry for prohibited substances.

In the longer term, support for U.S. beef exports is likely to come from increased Chinese demand as incomes increase and consumers expand their preferences for a wider variety of meat protein. U.S. beef exports in 2018 are revised upward by 35 million pounds from the previous month to 2.9 billion pounds.

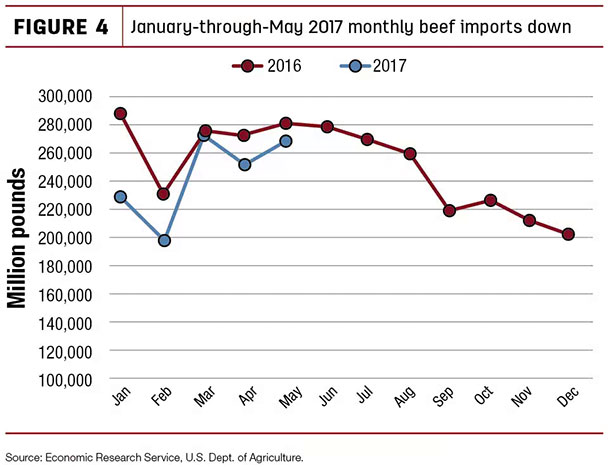

Beef imports down in May 2017

U.S. beef imports in May declined 4 percent year-over-year (Figure 4).

A sharp decline in imports from Oceania (-29 percent Australia, -27 percent New Zealand) outweighed the increased imports from other major suppliers (+76 percent Brazil, +31 percent Mexico, +5 percent Canada and +67 percent Uruguay).

Oceania imports were lower in each of the months from January through May 2017 compared to the same months a year ago due to lower production in Oceania. Dry conditions in Australia may likely continue to limit production. Cumulative imports through May declined by 10 percent year-over-year to 1.2 billion pounds. Higher domestic production and the weakening of the U.S. dollar also support the decline in imports.

Despite year-over-year declines in imports in May, imports were stronger than the previous month. Also, higher weekly imports reported by the USDA-AMS for June supported an upward revision of second-quarter 2017 imports by 20 million pounds to 795 million pounds.

Beef import forecasts for the fourth quarter 2017 and each of the quarters in 2018 have also been revised upward, likely due to higher expected imports from Oceania as herd rebuilding is likely to end there.

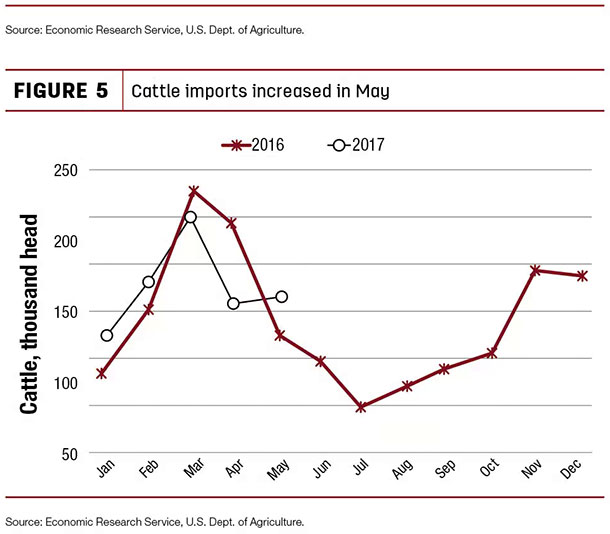

Cattle imports and exports both up in May 2017

In May 2017, U.S. cattle imports increased by 21 percent from the same month a year ago to 159,000 head (Figure 5).

Total January-through- May cattle imports in 2017 were fractionally below the level of 2016. Weekly USDA-AMS data also suggest a similar pace of imports will likely continue in June due to an increase in feeder cattle imports from Mexico.

U.S. cattle exported in May more than doubled year-over-year. Each month in 2017 through May had higher cattle exports than the previous year, contributing to 150 percent higher cumulative exports through May 2017 or 52,000 head.

Besides Mexico and Canada, significantly larger numbers of cattle were shipped to Turkey, Vietnam and Sudan during this period. First-half 2017 cattle exports appear stronger than previously expected. ![]()

Analyst Lekhnath Chalise contributed to this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.