However, toward early autumn, the Southern Plains experienced improved precipitation, allowing a much more promising outlook for pasture conditions in most of the region.

The Crop Progress report of Nov. 24, 2014, showed that 92 percent of winter wheat emerged in November, slightly higher than the 2009-2013 average of 89 percent.

The report also showed that in the week ending Nov. 23, 2014, 60 percent of selected states were experiencing overall “good” or “excellent” winter wheat conditions, slightly lower than the previous-year average of 62 percent but above the region’s historic average and indicative of what many see as potentially a good year for wheat-pasture grazing.

Corn and soybean yields were higher this year than in 2013. Prices for both commodities are similar to pre-2010 prices, giving many livestock operations a break from record-high grain prices.

Toward the latter part of 2014, many producers have been able to keep their cattle on pasture longer (due to improved pasture conditions) or to keep cattle on feed for longer periods (due to lower grain prices).

During the second half of 2014, the Agricultural Prices monthly report also showed a drop in other feed and feed-grain prices, including grain sorghum, alfalfa hay and other hay.

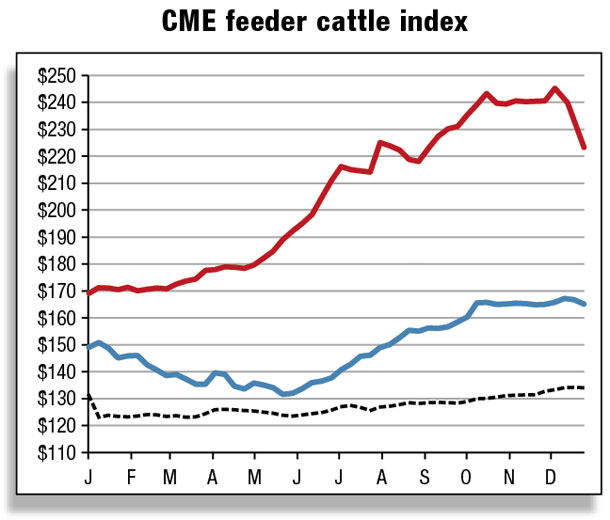

Producers have had ample incentives to retain animals, letting weights of their animals increase, as prices for steers, heifers and cows have reached record-high levels and feed prices have moderated.

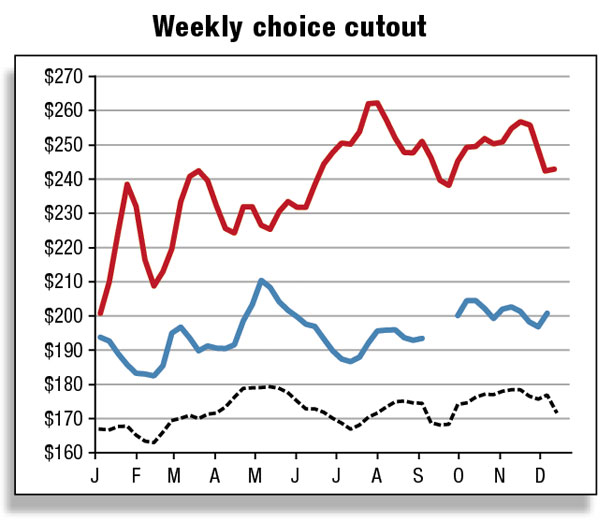

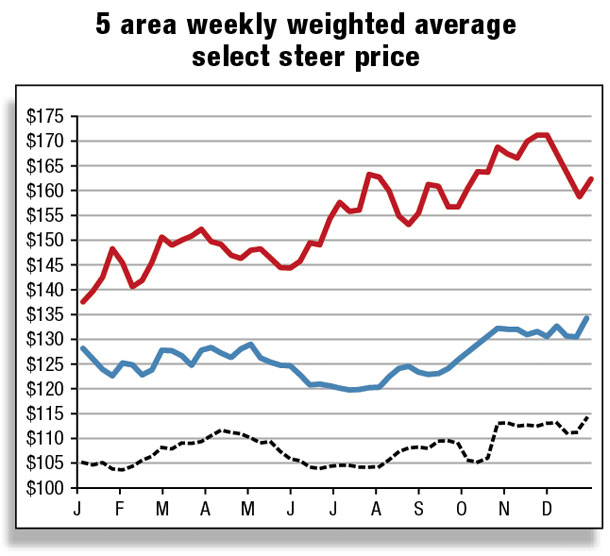

Along with fed cattle prices that reached a record $171.38 per cwt (5-area fed steers), feeder cattle prices exceeded $238.85 per cwt (750-pound to 800-pound medium and large No. 1 steers, Oklahoma City) the last week in November, roughly $65 per cwt higher year over year.

U.S. prices for 5-area steer projections for the fourth quarter of 2014 are between $167 and $170 per cwt (WASDE, December 2014), compared with $130.77 per cwt for the fourth quarter in 2013.

Prices are expected to average a record high of $160 to $172 per cwt in 2015, although there will also likely be some dips if packers and consumers balk at attempts to raise wholesale and retail prices.

How much beef in 2015?

A large share of total placements of feeder cattle into feedlots of 1,000 or more head during October weighed more than 800 pounds, which has been the case for much of the last half of the year. These heavy cattle will be on feed for relatively shorter feeding periods and will likely be ready for slaughter during the first quarter of 2015.

At the same time, October placements of less-than-600-pound feeder cattle were on par with placements for that category in recent years. These lighter cattle will be on feed for extended periods, perhaps as long as eight months. However, the combined share of 800-pound-plus and less-than-600-pound feeder cattle was more than 56 percent in October, far greater than the more typical share of roughly 50 percent, implying that “extra” cattle could reach market weights during the first half of 2015.

The Cattle on Feed report released Nov. 21, 2014, showed a slight increase in Nov. 1 cattle on feed inventories in 1,000-plus-head-capacity feedlots in the U.S. compared with November 2013. Cattle on Feed reported that October 2014 marketings and placements are the lowest since the series began in 1996.

Further, total net placements through October 2014 were only 1.5 percent below placements for the same period in 2013. Net placements of feeder cattle in feedlots of 1,000-plus head in 2013 were fractionally higher than net placements in 2012.

Despite the fact that calf crops in 2012-2014 (preliminary) were much lower year over year, supplies of feeder cattle outside feedlots on Oct. 1 were actually slightly higher than in October 2012.

As mentioned, the record-breaking feeder cattle prices have encouraged many producers to continue feeding cattle to heavier weights. Compounding this result, cattle feeders have placed large numbers of 800-pound-plus feeder cattle on feed compared with previous years.

These larger cattle will reach marketable body conditions a bit faster than lighter-weight placements, allowing for earlier marketings.

Average dressed weights for cattle continued to trend upward and reached record levels during 2014. As mentioned in previous Livestock, Dairy and Poultry Outlook reports, the slaughter mix has had an increased number of steers compared with heifers or cows. Steers are typically larger than heifers or cows.

The Livestock Slaughter report released Nov. 20, 2014, showed that October 2014 average dressed weights of all cattle in federally inspected slaughter facilities climbed to 827 pounds, up 24 pounds from October 2013.

October 2014’s average dressed weights for fed steers reached a monthly record 900 pounds, and heifers reached 822 pounds.

Record dressed weights are likely the result of heavier placement weights combined with lower corn prices that may have made it possible to increase days on feed, encouraging additional weight gains.

The Livestock Slaughter report also showed that beef production dropped 6 percent and slaughter dropped 9 percent in October 2014 compared with October 2013. October this year contained the same number of slaughter days as October 2013, emphasizing the year-over-year drop in monthly total commercial cattle slaughter.

Currently, fed steer slaughter makes up about 65 percent of total federally inspected steer and heifer slaughter and has implications for average dressed weights for all federally inspected cattle slaughtered.

Bull carcasses weigh the most, often close to or more than 900 pounds, but have seldom exceeded 2 percent of total federally inspected cattle slaughter since the mid-1980s.

Steer carcasses average the next highest weights, followed by heifers, then cows. Steers average about 66 pounds more than heifers, so the more steer carcasses in the mix, the higher the average dressed weight of all cattle.

This higher proportion of steers combined with steer carcasses that are record heavier has resulted in record dressed weights of all cattle in 2014. Overall, heifers and cows have made up a smaller share of the slaughter mix.

Commercial cow slaughter for 2014 is forecast to be about 14 percent of the Jan. 1, 2014, cow inventory. Cumulative weekly federally inspected cow slaughter through mid-November 2014 was down about 14 percent from the same period last year, with dairy cow slaughter down about 10 percent and beef cow slaughter down about 18 percent.

Total commercial cow slaughter for 2014 is projected to be down 20 percent from the recent peak cow slaughter observed in 2011, which represented a 17 percent share of the Jan. 1, 2011, total cow inventory.

The veal market has followed a trend similar to the trend in the cattle market. It appears that calves are also being fed for longer periods. At 304 pounds, average live weights of commercial slaughter calves in October were up 59 pounds from October 2013, largely offsetting declining veal calf slaughter.

While cumulative weekly federally inspected calf slaughter dropped 25 percent over the same period last year, cumulative veal production is down by only about 14 percent. The Weekly Veal Market Summary of Dec. 4, 2014, showed calf carcasses, hide-off, priced at more than $570 per cwt, an increase of almost $100 per cwt compared with November 2013.

Will they or won’t they expand the cow herd?

While there has been much speculation about rebuilding the national cow inventory, the 14 percent share of cow slaughter relative to the Jan. 1, 2014, total U.S. cow inventory is not as robust an indication as it has been during expansionary phases of past cattle cycles. Generally, lower proportions of cows in the slaughter mix imply cows are being withheld from slaughter.

For example, in 2004-2006 – the last time expansion was observed on any scale – the ratio of total annual commercial cow slaughter to Jan. 1 cow inventories was below 13 percent each year, with 2005 at 11.7 percent.

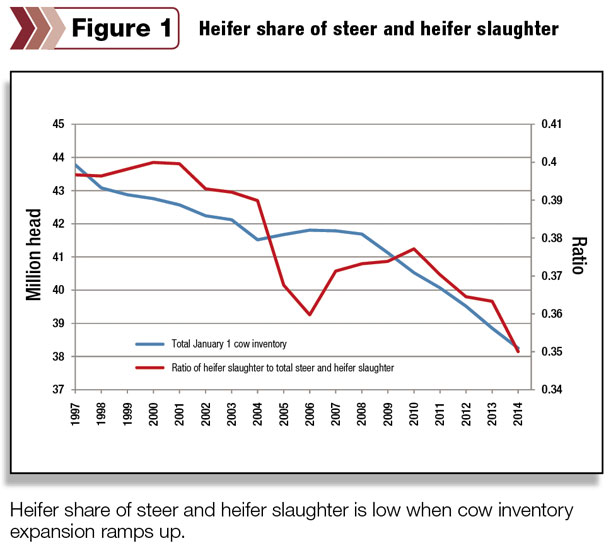

The relative proportion of heifers in the slaughter mix has also declined in 2014 (see figure). In October 2014, heifers showed a 9.4 percent drop in slaughter compared with October 2013.

Through mid-November, heifer slaughter made up about 35 percent of total federally inspected steer and heifer slaughter compared with 36 percent for all of 2013 and a range of 36 to 40 percent going back to 1997. This relatively small proportion of heifer slaughter likely indicates some heifer retention for breeding stock. The Cattle report NASS will release Jan. 30, 2015, will provide an estimate of heifers retained for cow replacements.

Because heifers retained for breeding are unavailable for placement in feedlots for near-term beef production, retaining heifers would exacerbate the already reduced supply of feeder cattle available for placement on feed, which is a direct result of current extremely low cow inventories.

However, extra heifer retention would mean a quicker recovery of cow inventories and a shorter time to greater future beef production.

“Quick” is a relative term, however, because of the extended period required to get beef from a heifer: A heifer retained from the 2014 calf crop (i.e., a spring calf) would not be bred until summer 2015.

Her calf – born in spring of 2016 and not placed on feed until sometime in 2017 – would likely be slaughtered for beef in 2017 or early 2018. Further, it takes heifer retention over several calf crops to build the cow inventory to levels that translate into significant increases in beef production.

However, heifers currently retained for breeding could still find their way into feedlots rather than breeding herds for a number of reasons, including poor forage conditions in 2015, even higher feeder calf prices, lower replacement female prices or increased incentives for producers to exit the industry.

With the U.S. total cow inventory at lows not observed in decades, speculation about when herd expansion will take place has been a concern of many analysts.

The current situation indicates that cow-calf producers may be having difficulty deciding whether to keep heifers for breeding – which will generate future income – or selling those heifers at record prices for placement in feedlots for current income.

Given the average age of cow-calf producers – 60 in 2008, the last time an Agricultural Resource Management Survey for cow-calf operations was conducted (The diverse strcture and organization of U.S. beef cow-calf farms) – and high costs of doing business, it is not difficult to understand the desire to capture current income. How these circumstances and dilemmas play out will influence beef production for the next several years.

The bottom line is that 2015 may be too soon to see much cow herd expansion. The highly anticipated Jan. 1, 2015 Cattle report should provide some insight for analyzing the prospects for herd rebuilding.

Record retail all-fresh beef prices

October 2014’s all-fresh beef retail value was $5.96 per pound, up nearly a dollar from this time last year. Retail choice beef prices backed off from their September record of $6.26 per pound.

Although beef prices are at record or near-record levels, it is possible consumers may balk at the higher retail prices for beef and substitute pork or poultry products for beef. However, it is likely that retail beef prices will on average move higher during 2015. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.