Dad raced after her and cleared the four-wire barbed fence in a single bound (in his jeans and cowboy hat). I was in awe.

Fast-forward to junior high. After a couple of tries sprinting to the hurdle, a few choppy baby steps, then a “hop” over the hurdle, my coach assigned me to a different race. However, my younger sister and brother were sleek and flawless at hurdles. My favorite race to watch at track meets: the hurdles.

The anticipation. The drama. The wrecks. The triumphs. The hurdles are a race of skill, a race of chance, a race of the unexpected. Fatigue trips many contestants on the last few hurdles.

Burned knees and elbows from high-speed entanglement with hurdle or asphalt turn into a good crash, arms and legs flailing into the other lane. The odds-on favorite to win is blindsided by the crash. The underdog burst through the string.

Ranching is a race of hurdles. The biggest hurdle for the next generation of ranchers is transitioning the business and assets. Ranch transition comes from more than one perspective and usually raises more questions than answers. The questions are hard to answer, and some questions are hard to ask. Ranch transition is a heavy burden carried by many who don’t have the final say in the decisions.

The next generation of ranchers is usually “sandwiched” between the generation who owns the land (their parents) and their children, who want to return to the family ranch. This sandwich generation returned to the family ranch decades ago to work beside their parents – and now are unsure of what the future holds. Often, the sandwich generation are the ones in the position with the most to lose after a bad estate plan.

Unique hurdles of the sandwich generation

- They have worked the family ranch for years but do not own the land or have the power to make decisions about the land.

- Often there are communication barriers in the family.

- It’s the family business, a messy intertwined combination that hasn’t been separated into family and the ranching operation.

- Most agreements with the on-ranch heir and landowner are verbal, agreements that will die with the landowner.

- The vision of the landowners may not have been discussed with all members of the family.

- Important decisions about the family ranch have been waited on for too long and now the landowner is “around the bend” or mentally unable to make decisions due to stroke, dementia or other illness.

Helpful tips for the transitional state

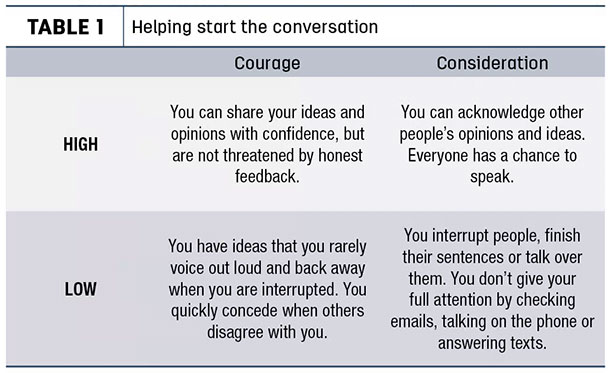

- Get the ball rolling by asking. That sounds simple, but many lack “courage” and “consideration.” Strive for high courage and high consideration in the conversation, states Keith Niemann, a communication specialist in Stephen Covey’s 7 Habits, who helped ranch families start dialogues at a ranch transition workshop (see Table 1).

- Ask “powerful questions” which are short, simple, open-ended (how, what, who and when) and are curious.

- “When you say _______, what do you mean?”

- “Can you tell me more about that?”

- Don’t be afraid of silence. Give the other person time to formulate an answer. Use “I” messages, rather than “you” messages. “I feel …” has a much different tone than “You always …”

- A list of powerful questions scripted by Niemann to start the conversation about ranch transition can be found online (Ranch transition when you aren't in control).

- Accountability isn’t blaming or placing judgement on a person. If you need accountability to keep the transition plan rolling, ask these three questions:

- What are you going to do?

- By when will you do this?

- How will I (or we) know it has been done?

- Remember the “golden rule.” According to Dave Goeller, transition specialist, the person with the gold gets to make the rules.

But what if “the people with the gold don’t want to play?”

Learn how to educate and inform the land-owning generation (those with the gold) on best practices to ensure ranch transition to the next generation.

- What is the goal of the family ranch? What do you envision the family ranch looking like in 10 years? 40 years?

- The next generation needs access and control of essential business assets. The next generation of ranchers must be able to access the land for grazing and have control of the management decisions of the land.

- Is it feasible for the next generation? Is the ranch big enough? Is the business plan of transition allowing for a new manager and retirement for the older generation? Is debt structure and cash flow realistic for both the sandwich generation and landowner?

- “Sometimes the most unfair thing a parent can do is to treat all their heirs equally” says Goeller. Fair treatment of heirs does not always mean the heirs inherit an equal share. Are you transferring a business (succession) or assets? A list of assets would be treated much differently in estate planning than if the goal is to pass the family ranch business to the next generation.

- How should compensation (sweat equity or business growth due to the on-ranch heir) be compensated? Was family labor paid for? Instead of money, was the labor reimbursed through a lower rent or trade? If not, compensation could be factored into the estate plan.

Focus on the legal side of transferring the ranch. First, discuss and record all agreements the on-ranch heir and others have agreed to over the years. Write it down, gather signatures and give a copy to all parties (and perhaps the family attorney to ensure the documents can be enforced later).

Transfer any purchases into the correct name: If Son bought the ranch pickup, the title should be in his name. If Son paid for half of the bill for the equipment that does not have a title, make sure to write out a bill of sale reflecting the part-ownership.

The sandwich generation is encouraged to reflect on their anxieties and “why they haven’t started the conversation.” Capture what you want to see happen, what could be the worst-case scenario and what you are afraid could happen.

Then move on to considering the best legal option for your family ranch. Match up desired outcome with the legal tool that best fits the needs and goals of the family.

How can the successor have access and control of the assets while including other siblings? Business entities can provide varying layers of control to various parties – who will run day-to-day operations (e.g., on-ranch heir), who will have voting control over bigger decisions (e.g., on- and off-ranch heirs) and who will be entitled to participate economically without voting rights (e.g., in-laws).

This can allow the successor to make management decisions without needing majority vote while siblings are still involved.

Think about and plan for the unexpected. What if heirs die before the landowner? If divorce happens, how will the ranch be protected? What if Mom and Dad need expensive health care sooner than expected? If someone wants “out,” what is the exit strategy? Do you want the ranch to eventually end up with one owner or an undisclosed number of owners?

An entity is only as good as its operating, partnership or shareholders’ agreements, which outlines the rights and responsibilities among those who run the business. These agreements are the heart and soul of the future ranch.

It explains who and what assets are part of the company, who is allowed to make management decisions, what vote is needed for major decisions, how shares can be bought/sold/gifted, how profit/losses will be shared among members, who will keep bookwork and file taxes, and how (and under what circumstances) the entity will be disbanded. Don’t scrimp here: Take the time to develop a good operating agreement.

Consider using a personal representative (also called the executor) or a trustee outside the family as part of the process. Many banks, trust companies and attorneys are a neutral substitute to alleviate family conflict.

Be proactive and take initiative to understand what your future will look like. Clear those transition hurdles and finish the race strong. ![]()

ILLUSTRATION: Illustration by Ray Merritt.

Disclaimer: This article is meant to inform and is not a substitute of legal advice. Contact your attorney when making legal decisions.

-

Bethany Johnston

- Beef Educator

- Nebraska Extension – Central Sandhills Area

- Email Bethany Johnston